With only a handful of trading days left in the year, it's looking like the S&P 500 (^GSPC 0.43%) will post double-digit gains for the third year in a row. As of mid-day trading on Dec. 19, the S&P 500 hovered around a near-record level of 6,839.

For nearly three years, the stock market has been largely driven by one megatrend: artificial intelligence (AI). With AI stocks leading the market higher into the new year, some investors may be bullish for what's in store in 2026.

However, a little-known market indicator is flashing a warning sign for just the second time in over a century -- and history has a predictable track record for what could happen next.

Is the stock market going to crash in 2026? Read on to find out.

Image source: Getty Images.

The S&P 500 is at an all-time high, and...

When Wall Street analysts talk about the market being expensive or frothy, what exactly do they mean?

Well, for some it means they are looking at valuation multiples -- specifically price-to-earnings (P/E) or forward earnings estimates -- and benchmarking these ratios and growth rates relative to historical thresholds. While there is merit to this methodology, it tends to be more useful when analyzing patterns around individual companies.

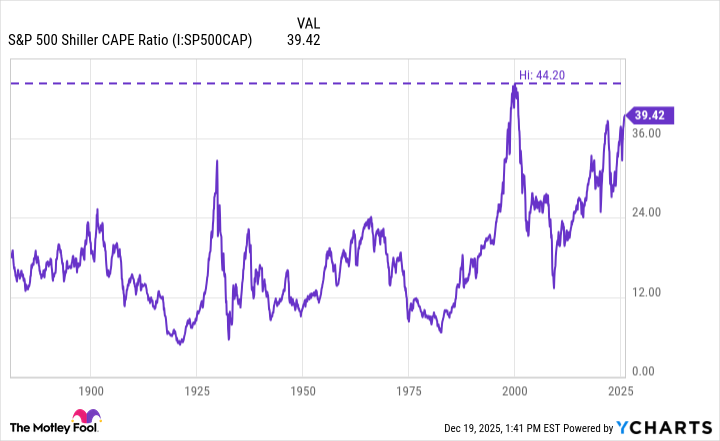

When it comes to the broader market, however, a helpful tool to look at is the S&P 500 Shiller CAPE ratio. This measures inflation-adjusted earnings over a 10-year period relative to the current level of stock prices.

Data by YCharts.

As the chart above illustrates, there are two particular instances when the CAPE ratio hovered near its current level of 39: the late 1920s and the year 2000. It's been more than 20 years since the market was priced at a similar level to where it is today.

...there is a clear indicator in which direction stocks could be headed in 2026

Per the graph in the prior section, stocks experienced the same outcome after the CAPE ratio peaked. During the late 1920s, the stock market crashed, which ushered in the Great Depression.

In more recent history, the CAPE ratio peaked at a level of 44 prior to the dot-com bubble bursting in early 2000.

Against this backdrop, history indicates that stocks should be headed for a pronounced reversal in 2026.

There are important caveats smart investors should be aware of going into 2026

While stocks could plummet next year, there are some important nuances to point out.

First, comparing the rise of the internet to the current AI supercycle may be misaligned. Many companies that marketed themselves as next-generation beneficiaries of the dot-com boom lacked a tangible business model. In other words, investors bought into a narrative or an idea rather than a concrete company with proven sales and compelling unit economics.

The same dynamic can't be said about AI as a whole. The biggest contributors to the S&P 500's rise over the last three years are megacap technology stocks like Nvidia, Alphabet, Amazon, Microsoft, Broadcom, Meta Platforms, and Apple. Virtually all of these companies have already monetized and profited from the rise of generative AI and ongoing infrastructure investment.

Furthermore, while history is consistent about corrections occurring shortly after the market peaks, the length of these reversals is quite variable. In other words, market crashes and even recessions could last years, or they could span a time period of a few months.

While it appears likely that stocks could take a breather for some amount of time in 2026, one other market indicator remains true no matter what happens.

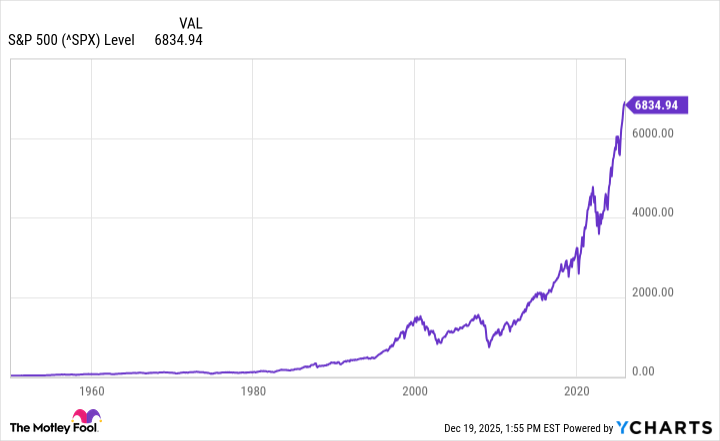

Data by YCharts.

Investing in the S&P 500 has been an overwhelmingly positive decision over the course of a long-term time horizon. With average annual gains of roughly 7% for nearly 100 years, outperforming the S&P 500 index is a tall order. I bring this up to make clear that even if history does repeat next year, buying the dip will be profitable in the long run.

For these reasons, investors shouldn't worry about trying to time their buys and sells as the market becomes ever more heated. Rather, smart investors will take advantage of sell-offs and continue buying quality companies that produce strong earnings power throughout 2026 and beyond.