The market is starting 2026 on a high, having finished three years of double-digit gains. The future still looks bright for U.S. stocks, and large artificial intelligence (AI) companies like Nvidia and Meta Platforms closed out the year with announcements of huge deals.

Could the AI bubble burst in 2026? Or, will the economy flourish, bringing new gains to confident investors? Whatever happens, make sure you have some excellent growth stocks in your portfolio that could withstand short-term market pressure and deliver strong results in a growing market.

If you're looking for a top growth stock that has incredible long-term opportunity, I recommend MercadoLibre (MELI 0.69%). Here's why it's the ultimate growth stock.

The vast opportunity

Any great growth stock needs to have a substantial long-term opportunity to continue growing. MercadoLibre is an e-commerce and fintech powerhouse operating in an underpenetrated region, and it's working hard to drive a shift towards digital functions while reaping the benefits.

In e-commerce, the company's market in Latin America lags behind many other global regions. In the U.S., e-commerce penetration is about 30%, while in China it's nearing 40%. In Latin America, it's just over 15%, which is about a decade behind the U.S. However, management believes that it can double over the next few years, and it's making many moves to grab market share.

Image source: Getty Images.

MercadoLibre recently lowered its free-shipping threshold in Brazil from R$79 ($14) to R$19 ($3.40), and this change is cascading into a string of positive effects. It achieved its highest percentage of new customer growth in the country since 2021 in the third quarter of 2025, at 29%, and its highest-ever number of new customers. Growth in items sold accelerated to 42%. That kind of customer growth is attracting new sellers, and items for sale quadrupled year over year. Customer retention and conversion rates reached an all-time high, and visits increased significantly. That's an exciting development for the company in terms of how it can think about generating future engagement.

The fintech business works together with the e-commerce business, creating a full ecosystem of financial products and services where users can buy and pay for items as well as manage their finances all in one place. Many of the countries in MercadoLibre's markets are behind in financial inclusion, with users closed out of the banking system and reliant on low-yielding bank accounts. Mercado Pago, MercadoLibre's digital wallet, has the highest number of monthly active users of any similar company in Mexico, Argentina, and Chile, as well as the No. 2 spot in Brazil, putting it in a great position as more people begin to engage with digital finance.

NASDAQ: MELI

Key Data Points

The top performance

MercadoLibre has been demonstrating outstanding performance as it continues to disrupt the status quo. Revenue increased 49% year over year (currency neutral) in Q3, and gross merchandise volume increased 39%. Total payment volume was up 54%, and assets under management increased 89%.

It's also highly profitable. Operating income was up 30% in the third quarter with a 9.8% margin, and net income increased 6%.

The reasonable price

Many top growth stocks are priced at a premium. However, when a stock price becomes too high, it already carries too much of the potential that is already priced in. That limits how much higher it can go.

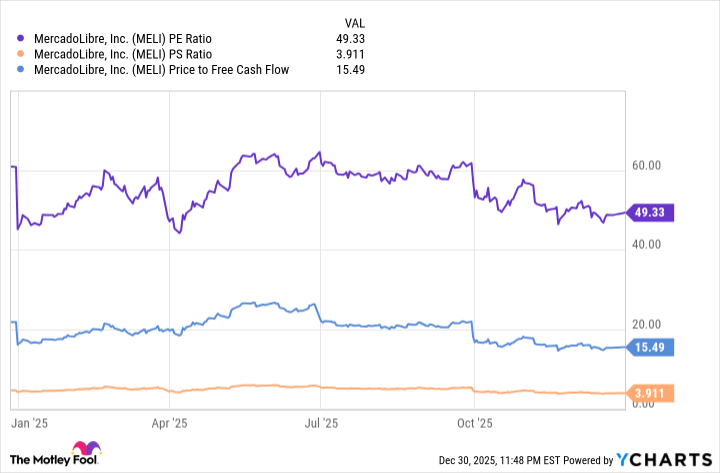

I wouldn't call MercadoLibre stock cheap, but it's comparatively cheaper than similar growth stocks. There's a premium to pay for growth, but it falls within a reasonable range that allows for expansion.

MELI PE Ratio data by YCharts.

MercadoLibre has a long growth runway, and the stock is trading at an attractive price. It's an excellent choice for the growth-oriented investor.