CoreWeave (CRWV +1.14%) has taken its investors on a roller-coaster ride in 2025. After a fairly lackluster IPO, its stock stayed flat for a month or so before spiking. It reached a return as high as 359% before peaking, and has slowly tumbled back to today's stock price. It's still up over 100% from its IPO price, marking a successful investment.

However, I think it could double in 2026 if it does just one thing. This task won't be easy, but if it can be accomplished, I will be an immediate buyer of the stock alongside the rest of the market.

Image source: Getty Images.

CoreWeave's business model is unsustainable right now

CoreWeave is an artificial intelligence (AI)-focused cloud computing provider. There is no shortage of cloud computing options available, but none are solely focused on AI like CoreWeave is. Its commitment to filling its data centers with the best possible graphics processing units (GPUs) from Nvidia gives its clients access to the best training hardware available, which is why it has scored several partnerships with AI hyperscalers.

I'm a huge fan of the cloud computing business, as it allows for monstrous profits in exchange for becoming an asset-heavy business. The basic idea is to build a data center, purchase computing units, and then rent the computing power out to customers. The computing units don't last forever, and the key is to charge more for rent than it costs to replace the unit when it fails.

Most companies lack access to the capital required to build their own data center, and they also do not have sufficient computing needs to justify the massive computing capacity needed. This makes the cloud computing model a win-win for CoreWeave and its clientele alike.

NASDAQ: CRWV

Key Data Points

The problem is, CoreWeave isn't profitable.

The lifespan of GPUs tasked with training AI models is known to be fairly short. Some estimates indicate a lifespan of one to three years, while others suggest a maximum of five years. Either way, CoreWeave needs to make a profit on these computing units fast or risk becoming a money pit.

Currently, CoreWeave is a money pit.

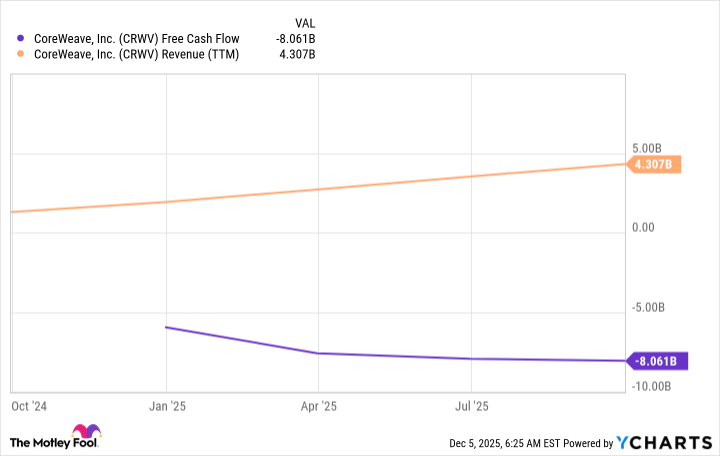

In Q3, revenue came in at $1.4 billion, up an 134% year over year. However, capital expenditures totaled $1.9 billion. That means CoreWeave is spending more on building out computing capacity than it is actually bringing in. That's hard to fathom, and is the primary reason why its free cash flow number is so bad.

CRWV Free Cash Flow data by YCharts

CoreWeave needs to continue growing its revenue at a rapid pace and also increase its free cash flow (FCF) to the point where it's near breakeven. If it can do that, I would be a buyer of the stock, as I love the business model. However, I'm not OK with these massive losses that could collapse the company if the market is unwilling to fund its buildout.

Fortunately, there seem to be some good signs on the horizon for CoreWeave.

CoreWeave has a lot of growth on the books

CoreWeave has already signed massive contracts and has $55.6 billion of revenue backlog. This isn't recognized revenue, but it indicates deals that were signed, so CoreWeave can prepare to have the correct capacity. Indeed, 40% of this revenue is expected to be realized over the next 24 months. That's about $22.4 billion total, and indicates that CoreWeave's revenue is expected to continue nearly doubling each year.

If CoreWeave can deliver the growth necessary to achieve profitability, it can become a popular stock and see its stock price skyrocket. However, if it needs to continue spending a massive amount of money to make that growth a reality, it may not be the best investment option.

I think the time frame when CoreWeave will be profitable will likely be after 2026, but I'd be happy to be wrong. CoreWeave is on my watch list, but I'm not buying shares until I see it get much closer to profitability.