When the market is roaring higher as it's been doing over the past three years, it's easy to forget about the importance of passive income. You may be more focused on the fantastic gains delivered by certain growth stocks that don't pay dividends -- and, don't get me wrong, these sorts of players are great to have in a portfolio.

But here's why it's also a good idea to add a few dividend players to the mix. First, who doesn't like extra cash? Whether the market is rising or falling, you'll collect these payments without lifting a finger -- the only thing you have to do is own a dividend-paying stock. Second, these payments may add to your gains during good times and limit your losses during bad times. And over the long haul, they could help you along on the path to wealth.

Which stocks to buy? Dividend Kings make a wise choice since they've increased their dividend payments for at least 50 straight years. This shows their commitment to a dividend strategy and their ability to make these payments over time. With this in mind, get ready to start the new year off with passive income: Here are three Dividend Kings to buy now.

Image source: Getty Images.

1. Coca-Cola

You probably know Coca-Cola (KO +2.04%) best for its eponymous beverage, but the company actually sells 200 brands covering a variety of beverage types -- from sparkling drinks to water. As the world's biggest non-alcoholic beverage company, and in existence for more than 130 years, it's had the time to build up a significant brand moat -- fans generally want a Coca-Cola and won't go for another cola drink -- and earnings track record.

NYSE: KO

Key Data Points

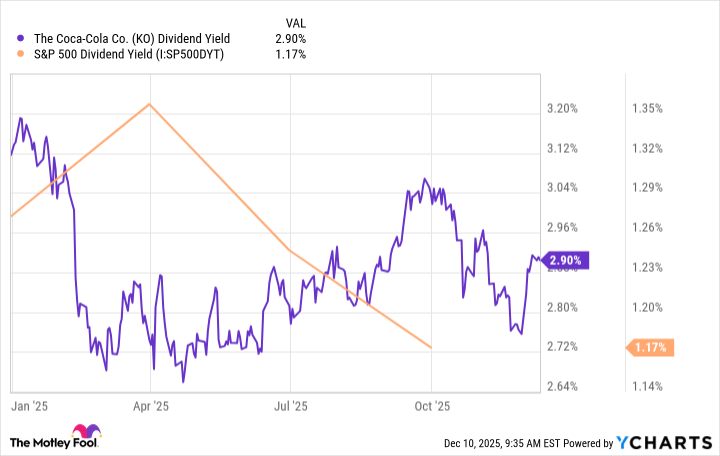

So, when you buy Coca-Cola shares, you're getting in on a solid company. This player also is a dividend giant, having increased its payments for more than 60 years. Today, Coca-Cola pays a dividend of $2.04, representing a dividend yield of 2.9%. This surpasses the dividend yield of the S&P 500. All of this makes Coca-Cola a no-brainer addition to any dividend portfolio.

KO Dividend Yield data by YCharts

2. Abbott Laboratories

Abbott Laboratories (ABT +1.78%) is a healthcare giant operating in four different specialty areas: medical devices, nutrition, diagnostics, and established pharmaceuticals. I like this business model because it offers investors some safety -- if one sector faces a challenge, the others may continue to perform and limit negative impact on earnings.

Like Coca-Cola, Abbott has delivered earnings growth over time, and the company is a leader in areas such as diabetes management and nutrition drinks.

NYSE: ABT

Key Data Points

In addition to this, Abbott also has scored a spot on the Dividend Kings list by increasing its dividend for the past 53 years. Abbott pays a dividend of $2.36 per share, at a yield of 1.9% -- and like Coca-Cola, Abbott's dividend yield is higher than that of the S&P 500.

Abbott, as a healthcare company, offers investors a certain level of security -- patients need their treatments in any environment -- as well as passive income they can count on.

3. Target

Target (TGT +0.17%) has been a difficult stock to own in recent years -- I know this firsthand -- as the company has faced various challenges. But the retailer has been addressing problem areas and even is transitioning to a new chief executive officer to guide it through recovery -- current chief operating officer Michael Fiddelke will take the role early next year.

NYSE: TGT

Key Data Points

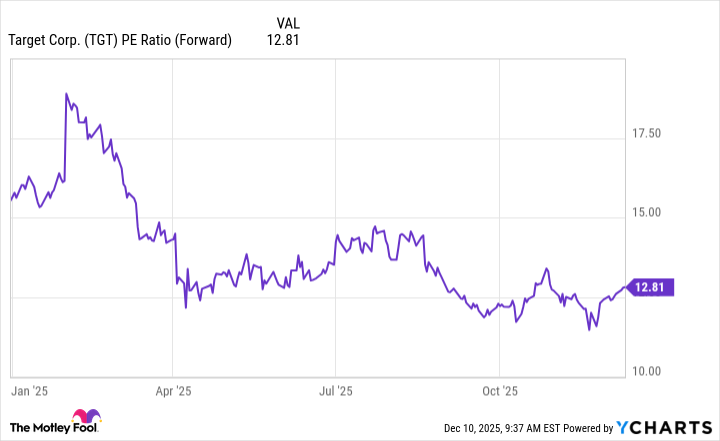

The company's portfolio of billion-dollar owned-brands and its evolving in-store fulfillment network are two major strengths that may support growth moving forward. So, today, trading for 12x forward earnings estimates, Target looks like a bargain recovery story buy.

TGT PE Ratio (Forward) data by YCharts

On top of that, Target has lifted its dividend payments for 54 years and now pays shareholders $4.56 per share, at a yield of 4.9%.

So, ahead of the new year, Target makes a great recovery story buy at today's valuation -- and one that is well-positioned to reward you with passive income growth.