Gold has been a widely recognized store of value for thousands of years, which is why investors buy it hand over fist during periods of high inflation, political turmoil, and economic uncertainty. All three of those issues are present in 2025, so it's no surprise that the shiny yellow metal is sitting on a year-to-date gain of 67%.

That's much higher than gold's average annual return of 7.96% over the last 30 years, which speaks to the investment community's anxiety about the current climate. In fact, when speaking at the Greenwich Economic Forum in October, billionaire Ray Dalio said investors should consider parking an unusually high percentage of their portfolios in gold right now.

Dalio is the founder and former CEO of Bridgewater Associates, a prominent hedge fund with a reputation for delivering positive returns in all market environments. I think his advice might be worth taking, because I predict gold will reach $5,000 per ounce in 2026.

Image source: Getty Images.

The perfect climate for higher gold prices

Governments, central banks, and investors in practically every country around the world own at least some gold, so there is a clear consensus about its status as a store of value. Scarcity is a key reason why. There is a fixed amount of gold on Earth, and we can't produce any more once it's all out of the ground. Humans have only extracted 216,265 tons of the yellow metal throughout history, compared to billions of tons of other commodities like coal and iron ore.

In the past, many countries pegged the value of their domestic currencies to gold. It required governments to own enough physical metal to match their currency reserves, which limited the amount of new money they could print, thus keeping economic headwinds like inflation under control.

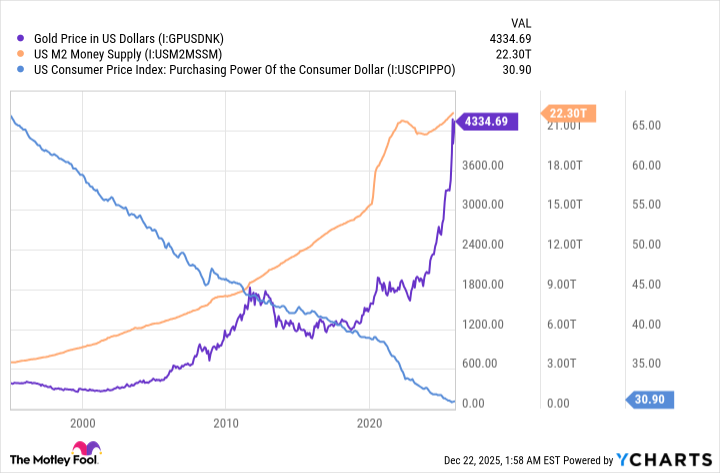

Even the U.S. was on the so-called gold standard until 1971. Since the U.S. abandoned that standard five decades ago, money supply has exploded, fueling a staggering 90% decline in the purchasing power of the U.S. dollar. The chart below shows a clear link between the price of gold, the increase in money supply, and the decrease in the purchasing power of the U.S. dollar over the last few decades.

Gold Price in U.S. Dollars data by YCharts.

The U.S. national debt just climbed to a new high of $38.5 trillion, following a government budget deficit of $1.8 trillion during fiscal year 2025 (ended Sept. 30). Since policymakers seemingly lack the willpower to cut spending, investors fear that the government's only way out of this fiscal mess is to devalue the U.S. dollar even further by expanding money supply, which is why they are aggressively buying gold.

Ray Dalio has some unusual advice for investors

Financial advisors have varying advice when it comes to gold. Some believe it should make up no more than 5% of investors' portfolios, because it usually underperforms earnings-producing assets like stocks. However, given the concerning fiscal situation in the U.S., Ray Dalio suggests bumping that allocation up to 15%.

Dalio is a student of history, and he has warned of the consequences of reckless government spending for several years. He likens the current situation to the 1970s when a surge in inflation, government spending, and government debt eroded confidence in paper currency.

As I highlighted earlier, gold typically appreciates by around 8% per year, so it might be borrowing some returns from the future with its blistering 67% gain in 2025. With that said, the Consumer Price Index (CPI) measure of inflation remains elevated, and since the U.S. government is likely to run a trillion-dollar deficit again in fiscal 2026, the conditions are perfect for another above-average return for gold next year.

The yellow metal is trading at $4,400 per ounce as I write this, which is a new all-time high. If it crosses the $5,000 milestone in 2026 as I predict, investors who buy it today will earn a return of almost 14%.

Here's the simplest way to buy gold

Buying physical gold is the surest way to profit from the metal's growing value, but it can also attract high storage and insurance costs. Plus, gold coins or bars can be difficult to sell in a pinch. That's why many investors choose to buy gold exchange-traded funds (ETFs) instead. They don't require any storage, and they can be bought and sold instantly with the click of a mouse.

The SPDR Gold Trust (GLD 0.41%) is one of the largest. It has $146 billion under management, which is fully backed by physical gold reserves. Shareholders aren't entitled to take delivery of any actual metal, but owning the ETF gives them direct exposure to gold's upside.

NYSEMKT: GLD

Key Data Points

The ETF has an expense ratio of 0.4%, which is the proportion of the fund deducted each year to cover management costs. That means an investment of $10,000 will incur an annual fee of $40, which probably still works out cheaper than storing and insuring physical gold in the long run.

Buying the SPDR Gold Trust is probably the most convenient way for the average investor to add gold to their portfolio. While Dalio's recommended 15% portfolio allocation might seem high relative to conventional advice, it isn't necessarily outrageous in this political and economic environment.