Issuers of exchange-traded funds (ETFs) are nothing if not inventive. One of the ways they find success with new products is to tie them to established, successful funds.

The Invesco NASDAQ Next Gen 100 ETF (QQQJ +2.45%) is an example of that phenomenon. This ETF follows the Nasdaq Next Generation 100 Index, which is equivalent to a "junior varsity" of the Nasdaq-100. In essence, this fund is the lower-market-capitalization cousin of the Invesco QQQ Trust (QQQ +0.69%) and the Invesco NASDAQ 100 ETF (QQQM +1.26%).

This tech-heavy ETF could deliver big rewards in 2026. Image source: Getty Images.

More than DNA defines this ETF

Obviously, the next-gen fund has noteworthy relatives, but this ETF has its own story to tell and some of that message explains why this $723 million fund could be a winner in 2026.

First, this Invesco ETF is classified as a mid-cap growth fund meaning its holdings are significantly smaller by market capitalization than the stocks residing in the aforementioned ETFs tracking the Nasdaq-100. Don't fret about that because this ETF allocates a third of its weight to tech stocks, positioning it as a complement to mega-cap-heavy growth funds.

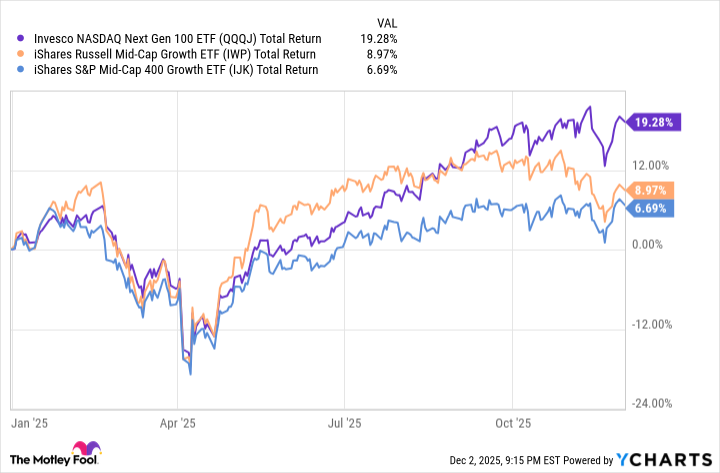

So if mid-cap stocks keep pace with their larger peers in 2026 and that resurgence is led by growth names, the next-gen ETF could be uniquely positioned to deliver big returns. As things stand today, the fund is up more than 19% year-to-date, easily outpacing traditional mid-cap growth ETFs in the process.

QQQJ Total Return Level data by YCharts

There may be reasons to consider this fund before 2026 arrives. The Nasdaq-100 rebalances later this month and for the index nerds out there -- hey, I'm one -- that's meaningful as it relates to this ETF for multiple reasons. First, some stocks will leave the fund to join the Nasdaq-100 while others will leave that gauge and join this ETF.

Second, history confirms that the stocks banished from the Nasdaq-100 often go on to notch better performances than those added to the index. In other words, this fund may be getting the superior end of the ETF equivalent of a trade in the sports world.