There's something refreshing about the new year. It's an excellent opportunity for a fresh start, which means new ideas for your stock portfolio.

Although the calendar is turning a page, artificial intelligence (AI) remains a hot theme for 2026, just as it has been for most of the past few years. Despite immense hype and soaring share prices, some AI stocks still represent compelling value today.

Taiwan Semiconductor Manufacturing (TSM 0.32%), also known as TSMC, was no slouch in 2025. The stock rose by more than 50%. Yet, it may still be the best AI stock to buy in January. Here's why shares could continue heading higher.

Image source: Taiwan Semiconductor Manufacturing

Gobbling up market share in the AI era

Everything electronic, from data centers for AI to your smartphone, uses microchips. Many companies that sell them, such as Nvidia or Advanced Micro Devices, design them and outsource the manufacturing to companies called foundries, which have the expertise and equipment to build them.

Taiwan Semiconductor is the world's largest foundry, and to say that it dominates its industry could somehow be an understatement. According to estimates from Counterpoint Research, TSMC's market share (by revenue) of the global foundry market was approximately 72% at the end of the third quarter. Samsung was the closest competitor at just 7%.

NYSE: TSM

Key Data Points

Perhaps what's more impressive is that despite surging demand for AI chips, TSMC has actually increased its market share amid this AI investment cycle. Its share was 65% midway through 2024.

Manufacturing chips is a complicated task. Given the money at stake -- there are hundreds of billions of dollars pouring into AI -- chip companies are flocking to TSMC's scale, equipment, and proprietary processes.

No other company can build as many high-end chips as quickly as this one can. They are the sure thing, and that has value.

Nvidia's Rubin chip is arriving soon

The top AI company, Nvidia, has partnered closely with TSMC for its graphics processing units (GPUs), including its Hopper architecture and its successor, Blackwell. Naturally, innovation continues, and its Rubin architecture is next in line, set to arrive on the market in 2026.

TSMC is building Rubin using its advanced 3-nanometer process, to achieve higher performance with less power consumption. Nvidia recently touted a $500 billion order backlog -- meaning that a company with $187 billion in sales over the past four quarters is poised to continue its impressive growth trajectory.

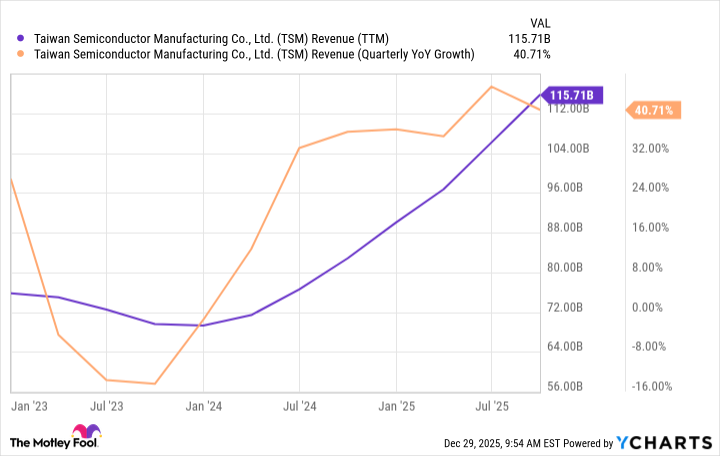

TSM Revenue (TTM) data by YCharts; TTM = trailing 12 months.

Nvidia's AI success is affecting TSMC, whose own revenue growth has accelerated dramatically over the past few years. In fact, Nvidia has challenged Apple as TSMC's largest customer at this point.

Fantastic growth at a compelling price

Barring an unexpected widespread collapse in AI spending, Nvidia's huge backlog is likely to help propel TSMC's business to new heights as those orders flow through its foundries. Fortunately for investors, there appears to be room for the stock to continue its ascent.

Its price-to-earnings ratio is just under 30 times TSMC's full-2025 earnings estimates. While that may seem high, the company is likely to continue growing rapidly, as discussed above. Analysts estimate that it will increase earnings by an average of nearly 29% annually over the next three to five years.

Using the price/earnings-to-growth ratio (PEG) to compare TSMC's growth rate to its valuation, its ratio of roughly 1 signals the stock is very attractive at its current price. I am often willing to pay up for a PEG ratio of about 2 to 2.5 for a high-quality stock, and TSMC certainly meets that standard as the world's leading chip foundry.

So even if TSMC's growth falls a bit short of analyst estimates, investors still have a good chance of achieving strong returns over the long term. The company's mission-critical role in the AI boom gives the stock a relatively high floor with enough upside to make it a leading investment idea heading into January.