The Nasdaq stock exchange is often the preferred destination for early-stage companies looking to go public, because it offers lower listing fees and fewer barriers compared to alternatives like the New York Stock Exchange. That's why technology giants like Amazon (AMZN +0.38%) and Nvidia (NVDA 0.39%) chose to list on the Nasdaq when their businesses started gaining momentum in the late 1990s.

Companies like Amazon and Nvidia have since become trillion-dollar giants on the back of hypergrowth themes like cloud computing, e-commerce, and artificial intelligence (AI). Thanks to their incredible scale, they dominate the Nasdaq-100 index, which features 100 of the largest nonfinancial companies listed on the Nasdaq, and is often a proxy for the performance of the tech sector.

The Nasdaq-100 plummeted by as much as 7% in November, but it has almost fully recovered. In fact, a gain of less than 2% from here will put the index at a new all-time high. The Invesco QQQ Trust (QQQ +0.12%) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 by holding the same stocks and maintaining similar weightings, so is it a good buy right now? History offers a clear answer.

Image source: Getty Images.

Packed with leaders in AI, autonomous driving, robotics, and more

Although the Invesco QQQ ETF is home to 100 different companies, its top 10 holdings alone represent a staggering 55.3% of the value of its entire portfolio. Therefore, not only does it offer a high degree of exposure to technology and technology-adjacent industries, but it's also highly concentrated, with just a select few names having an outsized influence over its performance.

|

Stock |

Invesco ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

9.36% |

|

2. Apple |

8.75% |

|

3. Microsoft |

7.52% |

|

4. Alphabet |

7.51% |

|

5. Broadcom |

6.23% |

|

6. Amazon |

5.13% |

|

7. Tesla |

3.48% |

|

8. Meta Platforms |

3.01% |

|

9. Netflix |

2.27% |

|

10. Palantir Technologies |

2.09% |

Data source: Invesco. Portfolio weightings are accurate as of Dec. 4, 2025, and are subject to change.

Nvidia and Broadcom are leading suppliers of chips and components for data centers, which are critical for AI development. Nvidia has also created software and hardware platforms for autonomous vehicles and robots, which could fuel its next phase of growth once the AI infrastructure buildout slows down.

Microsoft, Alphabet, and Amazon have each developed their own AI assistants, but they also operate the three largest cloud computing platforms in the world, which offer a range of services to help businesses develop and deploy AI software. Those services include access to state-of-the-art data centers and ready-made large language models (LLMs), which can be used to accelerate their progress.

Tesla, on the other hand, is one of the world's top manufacturers of electric vehicles (EVs), but investors are more focused on the company's futuristic product platforms like its autonomous robotaxi, the Cybercab, and its humanoid robot called Optimus. The Cybercab is expected to enter mass production in 2026, and Optimus could follow shortly after. Both products could be orders of magnitude more valuable to Tesla than its EV business.

But with other holdings like streaming giant Netflix, e-commerce titan Shopify, food delivery powerhouse DoorDash, and small business software juggernaut Intuit, the Invesco QQQ ETF isn't all about advanced technologies like AI. In fact, it also holds many stocks from outside the tech sector entirely, including Costco Wholesale, PepsiCo, and Starbucks.

NASDAQ: QQQ

Key Data Points

History suggests there is rarely a bad time to invest

The Invesco QQQ ETF has delivered a compound annual return of 10.5% since its inception in 1999, even after accounting for every sell-off, correction, and bear market -- including those triggered by earth-shattering events like the dot-com crash, the global financial crisis, and the COVID-19 pandemic.

Past performance isn't always a reliable indicator of future results, but the Nasdaq-100 tends to trend higher over time, so there is rarely a bad moment to buy the Invesco QQQ ETF as long as investors intend to hold it for a long-term period of at least five years (but the longer, the better). Betting against this index means betting against some of the greatest innovations of our time, many of which have permanently reshaped our lives.

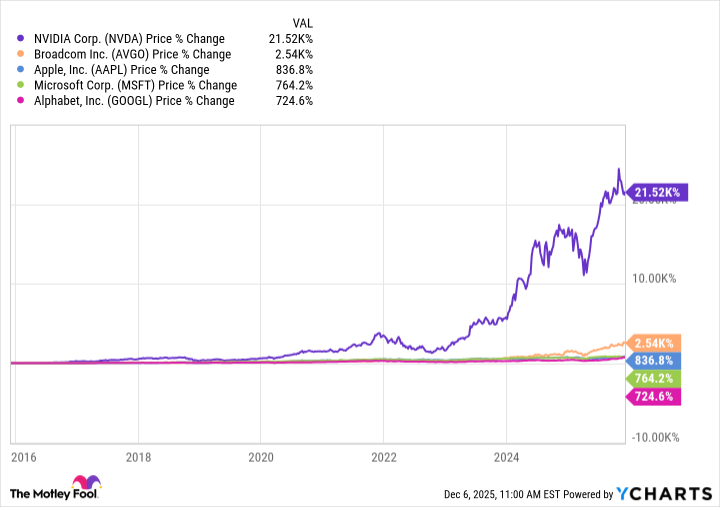

The chart displays the returns of the top five stocks in the Invesco ETF over the past decade alone. The evidence suggests it pays to stay bullish and optimistic:

Although AI has fueled blistering returns in some of those stocks over the last few years, other technologies like autonomous vehicles, robotics, and even quantum computing are likely to take over as the dominant drivers of upside sometime in the next 10 years or so. Simply put, technology is constantly evolving, so investors shouldn't be deterred from buying the Invesco QQQ ETF just because the Nasdaq-100 is near an all-time high.