Quantum computing is billed as the next wave of growth for the tech sector beyond artificial intelligence (AI). This is an important and emerging technology with the potential to create a large industry, estimated to be worth $1 trillion over the next 20 years.

IonQ (IONQ 4.22%) is currently the largest pure-play quantum computing company, and the stock is acting like a true market leader. It has skyrocketed 936% over the past three years. Here's why the stock should be on your holiday shopping list.

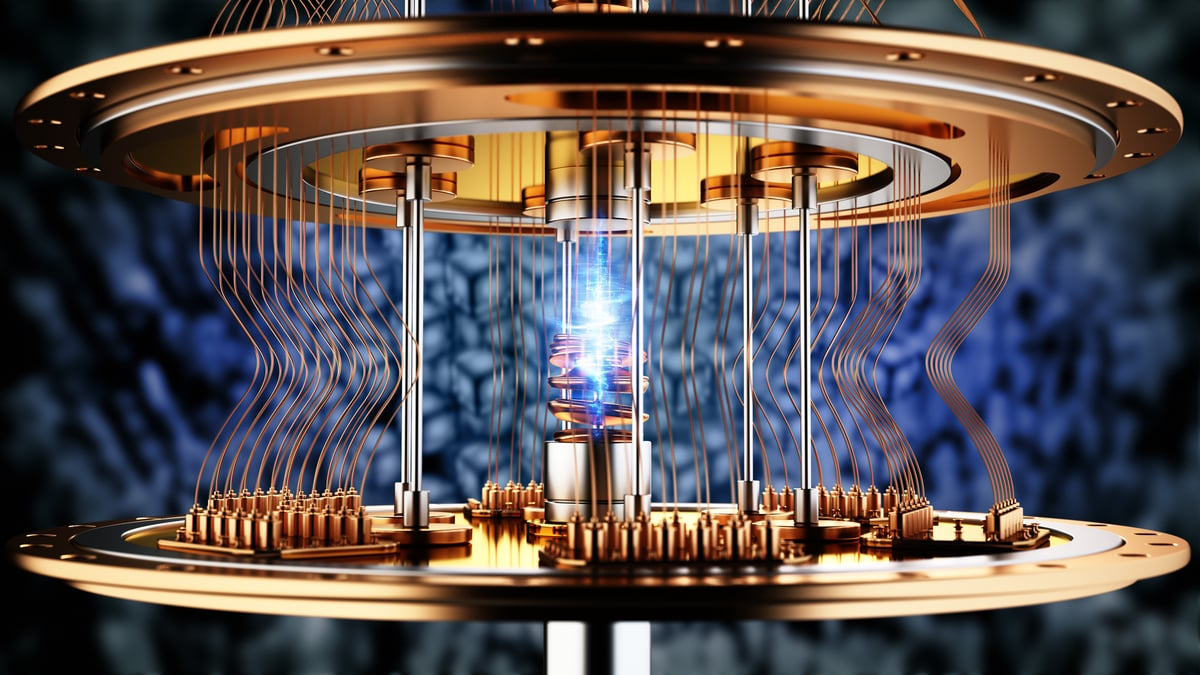

Image source: Getty Images.

Why IonQ is a long-term buy

The stock's performance reflects growing momentum in IonQ's business. IonQ's revenue jumped 222% year over year in the last quarter, exceeding expectations. This revenue growth was driven by recent strategic acquisitions that expanded its platform and enabled continued progress in commercializing its technology.

The company is developing a market-leading platform while also reducing business risk by establishing recurring revenue streams through subscription services. Its fifth-generation AQ64 Tempo quantum computer is designed to be faster and highly accurate with minimal calculation errors.

NYSE: IONQ

Key Data Points

This is a highly volatile stock that trades at a rich valuation, but what you are paying for is a piece of the future. Its $18 billion market cap reflects investor expectations for explosive growth, particularly if it continues to lead the industry. The long-term upside could make a small investment in IonQ worthwhile.