In case you haven't noticed, the energy sector is undergoing a nuclear resurgence.

Or, at least, it was.

Prior to about mid-October, nuclear energy stocks, especially those of companies that are designing microreactors, were surging in value. Oklo, for instance, was up by about 700% on the year, while uranium enricher Centrus Energy was up by about 440%.

Then came the reality check. Many of the companies with surging values were pre-revenue, speculative, unprofitable, posting disappointing results, and only viewed as valuable because they could possibly provide power to artificial intelligence (AI) data centers -- and that space, too, is increasingly viewed by some as being in a bubble.

Since the mood shifted, nuclear stocks have taken a beating -- including one start-up that has already gotten its design for a small modular reactor (SMR) approved by the Nuclear Regulatory Commission. Yes, I'm talking about NuScale Power (SMR 4.21%).

NYSE: SMR

Key Data Points

Shares of NuScale are still up by about 22% on the year, but they're also down almost 10% year over year. For long-term investors who believe nuclear will be a key piece of our energy future, a buying window might be opening. But for this stock to be a millionaire maker, a few things will need to go right for the company.

Image source: Getty Images.

What needs to happen for NuScale to make early investors millionaires

First, NuScale needs firm orders that turn its Nuclear Regulatory Commission-approved designs into actual construction. Although the company has secured agreements for future projects -- such as with the Tennessee Valley Authority -- none have put shovels into the ground yet.

Its collaboration with RoPower to deploy small modular reactors in Romania is one bright spot. Third-quarter revenue increased significantly in part due to NuScale's involvement with that project, though it did report a larger-than-expected loss for the period.

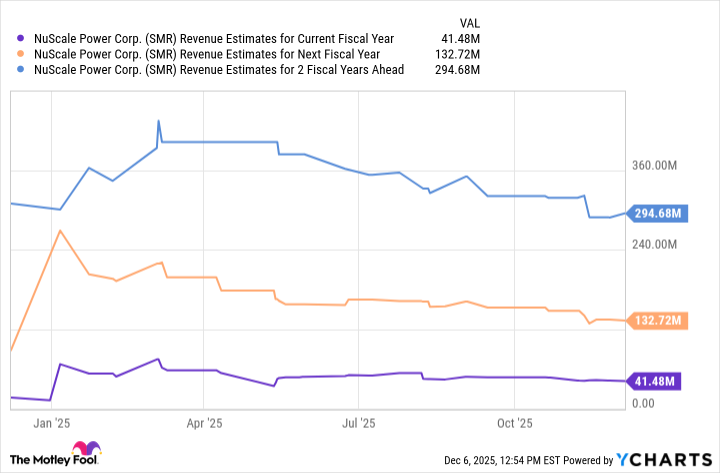

Analysts do expect revenue to grow from here over the next couple of years, as shown in the chart below.

SMR Revenue Estimates for Current Fiscal Year data by YCharts.

Additionally, NuScale has to prove that SMRs can compete on price with other methods of generating electricity, like natural gas plants and renewables. That could be especially challenging in these early years, as scaling up its operation could drive its costs higher.

None of this means NuScale can't eventually deliver millionaire-maker returns. But investors will need to be patient, as the business has a long way to go.