Nvidia (NVDA +1.15%) has made history in recent years by making the go-to product for training and running high-performance artificial intelligence (AI) applications. Its graphics processing units (GPUs) helped make Nvidia the biggest publicly traded company in the world, briefly achieving a market capitalization of more than $5 trillion.

Becoming No. 1 was great for the company and its shareholders. But it may be tougher in 2026 for Nvidia to maintain that advantage as its competitors -- some of whom are the biggest and most successful companies in the world -- roll out products to cut into Nvidia's market share.

Advanced Micro Devices has long been one of Nvidia's top competitors, but now there's renewed competition from some of Nvidia's biggest customers, such as Alphabet (GOOG +0.42%) (GOOGL +0.40%) and Amazon (AMZN +2.63%), that are looking to earn revenue from selling their own custom semiconductors rather than pumping billions into Nvidia's coffers.

Faced with increasing competition, is Nvidia stock still worth buying at a premium price?

Image source: Nvidia.

Why Nvidia has been dominant

AI is a generational breakthrough that's changing not only how companies operate but also how people invest. Top AI companies Nvidia, Alphabet, Microsoft, Apple, and Broadcom are among the biggest companies in the world right now, bringing in hundreds of billions of dollars a year. Their products are in high demand as businesses focus on using AI to modernize their operations, manage supply chain changes and inventory, and provide public-facing tools that differentiate them from competitors.

Nvidia has been at the center of this because it provides the lion's share of GPUs needed to train and run high-level AI programs. It's estimated to have as much as 90% of the data center GPU market. That's given Nvidia incredible growth in the last three years as its stock price is up more than 970%, and its revenue jumped by nearly 600%.

Nvidia's earnings reports continue to blow expectations out of the water. Despite massive comparable numbers on a year-over-year basis, Nvidia consistently outperforms. Revenue in the third quarter of fiscal 2026 (ended Oct. 26, 2025) was up 62% from a year ago, hitting $57 billion. Most of that money came from data center sales, which were $51.2 billion and up 66% from a year ago.

NASDAQ: NVDA

Key Data Points

CEO Jensen Huang has said demand for Nvidia's Blackwell GPUs remains strong, and next year the company will be rolling out the next-generation Rubin chips as demand continues for GPU-accelerated computing, generative AI, and agentic AI. "There's been a lot of talk about an AI bubble," he said. "From our vantage point, we see something very different."

A look at the competition

Undoubtedly, Nvidia's going to see some pressure in the next year. Blackwell chips cost more than $30,000, according to Huang, and data centers need to connect hundreds of them to operate AI-level programs. Major tech companies have been spending tens of billions on AI infrastructure this year, with estimates that spending will increase next year.

One way major companies can reduce costs is by designing their own chips. Amazon has taken that route, having recently announced the Tranium3 chip, which it claims is four times faster and has four times the memory of its previous generation chip, while also being more energy efficient.

And it's already working on a Tranium4 chip that will be able to work along with Nvidia GPUs while using Amazon's own versions that will be able to work with Nvidia chips. That means Amazon customers will be able to train on Nvidia GPUs and then scale up using Amazon Web Services (AWS) at a lower price point than Nvidia chips require.

Then there's Alphabet, which has developed tensor processing units (TPUs) designed for machine learning workloads. TPUs have been utilized in Google Cloud infrastructure, but Alphabet is reportedly in talks with Meta Platforms to supply billions of dollars' worth of AI infrastructure, including its TPUs, for Meta's own data centers. That would be a big blow as Meta is a Nvidia customer.

Is Nvidia still a buy?

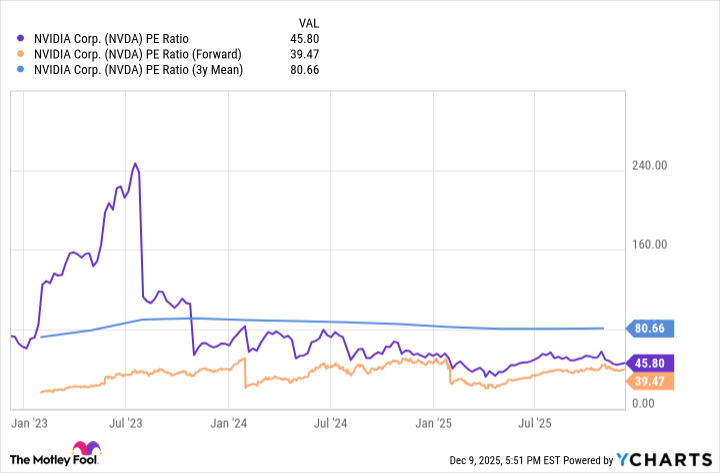

You would never confuse Nvidia for a cheap stock. However, it's not terribly expensive, considering its origin. The stock currently has a price-to-earnings (P/E) ratio of 45.8 and a forward P/E of 39.5. But when you consider that its three-year P/E mean is more than 80, the current ratio in the 40s isn't nearly as objectionable.

NVDA PE Ratio data by YCharts.

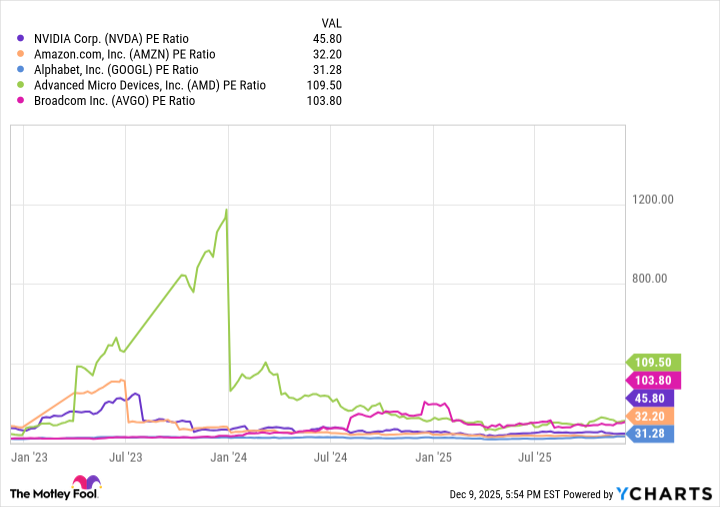

It's also much lower than anything you would get out of pure-play chipmakers like AMD or Broadcom, both of which have a P/E over 100. And it compares favorably to Amazon and Alphabet, which are both working to get a piece of Nvidia's data center business.

NVDA PE Ratio data by YCharts.

Nvidia may have a more challenging year in 2026, but it's still going to rake in huge numbers in revenue and profits, and its still a buy in my book. Investors should keep a close eye on the reception for the Rubin chips when they are rolled out, and they should also watch for any slippage in Nvidia's data center market share before making a decision.