While artificial intelligence (AI) stocks performed strongly throughout 2025, one particular pocket of the AI realm sticks out from the pack: quantum computing. As of market close on Dec. 23, shares of the Defiance Quantum ETF gained 37% on the year -- more than double that of the S&P 500.

Some of the biggest gainers in this exchange-traded fund (ETF) are quantum pure plays, including Rigetti Computing (RGTI 2.41%) -- whose shares have soared 46% this year.

Let's dive into why there is so much excitement surrounding Rigetti Computing and assess whether the red-hot stock can keep rallying in 2026.

Image source: Getty Images.

What does Rigetti Computing do and why is it important?

While quantum AI remains an exploratory and theoretical pursuit among research labs and higher education institutions, some believe the technology has the potential to revolutionize critical applications across clinical research, financial risk, logistics, supply chain management, and manufacturing.

Management consulting firm McKinsey & Company estimates that quantum computing could add up to $2 trillion in economic value by next decade. For now, however, there are only a small number of companies dedicated to developing quantum computing technology.

NASDAQ: RGTI

Key Data Points

Rigetti Computing builds quantum processors and computers that can be accessed through cloud infrastructure. By employing a vertically integrated model -- controlling the manufacturing process of its chips and designing its own software -- Rigetti aims to usher in a new era of computing beyond what today's most capable systems can handle.

This is important for the future of AI because if Rigetti achieves a quantum breakthrough, its full-stack suite across hardware and software could enable next-generation algorithms that today's GPUs simply are not designed to handle.

Is Rigetti Computing stock overvalued?

A common mistake that beginner investors often make is following the crowd. Sometimes, investors will chase momentum stocks -- knowingly buying shares at a premium in hopes of flipping their position for a profit. This is known as the greater fool theory.

Smart investors avoid this strategy. Thorough valuation analysis is required to determine whether a stock is actually a reasonable buy.

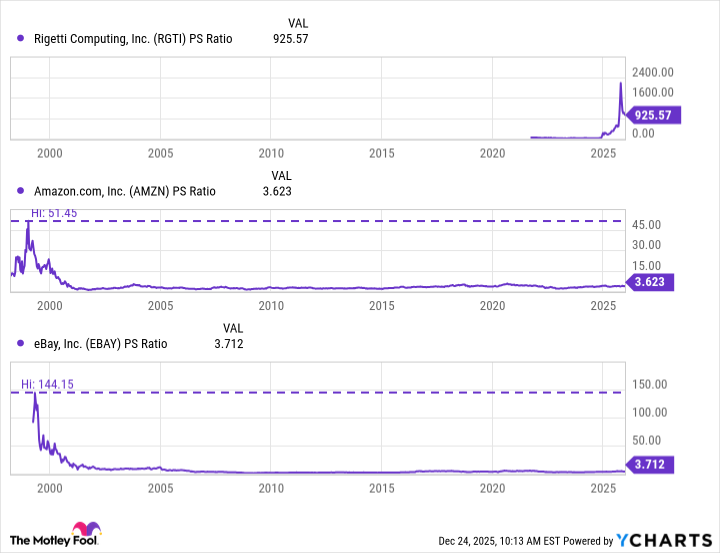

Early pioneers of the internet such as Amazon and eBay peaked at price-to-sales (P/S) multiples of 51 and 144 respectively prior to the dot-com bubble bursting. Right now, Rigetti Computing trades at a P/S ratio of 925 -- a completely different universe than even the most euphoric dot-com darlings.

RGTI PS Ratio data by YCharts

Another important fact to understand about the capital markets is that stocks do not rise in a linear fashion. While shares of Rigetti have risen by 46% in 2025, the stock had gains of more than 200% this year, and has surged roughly 2,600% over the entirety of the AI revolution.

Given the company's parabolic rise in combination with historical valuation trends, I think it's safe to say that Rigetti Computing stock is overbought and a pullback has begun. The question is, just how much of a correction could be in store?

Where could Rigetti Computing stock be heading in 2026?

Back in 2000, Cisco was the largest company in the world -- sporting a market capitalization of $555 billion. But in the aftermath of the dot-com bubble, the internet trailblazer saw its valuation plummet as low as $63 billion -- nearly a 90% decline. Today, Cisco's market cap remains more than 40% below its all-time high from 25 years ago.

It's important to note that past results do not guarantee future performance in the stock market. With that said, the reality is that developers such as Rigetti are similar to investing in an early stage start-up -- featuring limited revenue traction, unproven product-market fit, and consistent cash burn.

Against this backdrop, I think quantum computing stocks have flown too close to the sun and a pronounced pullback could be in store next year. Using Cisco as a proxy, I think it's more likely that Rigetti could crater in a similar fashion to what happened in the immediate fallout of the dot-com boom.

Depending on the magnitude of a potential sell-off, I think a realistic range for Rigetti stock could be between $3 and $7 by the end of 2026. I believe investing in Rigetti Computing is highly speculative and best avoided. I see the stock becoming a falling knife in the not-too-distant future. Smart investors know better than to chase narratives and be left holding the bag.