The current S&P 500 bull market turned three years old in October 2025. Ryan Detrick, the chief market strategist of financial services firm Carson Group, points out that once a bull market hits three years, it has a much better chance of stretching to an average of eight years, based on analysis of data going back to 1950. Detrick's confidence in this market stems from the healthy earnings growth that tech companies have been clocking. Additionally, HSBC analysts expect the S&P 500 index to hit 7,500 levels, driven by the sustained spending on artificial intelligence (AI) infrastructure.

Technology stocks in particular have clocked impressive returns in 2025, as is evident from the 22% gains registered by the tech-heavy Nasdaq Composite index. The good news for tech investors is that the Nasdaq is likely to head higher in 2026 as well, driven by a broader market rally.

These indicators and others suggest that now might be a good time to buy a couple of tech stocks that have been in impressive form on the market this year and have the potential to jump even higher in 2026.

Image source: Getty Images.

1. Advanced Micro Devices

With gains of 81% so far in 2025, Advanced Micro Devices (AMD +2.29%) stock has outperformed the broader PHLX Semiconductor Sector index's 46% gains by a wide margin. This solid performance is a result of AMD's growing stature in the artificial intelligence data center market, where its graphics processing units (GPUs) and server processors are experiencing healthy demand.

NASDAQ: AMD

Key Data Points

AMD has signed contracts with major names such as OpenAI, Oracle, Microsoft, and others to deploy its AI chips. The added contracts help explain why AMD expects an acceleration in its data center revenue from next year. The company pointed out in its recent financial analyst day that its data center revenue is likely to clock an annual growth rate exceeding 60% over the next three to five years. That would be an improvement over the 52% annual growth this business has seen in the past five years.

Even better, AMD's personal computing (PC) business is in fine form as well. Its client processor revenue was up by 46% year over year in the third quarter to a record $2.8 billion. This segment benefits from the proliferation of AI PCs, as well as AMD's market share gains against Intel. The good part is that 2026 is going to be another terrific year for AI PC sales, with shipments expected to surge by 83% to 143 million units.

As such, AMD is in a solid position to sustain its outstanding growth in 2026. Analysts expect its bottom-line growth rate to triple next year to just over 62% to $6.44 per share. With the stock trading at an attractive 35 times forward earnings as compared to the U.S. tech sector's average earnings multiple of 46, investors are still getting a decent deal on AMD stock.

If the company indeed achieves $6.44 per share in earnings next year and trades in line with the industry's average, its stock price could hit $296. That suggests potential upside of 34%, which is why buying this tech stock right now seems like a smart thing to do, as it could head higher in 2026.

2. Alphabet

Alphabet (GOOG 0.68%) (GOOGL 0.79%) is another Nasdaq stock that has done pretty well on the market in 2025, registering 67% gains as of this writing. The "Magnificent Seven" stock's healthy gains aren't surprising, as Alphabet has been growing at a healthy pace thanks to its AI investments.

NASDAQ: GOOG

Key Data Points

The company's revenue in the previous quarter was up by 16% year over year to $102.3 billion. Its earnings grew at an even better rate of 35% from the year-ago period. Alphabet saw healthy growth across its search and cloud businesses. Management points out that its investment in AI tools such as the Gemini app, AI search options, and cloud computing infrastructure is driving an improvement in user engagement and paving the way for stronger growth.

For example, Google Search's AI mode is being used by 75 million users daily, which is impressive considering that it was launched only earlier this year. Even the AI Overviews feature in search is driving "meaningful query growth" for the company, thanks to its ability to answer more of users' questions.

Coming to the Google Cloud business, the company reported a 34% year-over-year increase in this segment's revenue. Investors, however, can expect this business to grow at a stronger pace in 2026 and beyond. That's because the cloud AI market is expected to quadruple in size over the next five years, generating $327 billion in revenue at the end of the forecast period.

Google offers customers access to a diversified cloud infrastructure on which they can train, build, customize, and deploy AI models and applications. Its cloud infrastructure is powered by chips from the likes of Nvidia and AMD, as well as its internally designed chips. In fact, Anthropic recently announced that it will deploy up to 1 million of Alphabet's custom chips, and there are reports that Meta Platforms could become a customer for the search giant's AI chips as well.

Investors should also note that Alphabet reported a $155 billion backlog in its cloud business at the end of the previous quarter. The metric jumped by 46% sequentially, suggesting that the Google Cloud business is likely to sustain healthy growth levels in the future as demand for cloud-based AI services increases.

In all, Alphabet's focus on becoming a full-stack AI company that offers access to cloud infrastructure, popular large language models such as Gemini, and cloud-based AI applications that help improve productivity should set it up for robust long-term growth. Of course, the company's heavy investments in AI infrastructure will weigh on its top line next year, but investors shouldn't miss the bigger picture.

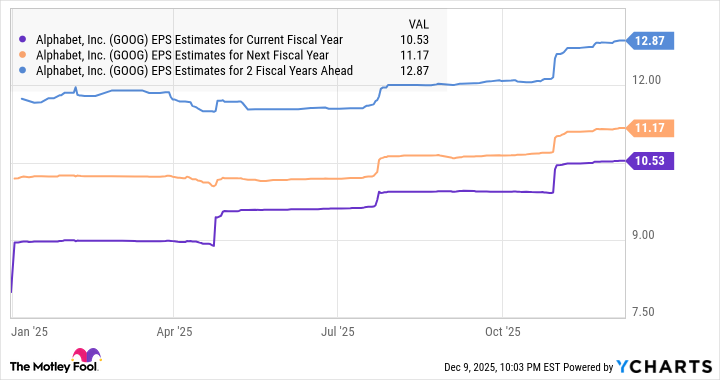

Data by YCharts.

The company's growth is expected to accelerate eventually as its AI efforts yield results. That's why it would be a good idea to buy Alphabet stock as it trades at an attractive 29 times forward earnings, a nice discount to the tech sector's average.