Shares of Redwire Corporation (RDW 10.92%) sank 30% last month and are now down over 75% from all-time highs, according to data from S&P Global Market Intelligence. An IPO from 2021 that is targeting the defense and space solutions sector, Redwire Corporation is down due to executive change, growing shareholder dilution, and a huge free cash flow burn.

Should you buy the dip on Redwire stock? Here's why it was falling yet again in the month of November.

NYSE: RDW

Key Data Points

Growing contracts, but burning lots of cash

On the cutting edge of the defense sector, Redwire sells autonomous aircraft (drones), space exploration, and space defense technologies. It is trying to ride the wave of growing spending on space defense, including proposed contracts such as the Golden Dome to protect the United States using satellite technology. This has enabled the business to grow quickly, with a current backlog of $355 million and a book-to-bill ratio of 1.25, which measures the amount of new contracts it has booked compared to how much it billed customers in the period.

Fast growth is not a problem for Redwire, nor is its large addressable market compared to its current revenue of $296 million. What is a concern is the company's free cash flow, which was negative $167 million over the last twelve months. In order to fund these losses, Redwire is diluting shareholders by raising money through common stock offerings. It also used a ton of stock to acquire Edge Autonomy, its new subsidiary for unmanned aircraft.

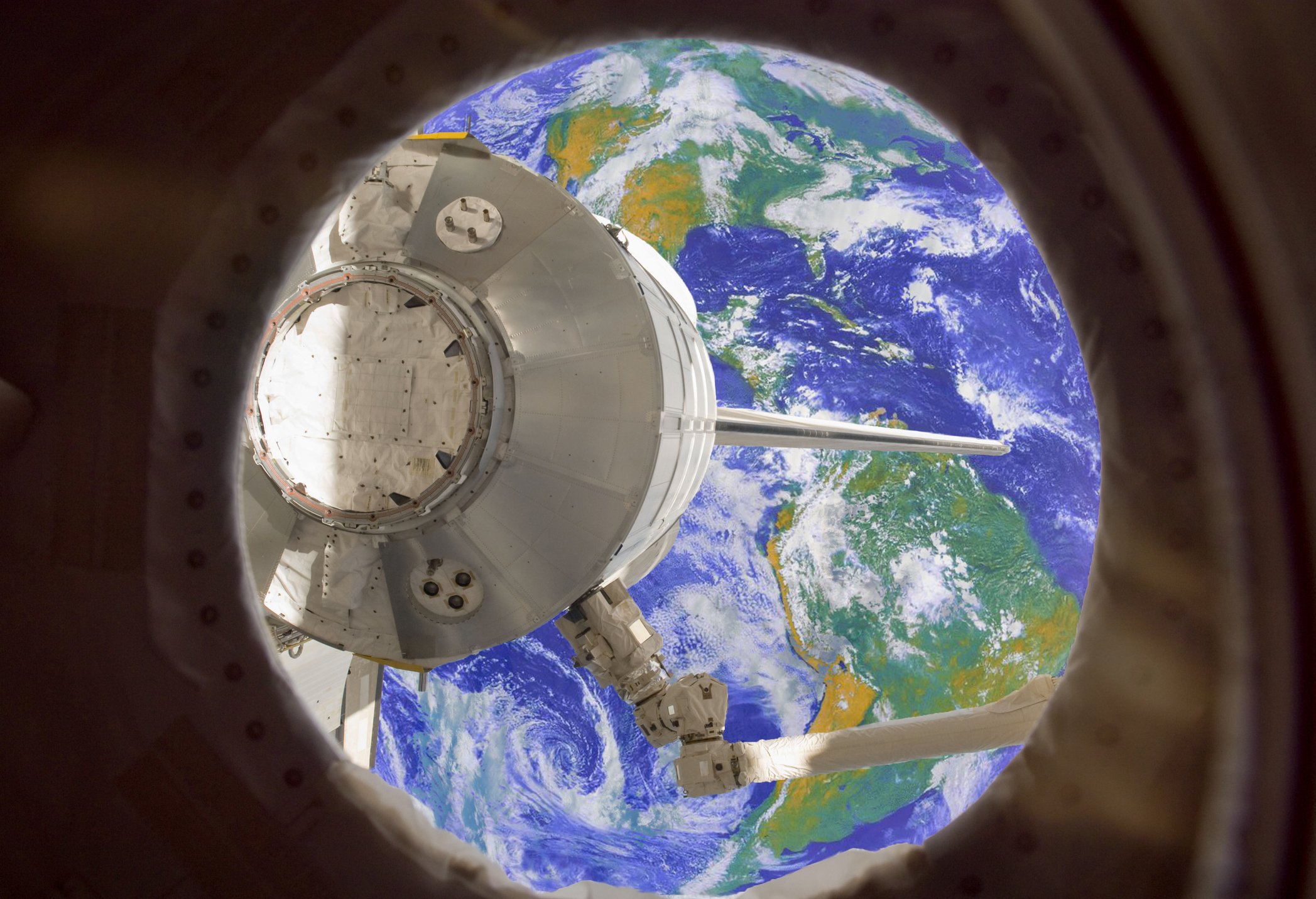

Image source: Getty Images.

Should you buy the dip?

Redwire's shares outstanding have about doubled in the past year. This has been necessary in order to fund its losses and finance its acquisition of Edge Autonomy, but it will present a large headwind to long-term growth in earnings per share (EPS) and, therefore, share price appreciation.

It is unsurprising to see Redwire stock falling last month on these recent developments. The company is seeing slowing revenue growth, lost $42 million on $103 million in revenue last quarter, and has experienced delays in contracts because of the recent government shutdown in the United States. Redwire consistently announces new contracts it has won from defense or space-focused customers such as the U.S. government, but that does not make up for its cash burn and shareholder dilution.

Redwire's stock deserves to keep sinking until it can prove it can generate a profit.