Palantir Technologies (PLTR 0.45%) has been one of the most popular artificial intelligence (AI) stocks since 2023. Its share price has more than doubled every year since then, and there is reason to think it will remain a popular pick heading into 2026.

Its strong performance has led enthused investors, and that has led to a rising valuation, making it a potentially overvalued stock. On the other hand, Palantir's growth is accelerating, and with many companies still only beginning to incorporate AI into their operations, the opportunity for further outsized growth is there.

Given these conflicting takes on the stock, what should potential investors think? Let's see if an answer is out there and explore reasons to buy and sell.

Image source: Getty Images.

Reason to buy: Palantir's growth is impressive

Palantir makes AI-powered data analytics software. While it was originally intended for government use, its applications eventually expanded into the commercial side and saw huge success as well. That expansion eventually led to the rollout of Palantir's Artificial Intelligence Platform (AIP), which allows clients to integrate generative AI agents into their analysis and task these agents with processes humans would usually do. There are options to fully automate, partly automate, or assist, making the software extremely flexible.

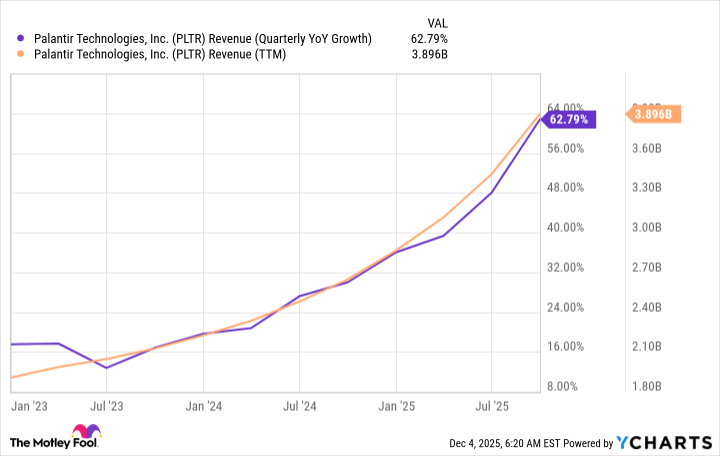

Revenue has exploded in recent quarters, with its most recent quarter being the best yet. Finding and investing in companies that have accelerating growth is usually a winning investment strategy, and Palantir is among the best in any sector.

Data by YCharts; TTM = trailing 12 months; YoY = year over year.

Managing to increase a company's revenue growth rate from 63% is rightly considered a very difficult task, but with the company's track record, I wouldn't be surprised if the growth accelerates further in the fourth quarter. The broader economy is still in the early stages of AI adoption, and companies are looking for the best way to deploy it. Palantir's product has a proven record of delivering improved returns on investments for its clients, which is part of why the growth is accelerating.

NASDAQ: PLTR

Key Data Points

There's still a fairly long runway, too, since Palantir has just 530 U.S. commercial clients ... so far. That bodes well, and if management can continue accelerating its revenue growth in 2026, I think it will be a winning stock.

Any slip-up could lead to a crash

But with success comes increased expectation of more success. And Palantir now has incredibly high expectations to live up to -- at least from its investors. This could cause them to struggle in 2026.

Palantir still manages to exceed both analysts' and its internal expectations nearly every quarter. Those accomplishments are what are causing the stock to continue rising. As soon as there is a miss on what management forecasts (or even just a match), it's likely the price will come tumbling down because of its astronomical valuation.

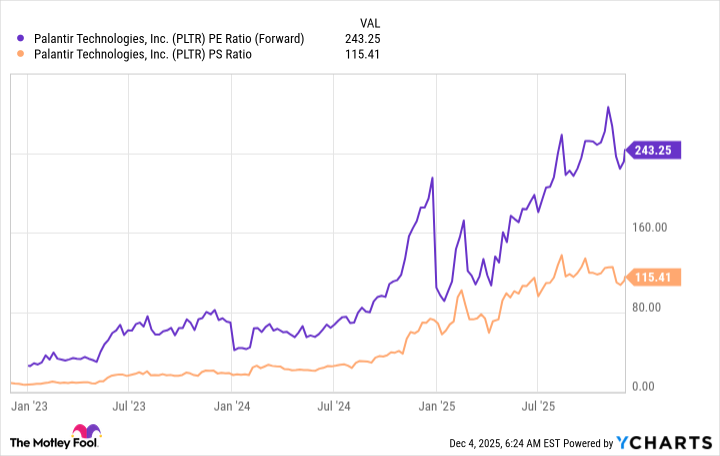

Data by YCharts; PE = price to earnings, PS = price to sales.

At 115 times sales and 243 times forward earnings, it's one of the most expensive stocks in the market. For reference, Nvidia, which is growing at a similar rate, trades for 24 times sales and 38 times forward earnings. Just adjusting Palantir's forward earnings multiple to 38 would cause the stock price to plummet 84%. That's a scary proposition, and it's unlikely to happen in a short timeframe (unless the company's growth seriously slows down).

Instead, let's focus on understanding how many years it would take for Palantir to grow into a 38 times forward earnings valuation. If it maintains a 60% compound annual growth rate -- and Wall Street analysts expect 40% next year -- while delivering a 40% profit margin (like it did during the fourth quarter), it would generate $25.6 billion in revenue and $10.2 billion in profits four years from now. At a forward earnings multiple of 38, that would give the company a market cap of $388 billion.

The problem? It has a market cap of $420 billion right now. So, there are at least four years' worth of strong growth already baked into the current stock price. That's a risk most investors shouldn't take on, and I think the case to sell is a lot greater than the one to buy at the moment.

If Palantir falls to a reasonable valuation, I would love to buy it because it's an incredible business. However, the valuation has gotten out of hand, and I think investors should steer clear of this one.