Following billionaires and seeing what stocks they hold can be a great gut check for investors. This is made possible due to a Securities and Exchange Commission requirement that all money managers with greater than $100 million in assets report their end-of-quarter holdings. This information is then made available to the public 45 days after the quarter ends through a Form 13F. So the latest information we have on billionaire holdings is from Sept. 30, 2025.

The key is to find fund managers who aren't actively trading the market but are instead long-term investors. One of those is billionaire Chase Coleman, who runs Tiger Global Management. In Q3, he made zero trades in four of his five largest holdings, so he's clearly not trading in and out of the market. He also holds a significant chunk of his portfolio, 10.5% to be exact, in one artificial intelligence (AI) stock that has been a long-term winner: Microsoft (MSFT 1.39%).

Microsoft is a common holding among billionaires, and it's Coleman's largest investment. So is it a smart buy for you? Let's take a look.

Image source: Getty Images.

Microsoft's business model is thriving in today's AI-driven world

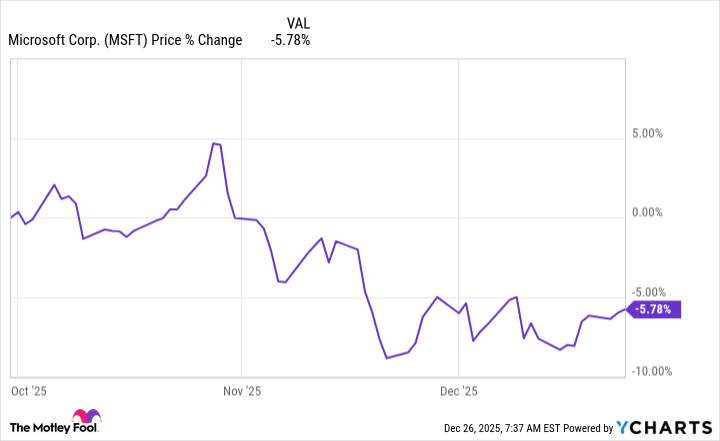

First, let's take a look to see if Microsoft's stock has moved significantly since Sept. 30.

Microsoft's stock is actually down since we last knew Coleman owned its stock. Because Coleman is a long-term investor, it's unlikely that anything has emerged in the Microsoft investment thesis that would have changed his mind about keeping Microsoft's stock as a large chunk of his portfolio.

This can give investors confidence that Microsoft could be a great buy now.

NASDAQ: MSFT

Key Data Points

The Microsoft investment thesis pivots around its artificial intelligence (AI) strategy. Microsoft has chosen not to develop its own generative AI model. Instead, it's serving as a facilitator and enabling AI creators to use whichever model suits their needs most. Azure Foundry offers models from OpenAI, xAI, Anthropic, DeepSeek, and many others. This makes Microsoft's cloud computing platform one of the most popular to build on, which shows up in its financial results.

During Microsoft's Q1 FY 2026 (ended Sept. 30, 2025), Azure grew its revenue 40%, making it the fastest-growing cloud computing business of the major providers. If Azure continues to be the most popular option in this space, I'd expect the stock to continue to outperform.

Another growth area for Microsoft is its Copilot product. Copilot integrates generative AI into Microsoft's core Office software, and it has done a great job of upselling existing clients on these capabilities. This improvement allowed Microsoft 365 commercial and consumer segments to rise by 17% and 26%, respectively, during Q1. However, there are some questions surrounding the usefulness of these products. While some users have certainly found value, there are many who haven't. This could cause some businesses to downgrade their licenses, causing a headwind for Microsoft in the future.

Microsoft's success hinges on how well its AI products are received. Currently, there is a near-universal positive reception regarding its strategy, but if that shifts, Microsoft's stock could be in for some pain.

Microsoft's stock isn't cheap

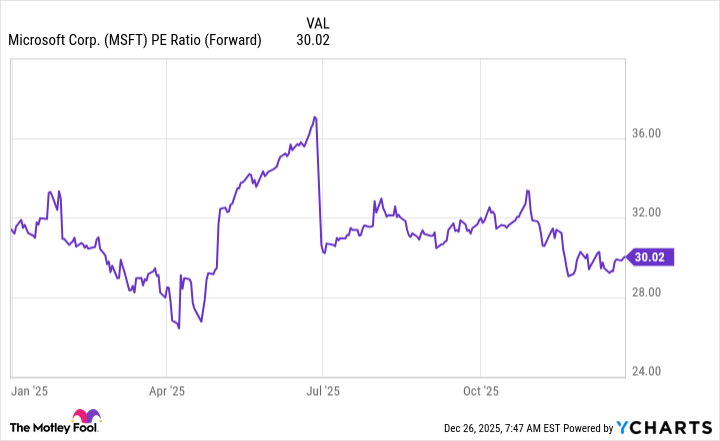

Even though Microsoft's stock has pulled back from where it ended Q3, it still maintains an expensive premium. It trades for 30 times forward earnings, which isn't cheap.

MSFT PE Ratio (Forward) data by YCharts

It's also quite average for the big tech companies, and as long as Microsoft continues to post quarters with midteens revenue growth, I think this valuation is reasonable. However, if it slows down to a market-average pace, the stock could struggle in 2026.

Wall Street analysts project 16% revenue growth for FY 2026 (ending June 30), and 15% for FY 2027. If that pans out, I have no doubt that Microsoft will be a market-beating stock, justifying Coleman's investment. But if growth starts to slow for any reason, Microsoft's stock could lose to the market. I think Microsoft's future will look pretty similar to its past, making it a solid stock pick over the next few years. Just don't expect it to deliver jaw-dropping returns.