Shares of AeroVironment (AVAV 1.40%) declined more than 12% on Wednesday after the unmanned aerial vehicle manufacturer's earnings fell short of investors' expectations.

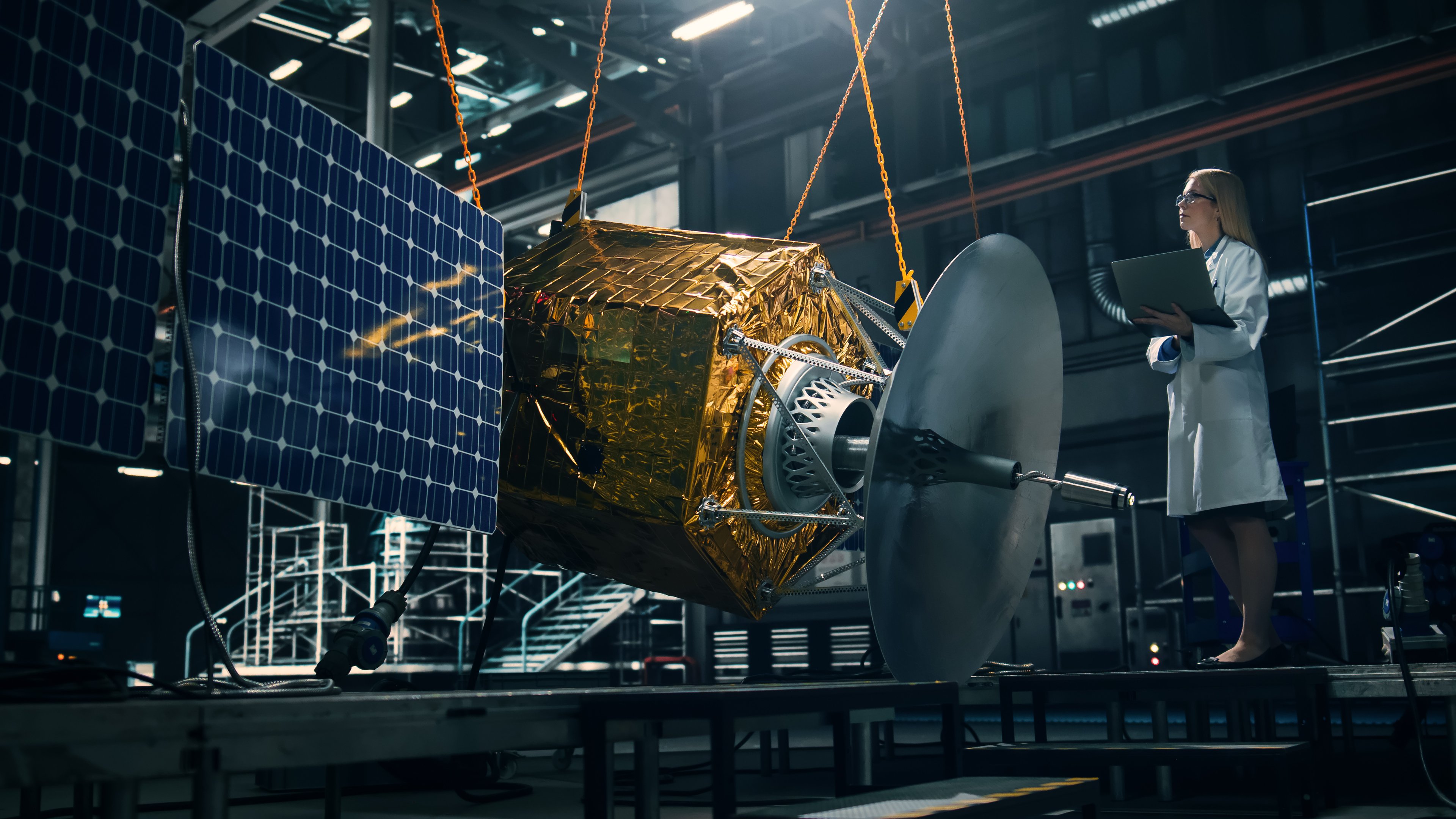

Image source: Getty Images.

BlueHalo is boosting sales growth, but acquisition costs weighed on profits

AeroVironment's revenue soared 151% year over year to $472.5 million in its fiscal second quarter ended Nov. 1. The gains were fueled by the defense contractor's acquisition of BlueHalo, a provider of space technology and autonomous systems, in May.

"We have built a portfolio of integrated capabilities and advanced technologies to meet the market's accelerating demand and serve as a partner of choice in critical moments," CEO Wahid Nawabi said in a press release.

Excluding the impact of BlueHalo, AeroVironment's revenue rose a solid 21% to $227.4 million.

NASDAQ: AVAV

Key Data Points

In turn, AeroVironment's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) surged 74% to $45 million.

However, the drone maker's adjusted earnings per share came in at $0.44, which was below Wall Street's estimates. Analysts had expected adjusted per-share profits of $0.79, according to Yahoo! Finance.

AeroVironment remains well-positioned for a drone-based future

Management guided for full-year revenue of $1.95 billion to $2 billion and adjusted EBITDA of $300 million to $320 million. The company also expects to generate adjusted earnings of $3.40 to $3.55 per share.

"We are confident that our unmatched innovation, strategic partnerships, and agility to expand our manufacturing capacity enable us to address evolving defense needs and lead the generational shift in defense over the longer term," Nawabi said.