Longtime rivals Nvidia (NVDA +1.53%) and Advanced Micro Devices (AMD +2.35%) saw their fortunes vary in the artificial intelligence (AI) chip market over the past three years.

Nvidia's early move into this market with its data center graphics cards, which enabled OpenAI to train ChatGPT in 2022, paved the way for remarkable growth in its top and bottom lines. What's worth noting is that Nvidia continues to reap the benefits of its first-mover advantage in the AI chip space, as evidenced by its latest quarterly results.

AMD, however, was late to the AI scene. It lags behind Nvidia in this market despite trying to close in on its bigger rival for the past three years. This explains why AMD stock's three-year gains of 183% pale in comparison to Nvidia's 963% increase. But what's worth noting is that AMD has outperformed Nvidia in 2025, clocking an 82% jump in its stock price as compared to Nvidia's 34% appreciation.

Can AMD sustain this momentum in 2026 and continue to outperform Nvidia? Let's find out.

Image source: AMD.

AMD stock seems primed for more upside in 2026

AMD is having a stellar 2025 so far. The company's revenue jumped by almost 35% in the first nine months of the year to $24.4 billion. AMD's guidance for $9.6 billion in revenue for the current quarter suggests that it will end 2025 with a top line of $34 billion. That would be a 32% increase over last year's revenue, when AMD's top line jumped by just 14%.

NASDAQ: AMD

Key Data Points

More importantly, AMD management is confident of achieving faster growth in the future. It expects its top line to grow at an annual rate of more than 35% for the next three to five years, a major improvement over the 21% annual growth it saw in the past five years. The company believes that its market share gains in the data center market will play a central role in accelerating its momentum.

That's not surprising, as AMD's Instinct data center graphics processing units (GPUs) gained impressive traction among customers. These chips are now deployed by several hyperscalers and AI companies such as Meta Platforms, Microsoft, OpenAI, Oracle, and others. The OpenAI deal alone could add $36 billion to AMD's top line during its duration, pointing toward a massive jump in its revenue when one considers the revenue that it is on track to generate in 2025.

Investors should also note that AMD is on track to launch its significantly upgraded MI400 series of data center GPUs and rack-scale AI solutions in 2026. These chips could start contributing significantly to its top line from next year since AMD has already inked partnerships with OpenAI, Oracle, and the Department of Energy. More deals for AMD's next-generation processors could be on the way since these chips are likely to challenge Nvidia's supremacy in the data center GPU market.

The above-mentioned tailwinds explain why analysts expect a 31% spike in AMD's top line next year, though the company could do better than that. Assuming AMD manages to increase its revenue by 35% (in line with its projected compound annual growth rate, or CAGR), its revenue could jump to $46 billion (from this year's estimated revenue of $34 billion).

The stock trades at 11 times sales, which is a massive discount to Nvidia's sales multiple of 23. Assuming AMD can maintain its sales multiple after a year, its market cap could increase to $506 billion (based on the $46 billion projected revenue for 2026). That would be 41% higher than its current market cap, though more upside is possible since the market could put a premium on this semiconductor stock due to its growing influence in the AI chip market.

Nvidia's tremendous backlog points toward a solid year, but there is a problem with the stock

Nvidia's revenue growth in the first nine months of fiscal 2026 (which ended on Oct. 26) is far more impressive when compared to AMD. It recorded a 62% spike in its top line during this period to $147.8 billion. Nvidia's fiscal fourth-quarter outlook of $65 billion means that it will close the ongoing year with $213 billion in revenue, a potential increase of 63% from last year.

NASDAQ: NVDA

Key Data Points

For comparison, Nvidia finished fiscal 2025 with a 114% increase in its revenue. So, the chip giant's growth rate is gradually slowing down. That's not surprising, as it has already achieved a high revenue base. Additionally, the growing competition from the likes of AMD, Broadcom, and Marvell Technology means that Nvidia now has to share the incremental growth opportunity in the AI chip market with its peers.

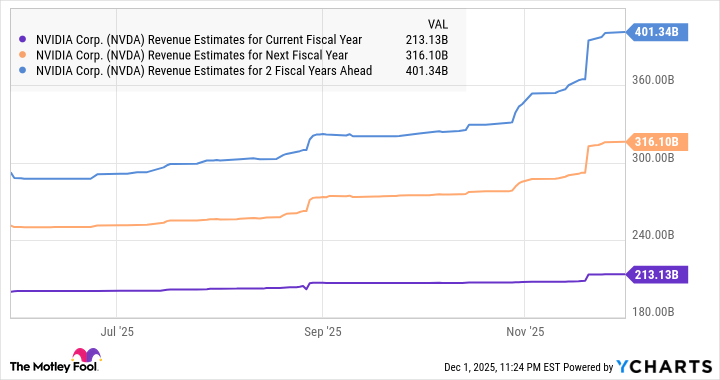

That explains why analysts forecast Nvidia's impressive revenue growth rate will eventually taper off.

Data by YCharts.

The slowing growth could lead to a drop in the massive premium that Nvidia trades at. Nvidia trades at 23 times sales, double that of AMD, and it has a forward price-to-sales ratio of 20, according to YCharts. If it indeed trades at that multiple after a year, its market cap could hit $6.3 trillion. That would be a potential increase of 43% from its current market cap.

So, Nvidia may outperform AMD in 2026. However, there is room for the market to reward AMD with a higher sales multiple thanks to its accelerating growth. On the other hand, Nvidia's premium could continue to erode because of its tapering growth, and this is the scenario in which AMD could continue to beat Nvidia's returns next year.