While artificial intelligence (AI) is solidifying its mark in the world, it would be naive not to expect that some of today's AI-focused companies won't stand the test of time. In some cases, these companies may be too niche to remain independent and will ultimately become acquisition targets. Others simply won't survive.

When I think about AI stocks I want to hold for the next decade, I look for companies that are key players in different phases of the AI pipeline. The following three companies fit that description and appear to be good long-term investments.

Image source: Getty Images.

1. Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company (TSM +2.83%) isn't an AI stock in the traditional sense, but it's one of the more important companies in the space. As the world's leading third-party semiconductor foundry, TSMC manufactures chips designed by "fabless" companies that don't own the facilities to produce them themselves.

NYSE: TSM

Key Data Points

When it comes to manufacturing the types of advanced AI chips used in data centers, TSMC essentially has a monopoly. With its superior technology and efficiency, it's the go-to company, and there's not a close second.

Companies like Intel and Samsung also operate foundries that can deliver chips using some of the most cutting-edge process nodes, but they have issues -- such as production delays and low yields -- that make them far less reliable. Not only has this made AI chips a large part of TSMC's business, but it has also given it more pricing power.

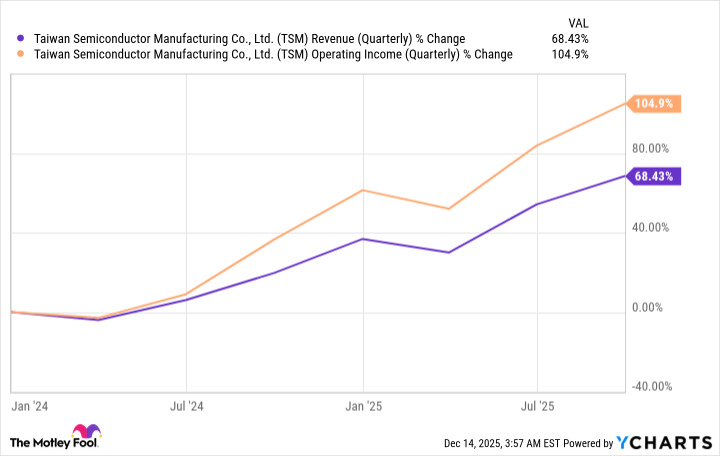

Both TSMC's revenue and operating income (profit from core operations) have grown impressively over the past couple of years; however, its dominance in advanced AI chips has enabled it to grow its profits at a significantly faster pace.

TSM Revenue (Quarterly) data by YCharts.

2. Nvidia

Whereas TSMC is the manufacturer that brings chips to life, Nvidia (NVDA +1.66%) is the designer behind critical parts of the AI ecosystem. Its lead in the parallel processor market, in particular, is why the stock skyrocketed over the past few years, turning it into the world's most valuable public company, with a market cap of nearly $4.2 trillion.

NASDAQ: NVDA

Key Data Points

For a time, Nvidia was known for making graphics processing units (GPUs) that were primarily used to improve the performance of video games. However, the company and other clients realized that its parallel processors were useful for other types of computing workloads, and it began to pivot its focus toward those markets. Its latest pivot came as the AI trend picked up steam, and demand soared for hardware capable of handling the massive data sets involved in that technology. Many of the data center chips used for training and operating AI systems come from Nvidia.

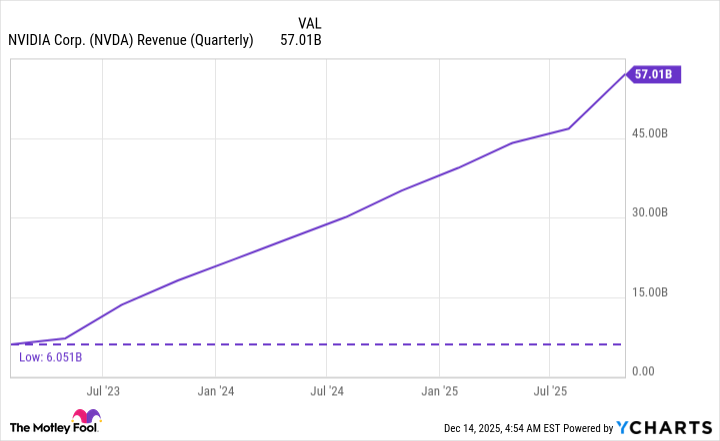

Of the $57 billion in revenue Nvidia made in the third quarter (up 62% year over year), $51.2 billion (up 66%) came from its data center segment.

NVDA Revenue (Quarterly) data by YCharts.

While Nvidia's GPUs and other hardware have gotten a lot of attention, CUDA -- its parallel computing platform and application programming interface -- has flown under the radar a bit. CUDA allows Nvidia's chips to be programmed for specific tasks, and the developers who work in AI are widely familiar with it, which adds to the company's moat. Moreover, CUDA programs only run on Nvidia chips, which further increases the switching costs associated with purchasing AI accelerator chips from competitors.

Other major tech companies, including Alphabet and Amazon, have begun designing their own AI chips, often with the assistance of Broadcom; however, Nvidia has a significant head start. It will inevitably lose some market share over the next decade, but as the size of the overall AI chip market continues to grow, it should remain relatively stable.

3. Microsoft

Microsoft (MSFT +1.49%) has two major things working in its favor regarding AI. First, Microsoft Azure is the second-largest cloud infrastructure platform in the world, and a go-to choice for many companies to build and host their own AI apps. Azure's AI capabilities have helped it close the gap a bit with segment leader Amazon Web Services.

NASDAQ: MSFT

Key Data Points

The second major factor is that Microsoft's software portfolio comprises numerous titles and services that hundreds of millions of people use regularly, including Microsoft 365 (Excel, Word, Teams, PowerPoint, Outlook, etc.), LinkedIn, GitHub, and the Windows operating system, among others.

This allows Microsoft to act as a seamless AI distributor because it can easily add this new technology to software that people are already using, and then monetize it. For many corporations and individuals, paying a relatively small additional fee for Microsoft 365 Copilot is a straightforward decision. It has become another reliable revenue source for Microsoft, and it should only get better as adopting these tools becomes the norm for corporations.

While pure-play AI companies, by definition, rely solely on this new tech for their revenues, for Microsoft, AI is more of a bonus. The company's business is well-diversified, spanning software, tech hardware, gaming, cloud computing, and professional networking. Even if the AI hype cools over the next decade, Microsoft's business will remain strong and highly profitable.