Investors who had little or no exposure to the artificial intelligence (AI) space during 2025 likely underperformed the benchmark S&P 500 (^GSPC +0.44%) index, because they would have missed out on significant returns from high-flying stocks like Nvidia (NVDA +1.46%), Broadcom (AVGO +2.71%), and Alphabet.

Since we're just a few weeks away from the start of a new year, this might be a good time for investors to make some adjustments to their portfolios. AI will likely remain a dominant driver of stock market returns in 2026, and there's a simple way to buy a basket of the industry's top stocks without having to pick winners and losers.

The Roundhill Generative AI and Technology ETF (CHAT +2.96%) is an exchange-traded fund (ETF) that invests exclusively in a small group of AI powerhouses, and investors can buy a single share for under $70. Here's why it could be a great addition to a diversified portfolio for 2026.

Image source: Getty Images.

The world's best AI stocks packed into one ETF

The Roundhill Generative AI and Technology ETF invests in companies developing the infrastructure, platforms, and software fueling the AI boom. The ETF holds just 50 stocks, so it doesn't offer much diversification, and its five largest holdings represent 25.9% of the total value of its portfolio, so it's also quite top-heavy.

This occasionally leads to high volatility, which is why it's important for investors to buy this ETF only as part of a diversified portfolio of other funds and individual stocks.

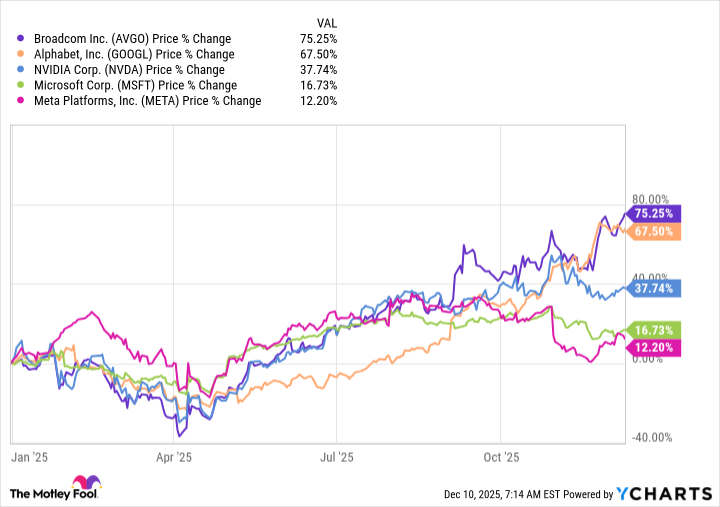

With that said, the top five holdings in the ETF (in order of their portfolio weightings) are Alphabet, Nvidia, Microsoft, Meta Platforms, and Broadcom, which are leading various segments of the AI boom. They have delivered a median return of 37% this year, far outpacing the S&P 500, which is up 16%.

Data by YCharts.

But those five stocks can be found near the top of many popular ETFs because of those strong returns and the enormous scale of the underlying companies. Therefore, I want to highlight a few of the other leading AI stocks in the Roundhill ETF that sit outside its top five positions:

- Advanced Micro Devices (AMD +0.19%): This company will launch its most powerful lineup of AI data center chips in 2026, which will bring it one step closer to catching Nvidia in this valuable market.

- Palantir Technologies (PLTR 0.53%): This company developed two platforms called Gotham and Foundry, which use AI to help businesses and government agencies extract maximum value from their internal data.

- CoreWeave (CRWV +11.60%): This company is one of the leading providers of AI infrastructure, which it delivers via the cloud. Businesses rent the computing capacity from its data centers and use it to develop AI software.

- Micron Technology (MU +5.54%): This is one of the world's leading suppliers of high-bandwidth memory solutions for data centers, which are critical in AI workloads. Nvidia and AMD both use Micron's HBM3E memory in their most advanced AI chips.

- Snowflake (SNOW +0.56%): This cloud provider offers a growing portfolio of tools and services to help businesses gather data and deploy AI software.

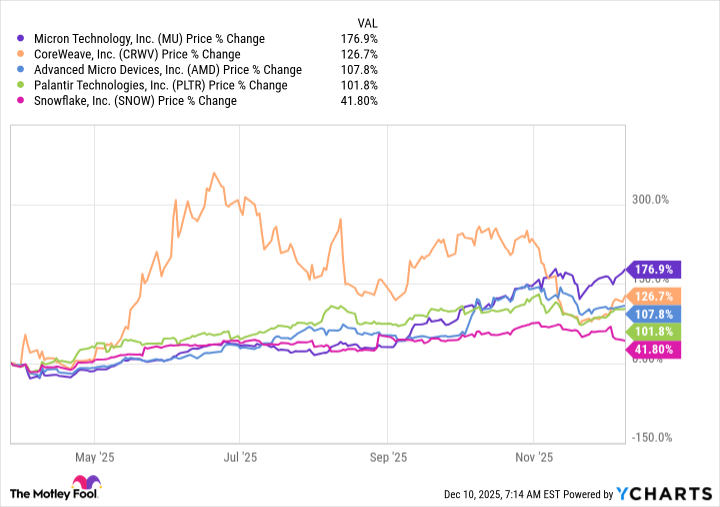

Those five stocks have also delivered spectacular returns this year -- in fact, four of them have more than doubled in value. I'm not suggesting these annual returns are sustainable over the long term, but it proves investors don't always have to pile into the market leaders to earn eye-popping gains:

Data by YCharts.

The Roundhill ETF is crushing the S&P 500

Given the performance of the stocks I highlighted above, it's no surprise that the Roundhill ETF has soared 53% in 2025, more than tripling the S&P 500's return. However, it's important to note that this ETF was only established in 2023, so it doesn't have a very long track record, and it hasn't been battle-tested during a prolonged bear market or an economic recession.

NYSEMKT: CHAT

Key Data Points

Plus, the Roundhill ETF's strong performance comes at a price. It has an expense ratio of 0.75%, which is the proportion of the fund deducted each year to cover management costs. It means an investment of $10,000 will incur an annual fee of around $75, whereas the same investment in a passive index fund from an issuer like Vanguard would cost as little as $3.

Those high fees aren't an issue right now because the ETF is producing blistering returns. However, if the AI boom falters at some point in the future, investors might have to endure a period of weak returns, which will make the high fees a little harder to stomach. I don't think that will happen for a few years, considering Nvidia CEO Jensen Huang predicts annual AI infrastructure spending will grow to a staggering $4 trillion between now and 2030, meaning this technological revolution might still be in the very early stages.

Therefore, while there is no guarantee the Roundhill ETF will produce another annual return of over 50% in 2026, I think it's likely to outperform the broader market yet again.