The premise of only picking a single stock from a small group of options obviously doesn't apply in the real world. You can buy any stock (or as many stocks as) you want to at any given time.

Nevertheless, this sort of thought exercise has value. Not only does it require you to weigh a company's own pros against its own cons, but it also forces you to compare one potential investment to another. This can end up being surprisingly enlightening.

With that as the backdrop, I recently made such a deep comparison of all the Magnificent Seven stocks to one another. One name emerged as the top prospect for 2026. That's Amazon (AMZN +0.06%). Here's why.

Image source: Getty Images.

4 reasons to buy Amazon stock sooner rather than later

Don't misunderstand. Other Mag-7 stocks like Nvidia, Microsoft, and Alphabet are still solid investments. On a risk-versus-reward basis, though, Amazon is the top prospect for 2026 for four largely related reasons.

1. Underperformance in 2025 means a discounted price

Just because a stock's been lagging the market doesn't mean it's become worth buying. On the other hand, the time to step into a good stock is when it's trading at a discount.

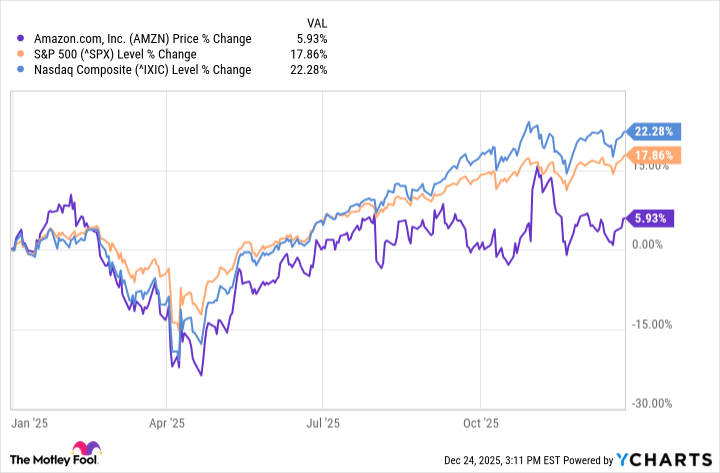

To this end, as of the latest look, Amazon shares are up just a little less than 6% since the beginning of 2025, versus nearly an 18% gain for the S&P 500 and more than a 22% gain from the Nasdaq Composite.

That's not an insignificant disparity. Indeed, it's enough of a difference to catch bargain hunters' attention.

2. This weakness doesn't reflect the past year's actual fiscal performance

Granted, a poor stock performance alone isn't enough of a reason to buy a stock; some stocks often deserve to underperform.

This arguably isn't one of those times, however. Amazon's revenue is on pace to improve by 12% year over year in 2025, pumping up profits from last year's $5.53 per share to $7.06. That's growth of nearly 28%. The company largely met or topped its sales and earnings estimates in 2025 as well. Its cloud computing arm's reported revenue and/or guidance disappointed a couple of times. However, some of these expectations were unfairly high, with much of any struggle on this front stemming from a tariff-driven headwind that hasn't been as persistent as first feared.

3. An impending swell of earnings growth

This is still just the beginning, though. Revenue growth is expected to accelerate all the way through the end of 2029, in step with profit growth.

Data source: Morningstar. Chart by author.

Yes, cloud computing (which already accounts for roughly two-thirds of companywide operating profits) plays a big role in this future growth ... but not as overwhelmingly much as you might think. As it turns out, Amazon's usually low-margin e-commerce operation is widening its profit margins quite a bit as Amazon.com's advertising business explodes. Ads may be a more lucrative means of monetizing its online shopping website than selling merchandise was, is, or will be.

4. It's still willing and able to add, subtract, and evolve as makes sense

Finally -- and perhaps most importantly -- Amazon is a compelling buy in 2026 for the same reason it's a great buy any other time. That's its willingness and ability to evolve as merited.

The ramped-up focus on advertising is one such initiative, although hardly the only one. There was also a time when the company didn't operate a cloud computing business, just as there was a time when its Prime program didn't exist to offer free shipping to Amazon's frequent customers. The recently forged partnership with Hertz, allowing the car-rental outfit to sell its used automobiles through Amazon's online selling platform, is yet another clever use of its deep reach that doesn't pose any real risk to its brand name.

NASDAQ: AMZN

Key Data Points

Now, not all of these initiatives work out. Its Fire smartphone was a flop, for instance, as was its restaurant delivery service, uncreatively called Amazon Restaurants.

Enough of them work well enough to continue widening the company's revenue net, however, to more than make up for the ones that don't. This sort of flexibility and experienced initiative allows the e-commerce giant to fully capitalize on any and all opportunities as they arise.

More upside than downside

None of this guarantees Amazon is going to suddenly lead the Magnificent Seven in 2026. It could. Or, it could continue to lag in the year ahead. One never knows for sure.

From a risk-versus-reward perspective, though, Amazon stock is arguably your best bet among the Mag-7 names right now. This past year's weakness, rooted in hit-and-miss cloud computing results, has been overshadowing how well the company's actually doing, and how much it's likely to continue growing from here. As more and more investors see it, look for this ticker to shake off 2025's lingering funk.