Nvidia (NVDA +1.09%) is the artificial intelligence (AI) stock everyone has been watching over the past few years. The company has established itself as the leading AI chip designer and launched an entire ecosystem of products that make it the one to turn to for anything AI. All of this has resulted in revenue exploding higher -- and the stock price has followed. Nvidia shares have soared a mind-blowing 1,300% over the past five years.

The tech giant has continued with this momentum in 2025, reporting record levels of revenue and high demand for its products. The stock also has climbed, advancing in the double digits -- but it's far from being this year's biggest stock market winner. In fact, the following unassuming AI stock is quietly outperforming Nvidia in 2025. Let's find out more.

Image source: Getty Images.

Earnings strength over time

Nvidia is on track for a 40% increase this year, but fellow tech player Alphabet (GOOG 0.23%) (GOOGL 0.18%) is heading for a gain of more than 65%. Alphabet picked up significant momentum in recent months, buoyed by its overall earnings strength, its position in AI, and the outcome of an antitrust suit.

We'll start out by talking about Alphabet in general. You may know this company very well, as it's the owner of something most of us use pretty regularly: Google Search. The world's No. 1 search engine, with more than 90% market share, has been Alphabet's ticket to billion-dollar revenue and steady growth year after year. This is as advertisers rush to the Google platform to catch us where they know they can find us -- and these ads generate the lion's share of Alphabet's revenue.

But Alphabet also has another significant, and growing, revenue source, and that's Google Cloud. This business sells a variety of cloud services to customers -- and here's where AI comes in. Google Cloud offers AI tools and platforms to those aiming to develop and use AI, and this has supercharged revenue in recent quarters. In the most recent period, for example, Google Cloud's revenue advanced 34% amid demand for AI infrastructure and generative AI services. Alphabet also has built its own large language model, Gemini, which it offers to customers -- and the company uses Gemini to improve its own business, for instance, making the advertising experience better and more productive for advertisers.

NASDAQ: GOOGL

Key Data Points

A first $100 billion quarter

The strength of Alphabet's ad business, as well as growth in Google Cloud, helped the company reach its first-ever $100 billion quarter in the latest period. This shows that Alphabet not only offers you a solid track record but also potential for growth as this AI story develops. It's important to keep in mind that analysts predict the AI market may reach into the trillions of dollars in just a few years. A company like Alphabet is well-positioned to benefit as customers turn to Google Cloud for various AI needs.

Finally, Alphabet recently received excellent news from the judge in a U.S. antitrust case against the company. The federal judge ruled out the worst-case scenario: the possible breakup of Google. He said Alphabet would not be required to sell Chrome or the Android operating system. Instead, the company faces other penalties that should be much less detrimental to the business. This news, in early September, clearly offered the stock a lift as it removed the biggest risk for Alphabet and its investors.

A look at valuation

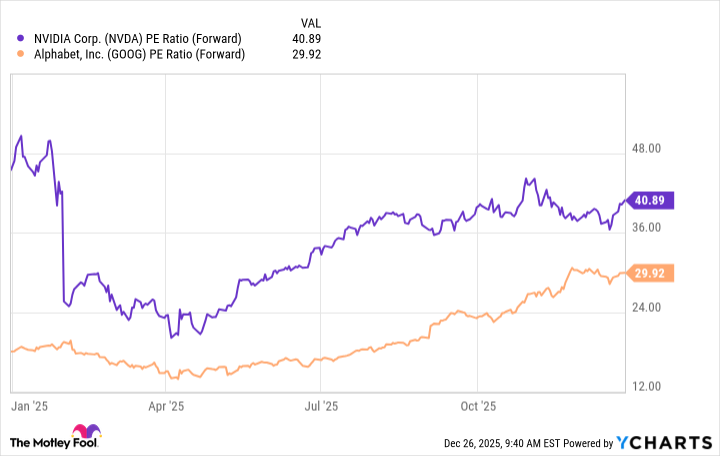

Now, as we look ahead to the new year, you may be wondering: Does Alphabet have what it takes to continue outperforming AI market star, Nvidia? I think it's possible. Alphabet, trading for 29x forward earnings estimates, is considerably cheaper than Nvidia.

NVDA PE Ratio (Forward) data by YCharts

This could attract buyers looking for a reasonably priced AI stock and one that may be heading for a new phase of growth. Alphabet not only offers access to Nvidia systems, but it also offers its customers access to a wide variety of alternatives too -- so, as I mentioned earlier, it's likely to benefit as the AI market grows.

I also like the fact that the company's main profit engine -- advertising -- is likely to keep on delivering revenue increases regardless of the AI spending climate. This offers investors who are worried about the pace of AI growth an element of security.

All of this means that there's reason to be optimistic about Alphabet's performance next year -- and it may even continue to outperform Nvidia.