Both Uber Technologies (UBER 0.36%) and Tesla (TSLA 0.65%) famously employed technology to transform transportation. Now, in the era of artificial intelligence (AI), the two are dueling for supremacy in AI-powered autonomous vehicles.

The anticipated boon delivered by AI-powered vehicles contributed to Uber shares climbing around 30% in 2025 through the week ended Dec. 19. Tesla stock is up about 20% in that time.

Which of these stocks may prove to be the superior investment in the age of self-driving cars? Here's a dive into each company to find out.

Image source: Getty Images.

Uber's path to business growth

Uber once attempted to build its own autonomous vehicles but sold that business as it switched to forging partnerships with similar companies around the world. For example, it began offering robotaxi rides in Dubai in the United Arab Emirates through a collaboration with WeRide on Dec. 12, and in Dallas on Dec. 3 through a partnership with Avride.

The company is switching tactics yet again, as it renews the pursuit of its own autonomous fleet. Management signed a deal with Nvidia to provide the AI brains behind a fleet of up to 100,000 self-driving cars to begin rolling out in 2027.

However, Uber's use of autonomy is still in the early stages. Its core ride-hailing and delivery operations drive business results today, and those results have been outstanding.

NYSE: UBER

Key Data Points

In the third quarter, Uber's trip volume rose 22% year over year to $3.5 billion. CEO Dara Khosrowshahi said, "Uber's growth kicked into high gear in the third quarter, marking one of the largest trip-volume increases in the company's history."

This volume growth led to third-quarter revenue of $13.5 billion, a strong 20% year-over-year increase. Uber's strategy to drive continued growth includes leaning into autonomous vehicles as well as investing in other areas of its business.

One of these is local commerce, where the company seeks to expand its grocery and retail delivery programs. Another involves new channels, such as Uber Direct, which provides delivery services to any size business. In December, Uber Direct and Shopify signed a deal to embed Uber's delivery options into Shopify's e-commerce platform.

Tesla's strategy for global prosperity

Tesla may have begun as an electric car company, but today its ambitions are far loftier. Its latest goal is what it calls "sustainable abundance." The company defines this as an era of boundless global prosperity for everyone, delivered through technology.

Part of this vision involves the development of a fleet of robotaxis. Tesla's cars have long supported some measure of self-driving ability, so extending that to a fully autonomous vehicle was a logical next step. The company is using a modified version of its Model Y in its robotaxi pilot program, which kicked off in Austin, Texas, over the summer.

NASDAQ: TSLA

Key Data Points

The goal is to transition to an AI-driven car with no steering wheel called the Cybercab. Production of these vehicles is set to happen in 2026.

Along with robotaxis, Tesla plans to build its AI-controlled humanoid robot, called Optimus, that can perform dangerous or monotonous work. The robot, when combined with self-driving cars, can "create a world where there is no poverty," CEO Elon Musk said. In a sign of confidence, he invested about $1 billion in his company's stock in September.

That "sustainable abundance" goal can be a worthwhile endeavor if it produces tangible outcomes. But it could take years for the company's autonomous vehicle and robotics efforts to generate meaningful revenue.

For instance, Tesla's other major business, energy generation and storage, contributed revenue of $3.4 billion in the third quarter. That represents impressive 44% year-over-year growth, yet it took a decade to get to this point.

Today, Tesla's key revenue driver remains its car sales. This part of its business contributed $21.2 billion of its $28.1 billion in the quarter, up 6% year over year.

Deciding between Uber and Tesla

Tesla's track record of technological innovation allowed it to outmaneuver automotive incumbents, but when it comes to choosing between it and Uber, the better stock right now is Uber.

Tesla's vision for sustainable abundance is commendable, but tangible results can take years to achieve, as its energy business demonstrates. Uber, meanwhile, is racing ahead with its robotaxi plans thanks to partnerships with the likes of Nvidia.

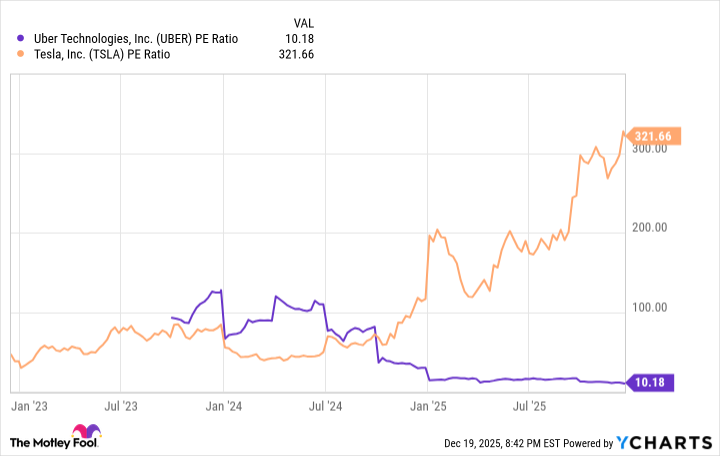

Another key factor is Uber's attractive share price valuation. This can be seen in each stock's price-to-earnings ratio (P/E), which reflects what investors are paying for every dollar of earnings based on the trailing 12 months.

Data by YCharts.

The chart shows that Uber's earnings multiple was sky-high in 2024 but has since dropped to a reasonable level. It's now Tesla's P/E ratio that looks inflated. Moreover, Uber's P/E appears cheap in comparison to competitor Lyft's P/E of 52.

Considering Uber stock is down from its 52-week high of $101.99, reached in September, now is a good time to pick up shares while its valuation remains compelling.