Did you know that Amazon (AMZN +0.21%) has actually underperformed the stock market indexes over the last five years? In that time frame, the S&P 500 index is up 98%, while Amazon's share price has risen by only 40%.

While that's not a terrible outcome, this is an unexpected development for one of the investing world's beloved technology stocks, which led the pack in both cloud computing and e-commerce in North America.

However, Amazon's underlying business still appears to be performing well. Does that make the stock undervalued and a buy for your portfolio in 2026?

Accelerating cloud growth

Amazon has been deemed a loser in the artificial intelligence (AI) race, as revenues for its cloud computing division, Amazon Web Services (AWS), have grown more slowly than those of rivals Google Cloud and Microsoft Azure.

However, last quarter, AWS' growth did accelerate to 20% year over year as its revenue hit $33 billion. It has an extensive relationship with the start-up Anthropic, which is growing its own revenue at a blistering clip and spending tens of billions of dollars on computing power to train and run its AI. A lot of that spending is going to AWS.

NASDAQ: AMZN

Key Data Points

It may not be a monopoly, but AWS is highly profitable and should be a durable grower for Amazon, with or without the exposure to AI. With $44 billion in trailing-12-month operating income, this is a highly valuable part of the Amazon business, and one that is apparently being underrated by investors today.

Image source: Getty Images.

Don't forget e-commerce

It seems like all the investing world can discuss right now is AI, cloud computing, and computer chips. But there is a much bigger part of the Amazon business that many investors are ignoring: online shopping. Its e-commerce and shipping business keeps chugging along as the entire e-commerce sector continues to take more market share in the retail space.

Amazon's North American retail sales grew 11% year over year last quarter to over $100 billion. Over the trailing 12 months, that division has now done over $64 billion in advertising revenue, $166.8 billion in third-party seller services revenue, and $48 billion in subscription revenue. Combined, that was almost $300 billion in annualized sales from business lines with higher margins than Amazon's original first-party e-commerce model, and should lead to expanding profit margins in the years to come.

Even in 2025, the North American retail division only has an operating margin of 6.6% as Amazon keeps investing in its growth efforts. In 2026, I expect these figures to slowly keep expanding.

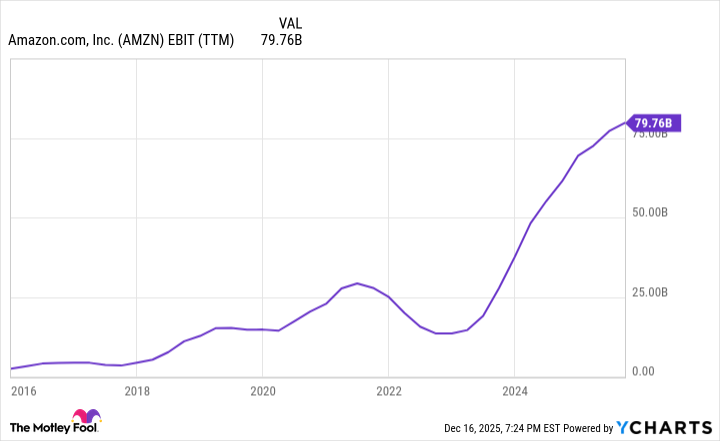

AMZN EBIT (TTM) data by YCharts; TTM = trailing 12 months.

Why the stock is a buy in 2026

Amazon's stock currently trades at a price-to-earnings ratio (P/E) of 31, which is fairly low when compared to its big tech peers. With its potential to keep compounding its revenue growth as well as margin expansion opportunities in 2026, I think the stock is a good deal for any investor looking to buy today.

For example, let's do some math with Amazon's revenue and earnings growth. Its trailing revenue figure is $691 billion. If that grows at 10% annually for the next three years, it will hit $919 billion in annual revenue.

Today, its margin, calculated on the basis of earnings before interest and taxes (EBIT), is 11.5% on a consolidated basis. With fast growth from AWS and steady margin expansions in the retail business, it is reasonable to expect Amazon's operating margin to grow to 15% three years from now.

That would bring the company's operating earnings at that point to $138 billion compared to $80 billion today. The combination of that expected steady rise in earnings and Amazon's currently reasonable P/E makes the stock a buy in 2026 and a hold for the long term.