When looking for potential stock buys for the coming year, it's sometimes helpful to look at the worst-performing stocks in the market during the past year.

But it's also counterintuitively beneficial to examine the best-performing stocks.

While the worst-performing stocks can reveal a stock that is undervalued or due for a turnaround, the best-performing stocks may also reveal a long-term structural positive change in a business or industry.

In 2025, 4 out of the top 5 performing stocks in the S&P 500 were all in the same artificial intelligence (AI) sub-industry. Heading into 2026, are they still buys, or over-extended and subject to a crash?

Image source: Getty Images.

Data storage is exciting again

The top 4 out of 5 performers in the S&P 500 this year were:

|

Company |

YTD performance as of Dec. 22, 2025 |

|---|---|

|

1. SanDisk (SNDK 15.95%) |

569.6% |

|

2. Western Digital (WDC 7.50%) |

292.3% |

|

3. Micron (MU 10.07%) |

228.7% |

|

4. Seagate (STX 5.82%) |

208.8% |

Data source: Finviz.

All of these companies are involved in data storage, albeit across different technologies. SanDisk was previously part of Western Digital, but the two companies split on Feb. 24, 2025, separating SanDisk's NAND flash technology business from Western Digital's hard disk drive (HDD) business.

Micron is the largest of these companies and not only produces NAND flash, but also DRAM volatile memory. Seagate, meanwhile, is a rival to Western Digital in the HDD space.

NASDAQ: MU

Key Data Points

NAND flash, DRAM, and HDDs are all types of data storage technologies. NAND and HDDs are both non-volatile memory technologies, meaning they store data even when power is turned off. DRAM memory is a much faster type of memory, but it only functions when power is turned on.

DRAM, especially high-bandwidth memory, has been in high demand since the advent of ChatGPT and the expansion of generative AI, as AI model training requires massive amounts of data to be fed quickly. Moreover, the DRAM industry is highly consolidated, with only three major players: Micron, SK Hynix, and Samsung.

However, what surprised investors this year was the massive increase in stocks involved in nonvolatile storage across both the NAND and HDD industries.

The storage industry: Boom-and-bust, though now even more so

The past few years of underperformance from the HDD and NAND industries set the stage for this year's storage boom. HDDs are an older technology that has seen its adoption across many applications dwindle to almost zero. However, HDDs still remain the most cost-effective method for bulk data storage in vast quantities. Thus, HDDs have still remained the bulk storage platform of choice for cloud hyperscalers.

And while the newer NAND flash technology has been replacing HDDs in many legacy applications and also certain data center applications, oversupply has still been a problem. The NAND flash industry has five major players, with China's Yangtze Memory Technologies actually adding another sixth capable player to the mix in recent years.

Not only has heightened competition made profitability challenging for NAND, but the verticalization of NAND flash cells, or "3D NAND," first introduced in 2013, has made supply much easier to grow than other forms of memory.

Following the pandemic, a prolonged bear market in NAND flash pricing ensued, leading to one of the worst downturns in the storage industry's history from 2022 through early this year. Even with a recovery in demand following the introduction of ChatGPT, the industry first had to absorb the excess inventory built up over the past few years.

Meanwhile, suppliers not only failed to expand their supply, but in many cases, even cut back on some production lines and slowed their pace of technology transitions.

2025: Demand becomes exponential

This year, as AI use cases have expanded and adoption has increased, more and more enterprises are using AI at "the edge," necessitating more local, fast storage. Chatbot prompts and models designed to remember your prior prompts must be stored somewhere. And AI has transitioned from the DRAM-intensive training phase to the broader inferencing stage, resulting in a massive, sustained storage demand boom.

Constrained supply combined with booming demand has led to some of the largest price spikes for HDDs and NAND flash in history. In November, the CEO of Phison, a memory controller company in Taiwan, noted that NAND flash spot prices have already doubled since mid-2025, and are sold out through next year.

That's striking. Over the long term, prices per bit usually decrease, as more efficient process nodes enable costs to fall, allowing for more memory bits per device. But if NAND prices have doubled, that's a massive counter-trend boom. And given that NAND flash manufacturers generally have a lot of fixed costs, all that extra increase in price falls right to the bottom line. It's no wonder these stocks have surged this year.

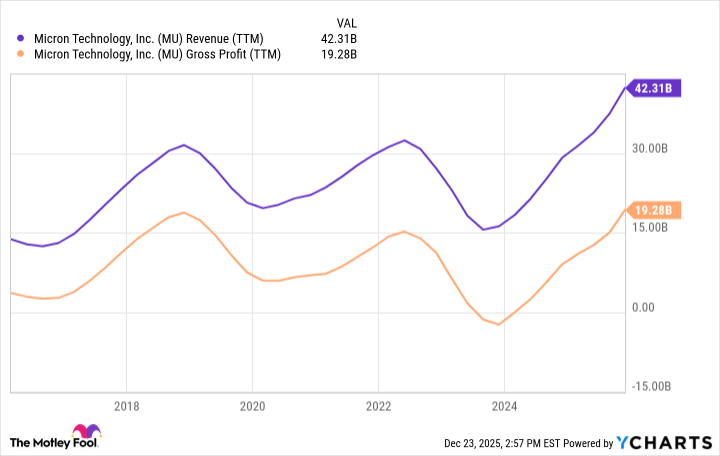

Just look at Micron's gross margin cycles over the past decade; as recently as late 2023, Micron had a negative gross margin -- not net margin, but negative gross margin -- only to realize record gross profits today, a mere two years later.

MU Revenue (TTM) data by YCharts

But investors should be wary of chasing these winners

While these stocks still appear "cheap" by conventional earnings metrics, investors should exercise caution when considering whether to buy them today.

History has shown that during periods of memory and storage booms, multiple things occur. First, customers worried about undersupply tend to order more than they need at the moment, essentially leading to double-ordering. Suppliers invest to increase supply to capture inflated profits. Yet, as is usually the case, as this increased supply comes online, prices fall, and demand evaporates as customers work through their excess inventory.

In sum, inflated profits can evaporate as rapidly as they've appeared.

Now, it may be the case that the AI era is somewhat different, and that demand will remain resilient for longer than other cyclical booms. However, with these stocks already having more than tripled, and SanDisk having appreciated over six times in just this year, these stocks appear to reflect top-of-cycle pricing. While there is the possibility that the AI boom has made the memory cycle "different this time," this experienced investor is skeptical of such declarations.