The energy sector is renowned for its high volatility, largely because of the importance of oil and natural gas to the top- and bottom-lines of most energy businesses. However, there are some companies that have proved they have what it takes to survive the energy cycle while still rewarding investors well with dividends. Two of the best are ExxonMobil (XOM +1.00%) and Chevron (CVX +0.04%). Which one could be best for you as we head into 2026?

The business models are similar

Exxon and Chevron are both integrated energy companies. This means they have exposure to oil and natural gas production (the industry's upstream segment), pipelines and other transportation assets (the midstream), and chemicals and refining (the downstream).

NYSE: XOM

Key Data Points

This is important because each segment of the broader industry operates a little differently as the energy cycle progresses. Having all three under one roof helps to smooth out the peaks and valleys that come with energy price fluctuations.

Image source: Getty Images.

There are slight variations in their specific businesses and their approaches. For example, Chevron has tended to have more exposure to commodity prices. However, both are strong, diversified options.

They are both giants, but one is bigger

Exxon is the second-largest publicly traded energy company, followed by Chevron in third place. If you prefer to go with industry-leading companies, either one will do. That said, Chevron's market cap is roughly $300 billion while Exxon's market cap is about $500 billion. Bigger isn't always better, but Exxon is substantially larger than Chevron.

Each company is globally diversified

A significant amount of effort in recent years has gone into expanding in the U.S. market, primarily to gain access to quick-to-develop oil and natural gas in key fracking areas. That is also true of Exxon and Chevron.

However, both have globally diversified portfolios. This fact, plus their integrated models, allows them to direct their capital investments to where management believes they can generate the highest returns.

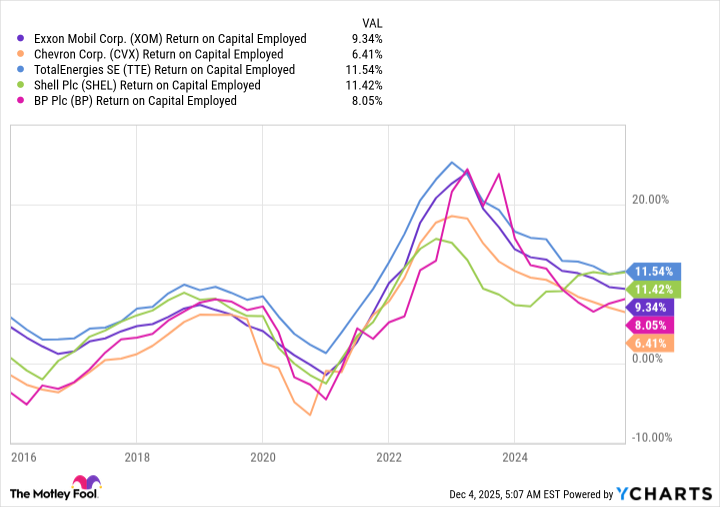

XOM Return on Capital Employed data by YCharts.

Examining return on capital employed, which measures how effectively a company's capital investments have performed, Exxon has historically outperformed Chevron. Still, neither company's performance here falls outside the normal range for their peer group.

There are also times when Chevron outperforms Exxon. On average, Exxon is likely a better capital allocator, but Chevron is hardly a poor one.

Rock solid financial foundations

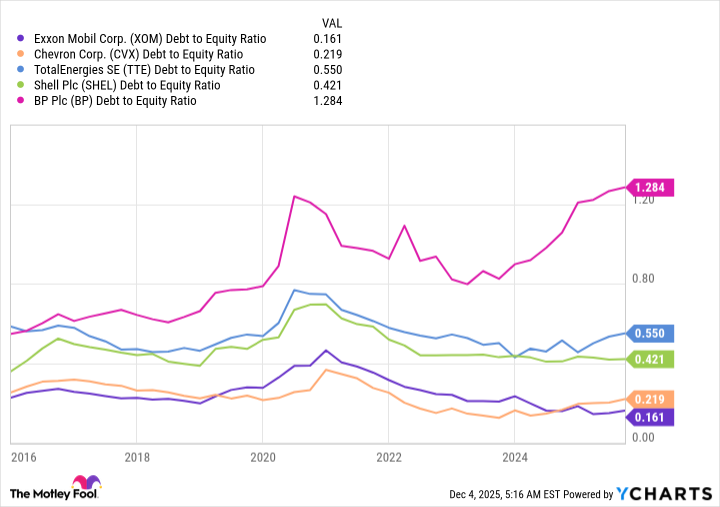

Another way in which these two energy giants are similar is the strength of their balance sheets. Exxon's debt-to-equity ratio is an ultra-low 0.16, and Chevron's ratio is slightly higher at 0.22. Both are low on an absolute basis and would be attractive for any company. And both are at the low end of the peer group, noting that the European integrated energy giants tend to carry more debt and more cash.

XOM Debt to Equity Ratio data by YCharts.

Less debt is likely better than more debt and more cash. Simply put, Exxon and Chevron both have ample capacity to take on debt during energy downturns, enabling them to support their businesses and dividends throughout the entire cycle. The proof of this is evident in the dividend cuts at BP and Shell during the 2020 pandemic, a particularly challenging period for energy markets.

The dividend will likely inform the final determination

The key differentiator between Exxon and Chevron as 2025 comes to a close is likely to be their dividends. However, there are ways in which, even here, the companies are very close. For example, while Exxon has increased its dividend annually for 43 years, Chevron's streak is not exactly shabby at 38 years. Yes, Exxon's streak is better, but both have proved they place a high value on dividends.

NYSE: CVX

Key Data Points

Where things get a little more interesting is in the dividend yield. Exxon's yield is 3.5% right now while Chevron's is 4.5%. That's a full percentage point higher, which is a roughly 29% bump in the income you'll collect. Although these are two similar businesses, the income that dividend investors can generate with Chevron is substantially higher.

Exxon vs. Chevron is a nuanced decision

You probably wouldn't be making a mistake buying either one of these energy industry giants. They have consistently demonstrated over time that they know how to navigate the energy cycle and, at the same time, reward their shareholders with reliable and growing dividends.

However, an investment in Chevron will allow you to generate materially more income as the calendar year switches from 2025 to 2026. For many investors, that will be the key to selecting one of these energy stocks over the other.