Shares in autoparts retailer Advance Auto Parts (AAP 0.06%) rose by 10.1% in November, according to data provided by S&P Global Market Intelligence. The move follows a slew of analyst upgrades after the company's third earnings were released at the end of October. Let's take a closer look at what this means for the investment proposition now.

A perennial value stock

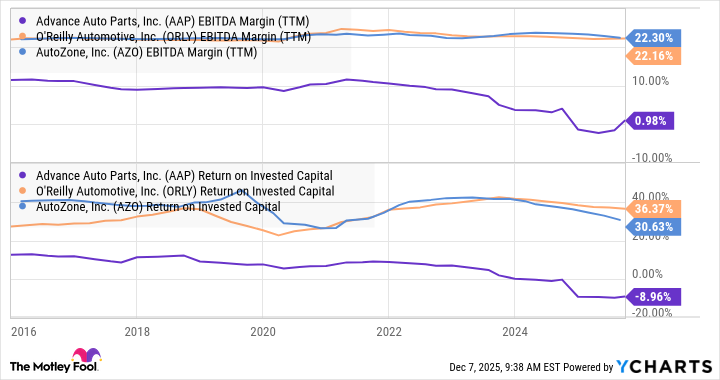

The company is in restructuring mode, and the investment case for buying the stock is based on a simple value proposition. In other words, comparing Advance Auto to its peers like O'Reilly Automotive, and AutoZone, and asking why the company can't get, at least somewhere near, the operational performance of them? If it does so, then the upside potential is significant.

The two charts below provide a small indication of how poorly Advance Auto has performed operationally over the years, and also hint at the potential upside if management turns matters around.

AAP EBITDA Margin (TTM) data by YCharts

But here's the thing: Advance Auto Parts has been in "restructuring mode" for a decade, and little progress has been made.

Is Advance Auto Parts about to turn the corner?

As such, CEO Shane O'Kelly must have known he had a hard task ahead of him when he took over as President and CEO in September 2023. Given the importance of inventory management and logistics in the auto parts retailing business (which revolves around making sure the right parts are in the right stores for customers who want to quickly repair cars), O'Kelly's appointment appears to be a good chance. A longtime veteran of the supply chain industry, O'Kelly was previously the CEO of HD Supply, a major distributor of industrial products.

Favorable market conditions haven't accompanied O'Kelly's tenure, and the tariffs imposed in 2025 have led to increases in prices for imported products, which have led to auto parts retailers "responding rationally by adjusting prices in response to rising product costs," according to O'Kelly on the recent earnings call.

Still, there are signs of improvement, and O'Kelly's plans involve a fundamental rethink of the company's business model. The three-year plan involves the (now completed) closure of 700 stores and locations, as well as four distribution centers, followed by consolidating distribution centers and investing in "market hub" stores. The key to the plan is the new, larger market hub stores, which aim to provide reliable inventory for professional customers.

Image source: Getty Images.

Where next for Advance Auto Parts

O'Kelly's plans make sense, and the third-quarter earnings saw management confirm that it is on track for comparable same-store sales growth of about 1% (midpoint of guidance) in 2025, with an operating income margin of about 2.5%.

That may not sound like much, but it represents a definite improvement over the decline in comparable same-store sales of 0.7% in 2024 and the whopping $713 million operating loss.

As such, investors are growing hopeful that, this time, the turnaround is for real.