For the last three years, investing in semiconductor stocks has proven to be a profitable decision given the critical role chips play in the development of generative artificial intelligence (AI). Companies such as Nvidia, Advanced Micro Devices, Broadcom, and Micron Technology have been some of the biggest contributors to the semiconductor industry throughout the artificial intelligence (AI) revolution.

Flying under the radar is another chip company whose storyline seems muted compared to its peers. That's Taiwan Semiconductor Manufacturing (TSM +1.33%), the pick-and-shovel specialist of the chip realm.

Let's dive into Taiwan Semi's increasingly important role for the future of AI and assess why the stock looks like a no-brainer buying opportunity for investors with a long-term horizon.

Image source: Taiwan Semiconductor Manufacturing.

How does Taiwan Semiconductor benefit from AI?

Throughout the AI revolution, hyperscalers such as Microsoft, Alphabet, Amazon, Meta Platforms, and OpenAI have collectively poured hundreds of billions of dollars into AI-related capital expenditures (capex) -- namely, chips and networking gear for data centers.

On the surface, this is great news for the likes of Nvidia, AMD, and Broadcom. But underneath the surface, it's even better news for Taiwan Semi. Why is that?

TSMC is the largest chip manufacturer in the world in terms of revenue. While Nvidia, AMD, and Broadcom design the most-in demand GPUs and custom application-specific integrated circuits (ASICs) on the planet, each of these giants relies heavily on Taiwan Semi's cutting-edge fabrication processes.

In other words, if Nvidia and its competitors represent the body of the car moving the AI narrative forward, TSMC holds the keys to the ignition.

TSMC's growth is off the charts

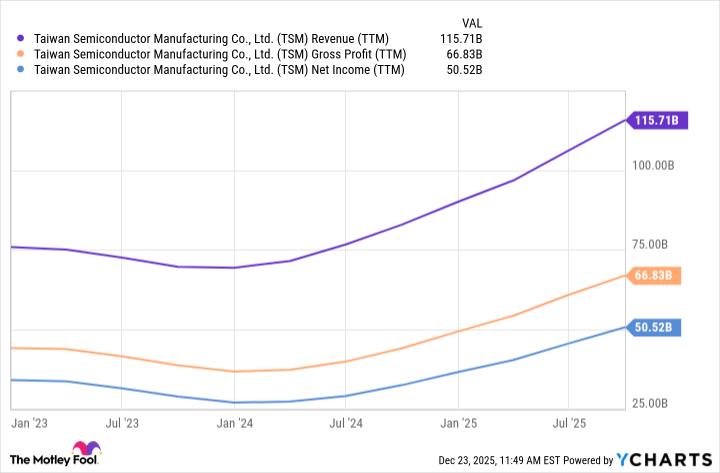

Over the last year, Taiwan Semi's revenue has been growing strongly thanks to ongoing demand for AI accelerators. What's interesting to point out is that the company's revenue trajectory is actually steepening. This is largely driven by rising demand for Nvidia's and AMD's next-generation Rubin and MI400 Series chips, as well as increasing investment in custom hardware from cloud infrastructure providers.

TSM Revenue (TTM) data by YCharts

The more subtle aspect from the financial picture above is Taiwan Semi's expanding profitability profile. Given its near-70% market share, TSMC is able to command enormous pricing power relative to competitors like Intel or Samsung.

Against this backdrop, Taiwan Semi's gross margin is widening -- with excess cash flowing straight to the bottom line. The company is making the most of this new wave of capital by expanding its geographic footprint -- building additional foundries in Arizona, Germany, and Japan.

Is Taiwan Semi stock a good buy right now?

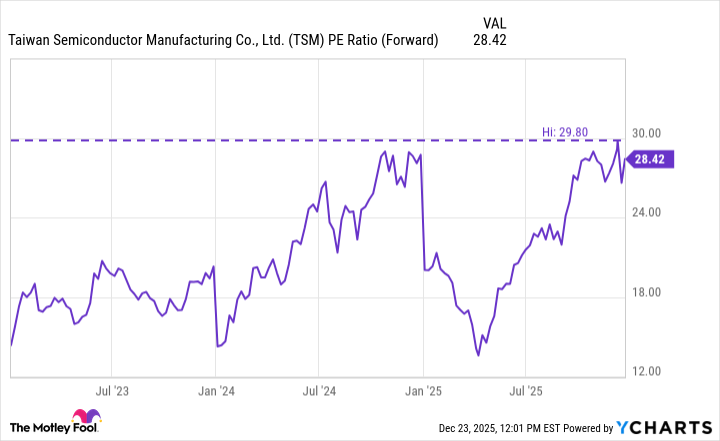

At the moment, TSMC boasts a forward price-to-earnings (P/E) multiple of 28.4 -- hovering near its highest level during the AI revolution. If you were to base your investment decision purely off of this metric, you may think Taiwan Semi is overvalued.

TSM PE Ratio (Forward) data by YCharts

Smart investors understand that TSMC's premium valuation could be warranted, though. McKinsey & Company is forecasting AI infrastructure to be a $7 trillion market through 2030 -- with the majority of spend allocated toward refining AI workloads.

In essence, building out AI-equipped data centers is expected to accelerate throughout the rest of the decade as training and inferencing models becomes more sophisticated and demanding. This is great news for TSMC as it paves the way for long-run visibility across the business.

The AI infrastructure chapter is still in its early innings. Over the course of the next several years, Taiwan Semi is positioned to benefit from the secular tailwind of rising investment in infrastructure both domestically and abroad.

Taking this one step further, physical applications such as autonomous systems and robotics are yet to be deployed in a commercial sense. Looking beyond into the 2030s, these use cases are expected to drive additional trillions in economic value.

Should they achieve some form of adoption and set the stage for the next wave of AI, Taiwan Semi has the potential to benefit immensely beyond where AI stands today -- building large language models (LLMs) and other software-based applications.

When you consider the bigger picture and begin to think longer-term, TSMC's growth potential relative to its valuation looks compelling. So while the stock may not appear dirt cheap at first glance, I think there is ample room for meaningful valuation expansion over the course of the next decade -- making the stock a no-brainer buy right now in my eyes.