Modern companies often use multiple providers of cloud services (like Microsoft Azure and Amazon Web Services) in their daily operations. But this means valuable data is stored in several different places, so it becomes difficult to analyze.

Snowflake (SNOW 0.68%) developed the Data Cloud, which helps businesses aggregate this disparate data in one place, where it can be utilized more effectively. This is especially useful when developing artificial intelligence (AI) models, because they need uninterrupted access to all of a company's internal data to produce the best results.

Snowflake stock has soared by 43.7% this year thanks to the company's incredibly strong operating results. It's crushing the S&P 500 (16.5%), the Nasdaq-100 (22.3%), and even Nvidia (37.5%). Can it outperform again in 2026?

Image source: Getty Images.

Accelerating AI adoption for businesses

Snowflake launched a new platform called Cortex AI in 2023, which includes a suite of services to help businesses bring their AI ambitions to life. For instance, it offers access to ready-made large language models (LLMs) from leading developers like OpenAI, which businesses can combine with their internal data to create their own custom AI software.

Cortex also includes tools like Document AI, which can autonomously extract valuable data from unstructured sources like contracts and invoices. Previously, it would have taken human employees days or even weeks to harvest that type of data at scale, leading to significant costs.

A feature called Snowflake Intelligence is at the heart of Cortex. It's an AI agent that allows employees of all skill levels to use natural language to extract value from their organization's internal data. That means even non-technical staff members can turn high volumes of messy data into actionable insights, which substantially improves their productivity.

Snowflake had 12,621 customers at the end of its fiscal 2026 third quarter (ended Oct. 31), and 7,300 of them were using at least one of the company's AI products every week. That number more than doubled from 3,200 customers in the year-ago period.

Rapid revenue growth, but there's a catch

Snowflake generated $1.16 billion in product revenue during the third quarter, which was up 29% year over year. It comfortably beat the upper end of management's forecast, which was $1.13 billion.

Snowflake's remaining performance obligations (RPOs) grew at an even faster pace of 37%, coming in at a record high of $7.8 billion. RPOs are like an order backlog, so they can be a useful indicator of future revenue. However, Snowflake expects to recognize less than half of its RPOs over the next 12 months, and it hasn't offered any guidance for the rest, so investors shouldn't hang their hats on this metric. Customers can always change their plans or neglect to follow through on their commitments.

NYSE: SNOW

Key Data Points

But the real concern for Snowflake is at the bottom line. The company lost an eye-popping $293 million on a generally accepted accounting principles (GAAP) basis during the third quarter, taking its year-to-date net loss to over $1 billion. The losses have been fueled by a large increase in operating expenses throughout the year, because the company is aggressively trying to acquire new customers and develop its AI product portfolio.

Snowflake has issued almost $1.3 billion worth of stock-based compensation to its employees (across all departments) so far in fiscal 2026, which is one way the company incentivizes them without depleting its cash reserves. If we exclude this cost, along with other non-cash and one-off expenses, Snowflake actually generated an adjusted (non-GAAP) profit of $347 million during the first three quarters of fiscal 2026.

But even though stock-based compensation is a non-cash expense, it still impacts investors. Every time Snowflake issues new shares to its employees, it's diluting the holdings of every existing shareholder. That's why many Wall Street analysts don't consider non-GAAP profits to be "true" profits.

Snowflake's valuation could limit further upside in 2026

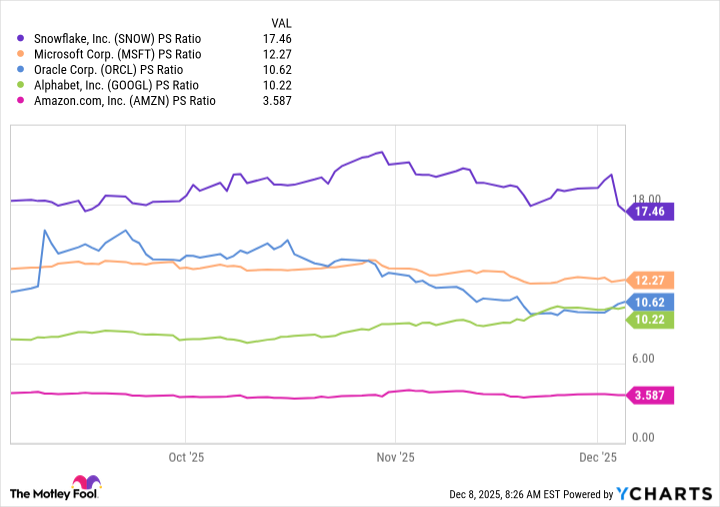

Snowflake stock might struggle to deliver another barnstorming gain in 2026, because it's entering the year at an elevated valuation. Its price-to-sales (P/S) ratio is 17.4 as I write this, which makes it far more expensive than every other major provider of cloud and AI services:

Data by YCharts.

Those companies aren't perfect comparables to Snowflake, because products like the Data Cloud and Cortex AI are highly specialized. Plus, Microsoft, Amazon, Alphabet, and Oracle offer more than just cloud services, so investors have to take all of their businesses into account to arrive at an appropriate valuation.

However, the cloud divisions in each of those companies (except Amazon) delivered faster revenue growth than Snowflake in their most recent quarters; Google Cloud grew by 34%, Microsoft Azure grew by 40%, and Oracle Cloud Infrastructure grew by 55%. From that perspective alone, it's hard to justify Snowflake's premium valuation.

As a result, I think further upside in Snowflake stock could be limited next year.