Shares of Oracle (ORCL 1.36%), the database and cloud computing specialist, have kept pace with the S&P 500 in 2025 -- up 17% year to date at the time of this writing, compared to a 17.5% gain in the index. But the tech giant's stock is down about 40% from its all-time high (made in August of this year).

In hindsight, Oracle's stock probably ran up too far, too fast in a short period, driven by exuberance for its cloud computing deals with OpenAI, Meta Platforms, and other notable companies. But the sell-off is overblown.

Here's what investors are getting wrong about Oracle and why the stock is a great buy for 2026.

Image source: Getty Images.

Oracle's divisive transformation

Financial markets often struggle to price companies undergoing a transformation. After all, investor expectations stem from what a company does and what it is expected to do in the coming years. And if a company is doing something completely different, there's more uncertainty, which can lead to volatility.

Enter Oracle, a legacy database services company looking to become a cloud computing titan with the likes of Amazon Web Services, Microsoft Azure, and Alphabet's owned Google Cloud.

Oracle's legacy software business is a stable cash cow. But Oracle doesn't generate nearly enough cash flow to cover the massive capital expenditures (capex) needed for building AI infrastructure. So it has turned to the debt markets to fund its massive expansion, which is needed to fulfill $523 billion of remaining performance obligations (RPO).

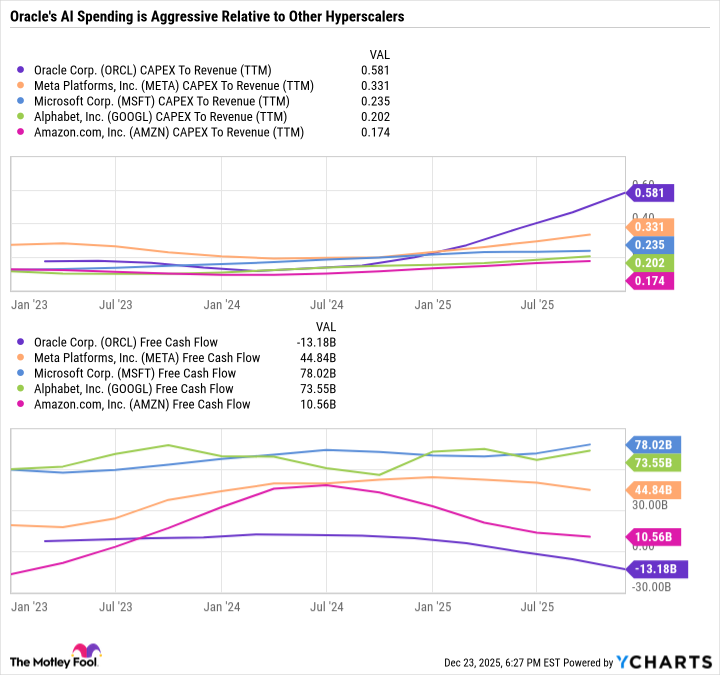

The capex-to-revenue metric shows the relative size of a company's spending within the context of its revenue. Just a few years ago, the major hyperscalers like Microsoft, Alphabet, and Amazon had roughly 0.1 to 0.15 capex-to-revenue ratios, meaning they were raking in around 7 to 10 times more revenue than they were spending on capex. Those ratios have increased as hyperscalers ramp up their spending on artificial intelligence (AI). But Oracle is on another level -- with a capex-to-revenue ratio at a sky-high 0.58.

ORCL CAPEX To Revenue (TTM) data by YCharts

Oracle is spending so much on AI that its free cash flow (FCF) has turned negative. And that has a lot of investors worried that Oracle is taking an unnecessary gamble on AI. Oracle's credit risk has increased, and it could face a downgrade by ratings agencies to the lower bound of investment grade or possibly even just outside investment grade.

However, Oracle did mention multiple times on its Dec. 10 earnings call that it is committed to maintaining its investment-grade rating. These fears are arguably already reflected in the stock price. And investors are overlooking the most critical detail about Oracle's debt load: the timeline.

NYSE: ORCL

Key Data Points

An end in sight for Oracle's cash burn

Oracle is now more than halfway through building 72 multicloud data centers that embed its database services into third-party clouds like AWS, Azure, and Google Cloud. Oracle expects Oracle Cloud Infrastructure (OCI) revenue to ramp up substantially in fiscal 2028, which overlaps with calendar year 2027, as the bulk of its data centers will come online. This is also the time period when Oracle's five-year, $300 billion deal with OpenAI begins.

Oracle Senior Vice President of Investor Relations Ken Bond said the following when discussing Oracle's negative $10 billion in second-quarter fiscal 2026 FCF on its Dec. 10 earnings call:

As a reminder, the vast majority of our capex investments are for revenue-generating equipment that is going into our data centers. And not for land, buildings, or power that collectively are covered via leases. Oracle does not pay for these leases until the completed data centers and accompanying utilities are delivered to us. Rather, the equipment capex is purchased very late in the data center production cycle allowing us to quickly convert cash spent into revenues earned as we provision cloud services to our contracted and committed customers.

In sum, Oracle is in the midst of a temporary boom in capex that should soon translate to FCF. It's not a company in a burgeoning industry bleeding cash in the hopes that it can turn profitable down the line.

Therefore, the biggest risk to Oracle isn't necessarily its debt load or the timeline for converting capex to FCF to pay off debt, but rather, if its customers actually come through on their commitments to pay for OCI services.

OpenAI's $300 billion deal is massive, even within the context of Oracle's $523 billion in RPO. However, even if OpenAI retracts some of that commitment or spreads it out over a longer period, I still believe Oracle will have no shortage of customers to redirect that capacity.

Oracle is a top AI growth stock to buy in the new year

Oracle's stock price could be volatile until it proves to investors that it can convert AI capex into FCF. Right now, OpenAI is playing a major role in that narrative because it is potentially Oracle's largest customer. But Oracle doesn't need OpenAI to succeed.

Oracle's data centers are purpose-built for high-performance computing. Its multicloud data centers reduce latency and costs and boost performance by embedding database services within third-party clouds rather than moving large data sets across clouds. So, OCI can be more cost-effective and achieve better performance than its peers.

With that advantage in mind, it stands to reason that Oracle should be able to win business from other hyperscalers, possibly even OpenAI's top competitors, such as Anthropic, the company behind the Claude AI assistant and large language models.

With Oracle stock trading at a26.6 forward price-to-earnings ratio, the market seems to have already digested Oracle's risks, but it is downplaying its potential -- especially the speed at which Oracle could begin paying down debt with FCF. All told, Oracle stands out as a high-conviction growth stock to buy for 2026, but only for risk-tolerant investors who can withstand high volatility.