Taiwan Semiconductor Manufacturing (TSM +0.32%) has been a top stock to own over the last few years, and 2025 was no exception. Its stock rose more than 50% in 2025, making it a top performer in its space. But after such a strong year, is the semiconductor foundry worth owning in 2026?

Let's take a look at Taiwan Semiconductor's prospects and determine if it can continue its outperformance or if investors should move on from the stock.

Image source: Getty Images.

Taiwan Semiconductor is a key supplier in a growing industry

Taiwan Semiconductor is well-positioned to take advantage of all of the artificial intelligence spending that's ongoing. The company is a neutral party in the chip realm, as it makes chips for companies like Nvidia, Advanced Micro Devices, and Broadcom. These three are competing for computing market share, but source most of their chips from Taiwan Semiconductor. So, as long as the AI hyperscalers continue to spend heavily on data centers, it will be in a good spot.

Fortunately for Taiwan Semiconductor, the AI computing market is massive. AMD believes that the global computer market will be worth around $1 trillion by 2030. Nvidia offered a similar projection for 2030, as it believes global data center capital expenditures (which include compute and other expenses) will reach $3 trillion to $4 trillion by 2030. Companies with the most knowledge about what's coming all project huge growth over the next few years, which bodes well for Taiwan Semiconductor.

NYSE: TSM

Key Data Points

Wall Street analysts project that Taiwan Semiconductor's revenue growth in 2026 will be 21% in New Taiwan dollars. That growth rate could be higher or lower in U.S. dollars based on currency exchange rates, but projections that Taiwan Semiconductor's revenue will rise around 20% next year are a safe bet. That's impressive performance from any company, let alone one that has a market cap of nearly $1.6 trillion.

As long as Taiwan Semiconductor's valuation is reasonable, that growth can translate directly to stock price appreciation. If the stock is reasonably valued, then it's one well worth buying.

Taiwan Semiconductor trades at a discount to its big tech peers

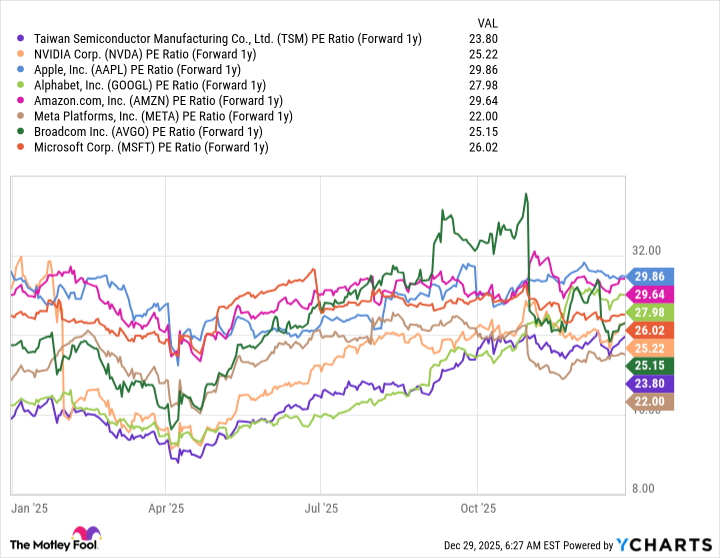

If we compare Taiwan Semiconductor's stock to some other big tech companies, it's clear that it trades at a discount.

TSM PE Ratio (Forward 1y) data by YCharts

At 24 times next year's earnings, Taiwan Semiconductor has the lowest valuation of the major tech companies outside of Meta Platforms. While this doesn't make Taiwan Semiconductor's stock necessarily cheap, I think it's reasonably valued.

Because Taiwan Semiconductor's stock is at a fair price for its market position and performance, it looks like a great candidate to buy for 2026. Furthermore, because it is slated to grow at an above-market-average pace (the S&P 500 usually grows at a 10% rate), Taiwan Semiconductor is expected to outperform the market once again in 2026.

As a result, this a stock that every investor should consider adding to their portfolio in 2026, as long as you're not already too exposed to the AI trade. There are multiple companies involved in this area, and it's easy to get overleveraged to this sector. However, it's also the primary place where the largest tech companies are spending their money, so having increased exposure to this sector isn't a bad thing either.

I'd expect Taiwan Semiconductor to be one of the best-performing stocks from the cohort compared above in 2026. The only thing that may derail its performance is if the AI hyperscalers start to pull back on spending. I don't see that happening for many years, so I think Taiwan Semiconductor is both a safe investment and a strong one for 2026.