When does a hardware company become a software company? It's a good question, particularly in the case of Trimble (TRMB 0.41%), a company specializing in positioning and workflow technology. The stock is priced at a discount to its software peers due to its legacy hardware business, despite its software, services, and recurring revenue now accounting for almost 80% of its revenue. Here's why Trimble is undervalued by as much as 30%.

Why Trimble should trade at a premium

Instead of trading at a discount, Trimble should arguably trade at a premium to its peers. This would reflect the margin expansion and increased free cash flow (FCF) generation opportunities from the ongoing shift to recurring revenue from software subscriptions and services. I'll address the valuation argument momentarily, but first, a few words on the growth opportunities ahead.

NASDAQ: TRMB

Key Data Points

Trimble's software growth opportunity

To be clear, Trimble's hardware will always be a part of its business. The company's roots lie in hardware products that provide customers with precise positioning, notably in the construction, infrastructure, geospatial, mapping, and transportation sectors.

However, its future lies in connecting the physical world with the digital world, creating a common data environment , so that project designers and project managers can see the same thing in real time and collaborate immediately. One example could be a structural engineer remotely monitoring the real-time positioning of a structural element (such as a beam, column, or slab) on a construction project.

The opportunity to prevent waste and ensure on-time delivery of construction/infrastructure projects using Trimble's technology should not be underestimated. A more timely delivery of an infrastructure project, such as a railway or highway, can save vast sums of money.

The benefits of its software will be further enhanced by embedding artificial intelligence (AI) into its solutions, enabling customers to streamline their daily workflows by automating repetitive tasks, analyzing workflows (such as those of vehicles in a transportation fleet), and creating actionable insights.

Image source: Getty Images.

Trimble is growing at a double-digit rate

The key metric to follow with Trimble is its annualized recurring revenue (ARR), which management expects to grow at a low double-digit to mid-teens annual rate through 2027. The increase in ARR will lead to an increase in profit margins and cash flow generation. The Wall Street analyst consensus has Trimble growing its FCF from an adjusted figure of about $750 million in 2025 to $1 billion in 2027, representing an annual growth rate of 15%.

Image source: Getty Images.

That mid-teens growth rate is above management's estimates for ARR growth and reflects the potential for more ARR to be converted into cash flow. That's driven by the fact that the cost of delivering additional software on subscription is marginal, and particularly when compared to the cost of delivering lower-margin hardware products.

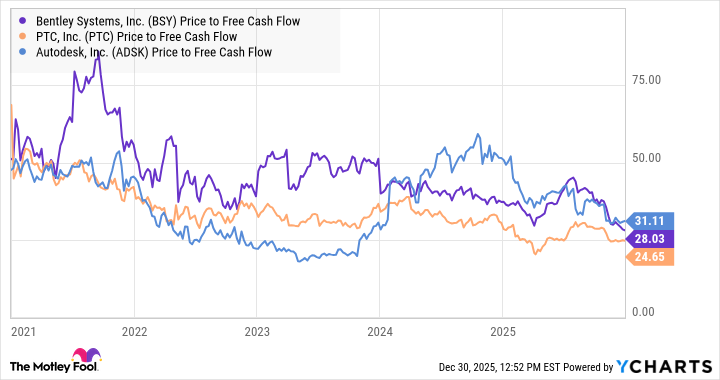

Trimble should trade at a premium, not a discount. A quick look at some of its peers' price-to-FCF multiples shows that Trimble trades at the low end of the group. For comparison, Trimble's adjusted FCF of around $750 million (adjusted to exclude a $277 million one-time cash tax payment relating to the sale of an asset) would put it on a 25.3 times FCF multiple in 2025. For the record, PTC also appears to be significantly undervalued.

BSY Price to Free Cash Flow data by YCharts.

But here's the thing: Trimble should arguably trade at a premium to reflect its greater opportunity to expand margins and FCF. Let's put it this way: A traditional mature industrial might trade at 20 times FCF, but a higher-growth software company might trade at something closer to 30 times FCF, as Bentley and Autodesk currently do.

A stock to buy for 2026

Slapping a 30 times FCF multiple on Trimble in 2027 could lead to a $30 billion market cap. Conservatively applying a 25 times FCF multiple would get Trimble to $25 billion, representing a 31.4% increase on the current stock price.