The Metals Company (TMC +14.06%) isn't your typical miner. Instead of blasting rock, it wants to vacuum potato-sized "nodules" from the Pacific seabed and turn them into battery-grade nickel, copper, cobalt, and manganese.

In theory, sucking nodules from the Pacific Ocean could be more financially efficient and less environmentally destructive than digging for them on land. At the same time, no one knows for certain what deep-sea mining entails, as no metals company has a license to scale operations commercially.

Image source: The Metals Company.

TMC, however, might be getting close. While a start date for commercialization was formerly a big unknown, it now projects late 2027 as a potential launch window.

That timeline makes TMC stock intriguing, as it currently trades under $10. But it's also why investors should slow down and look closely at what has to go right for this stock to take off.

A massive treasure chest with a lot of "ifs"

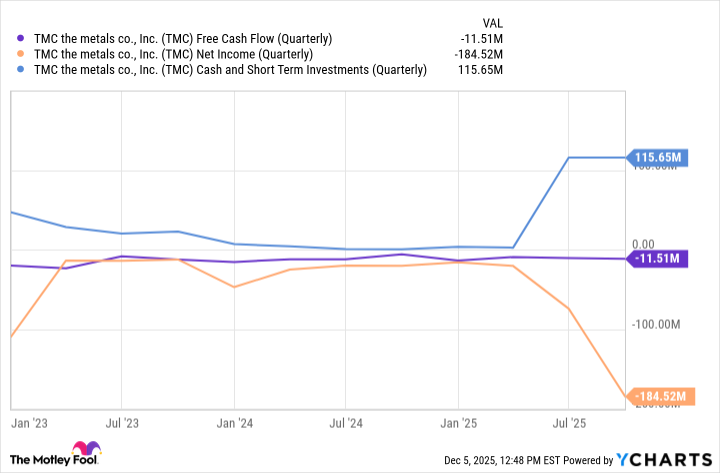

TMC's late-2027 target depends on a few factors. First, it needs enough capital to make it to first revenue. On that note, it had about $165 million in total liquidity at third quarter's end, but with ongoing cash burn, that cushion won't last forever.

TMC Free Cash Flow (Quarterly) data by YCharts

The second thing it needs is a license for commercial operations. That means a rulebook for deep-sea mining needs to be finalized, and a regulator has to let TMC be the first to put it into practice.

The International Seabed Authority (ISA) is the agency responsible for this rulebook, and it hasn't quite figured it out. And while TMC is exploring a U.S. permitting path, it's not clear if that route will hold up legally.

NASDAQ: TMC

Key Data Points

Finally, it's worth noting that TMC's technology has never been proven at scale. As such, technical uncertainties and engineering problems could challenge its operations, even if the company obtained a commercial license.

With as little as we know about deep-sea mining, TMC's current share price seems appropriate. Aggressive investors with a long-term horizon might want to add shares. More conservative investors may find a metals exchange-traded fund (ETF) more appropriate.