Most dividend investors seek a high yield backed by a sustainable dividend. After all, if the dividend can't be maintained, the income stream is just a temporary illusion that will disappear when the dividend is cut.

This is why dividend investors will love Enterprise Products Partners (EPD +0.86%), which could set you up for a lifetime of reliable income. Here's what you need to know.

Enterprise has a good business model

Enterprise is a master limited partnership (MLP) that operates in the midstream segment of the broader energy sector. Starting with the business structure, MLPs are designed to pass income on to unitholders in a tax advantaged manner. There are tax complications to consider, which become apparent in full force come April 15 when you must deal with a K-1 statement. Still, generating income is a core focus here.

Image source: Getty Images.

The next foundational piece to consider is the midstream focus. The upstream is where oil and natural gas are produced. The downstream is where these volatile commodities are processed. The midstream is what connects the upstream to the downstream and the rest of the world.

The primary driver of a midstream business' financial results is the volume of material flowing through its energy infrastructure, which includes pipelines and storage facilities. Enterprise charges customers fees for the use of its assets; it really doesn't care much about the price of oil.

If you are looking to generate reliable income with an energy investment, Enterprise is a good choice from a foundational level. However, the good news doesn't stop there.

Enterprise has a high yield and a history of success

Enterprise's distribution yield is a very attractive 6.8%. That compares incredibly well to the S&P 500 index, which has a dividend yield of only 1.1%. However, it is also more than twice the level of the average energy stock's yield of 3.2%. So from an income standpoint, Enterprise is highly attractive.

NYSE: EPD

Key Data Points

It is also highly reliable. The distribution has been increased annually for 27 consecutive years. That's roughly as long as Enterprise has been a public entity. So it is very clear that being a reliable income investment is a key focus of management and the board of directors.

That's not likely to change anytime soon. There are two strong foundations when it comes to the distribution. First is the balance sheet, which is investment-grade rated. Second is the MLP's distributable cash flow, which covers the distribution by a very solid 1.7x. A lot would have to go wrong before the distribution would be at risk, and even then, Enterprise could lean on its balance sheet temporarily to muddle through the headwinds.

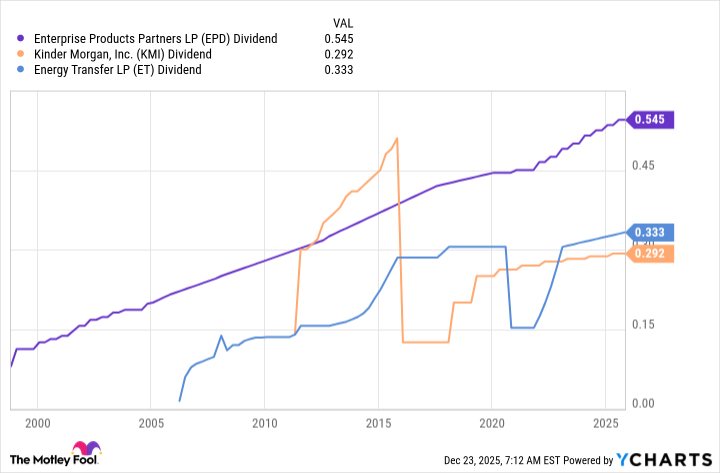

In fact, when key peers Kinder Morgan and Energy Transfer cut their disbursements in 2016 and 2020, respectively, Enterprise's distribution didn't skip a beat and kept on rising. In each of the cut cases, strengthening the balance sheet was a part of the reasoning. Enterprise has essentially always focused on being financially strong enough to withstand adversity.

EPD Dividend data by YCharts

Enterprise is a great option for dividend lovers

Enterprise Products Partners should be on your shortlist if you are a dividend investor seeking to maximize the income stream from your portfolio. It has a strong business model, a proven track record of reliability, and the financial strength to support its lofty distribution even during challenging times. It looks highly likely that Enterprise will set you up for a lifetime of reliable income.

There's just one caveat. Enterprise is a slow and steady tortoise with only modest growth prospects. The yield will likely make up the lion's share of your return over time. However, if your goal is income, that probably won't be a problem for you.