Investors who are looking for a highly diversified exchange-traded fund (ETF) in 2026 might want to consider the Vanguard Total Stock Market ETF (VTI 0.08%). It tracks the performance of the CRSP U.S. Total Market Index, which invests in all 3,498 companies listed on American stock exchanges, so it's basically an entire portfolio all on its own.

That means it offers exposure to powerhouse artificial intelligence (AI) stocks like Nvidia and Amazon, but also small-cap growth stories like Lemonade, which soared by 95% last year.

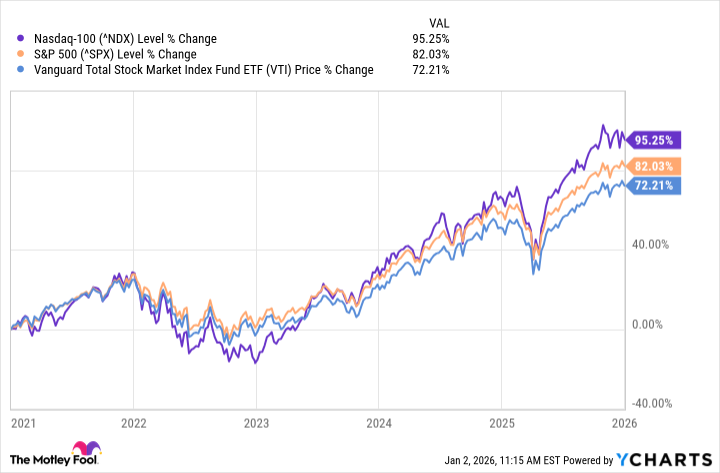

Highly diversified ETFs typically generate lower returns than ETFs that track more concentrated indexes like the S&P 500 (^GSPC 0.04%) or the Nasdaq-100, but they also produce far less volatility. With that said, the Vanguard Total Stock Market ETF can still deliver life-changing results for investors who buy it in 2026. Here's how it could be a millionaire maker over the long term.

Image source: Getty Images.

Trillion-dollar giants to small-cap growth stories

The Vanguard Total Stock Market ETF is weighted by market capitalization, so the most valuable companies in the fund have a greater influence over its performance than the least valuable. As a result, its top three holdings are Apple, Nvidia, and Microsoft, which are worth a combined $12.3 trillion.

Therefore, despite having almost 3,500 holdings, 18.1% of the total value of this Vanguard ETF is parked in those three high-flying stocks alone. But although that sounds like a big number, those three stocks have a much higher weighting of 20.8% in the S&P 500, and 36.3% in the Nasdaq-100. That's partly why the Vanguard ETF has underperformed those indexes over the last five years:

With that said, the technology sector overall has a beefy weighting of 38.5% in the Vanguard ETF. The sector not only includes Apple, Nvidia, and Microsoft, but also other powerhouses like Broadcom, Oracle, Palantir Technologies, and Advanced Micro Devices. Simply put, this ETF gives investors ample exposure to the AI boom.

Plus, it holds a number of promising growth stocks at the smaller end of the market, which you won't find in the S&P 500 or the Nasdaq-100 at all:

- Lemonade, an insurance technology company using AI to calculate premiums, process claims, and transform the customer experience

- Tenable, a leader in the exposure management segment of the cybersecurity industry

- Serve Robotics, which develops last-mile logistics solutions in partnership with Nvidia and Uber Technologies

- Sprouts Farmers Market, which operates 460 organic grocery stores across 24 U.S. states (and growing fast)

The Vanguard ETF could be a millionaire-maker

The Vanguard Total Stock Market ETF has produced a compound annual return of 9.2% since it was established in 2001. But it has delivered accelerated annual returns of 14.2% over the last decade, primarily because of the incredible growth in areas like technology.

NYSEMKT: VTI

Key Data Points

Here's how long it could take to turn a one-time investment of $50,000 today into $1 million, based on three different annual returns.

|

Compound Annual Return |

Time To Reach $1 Million |

|---|---|

|

9.2% |

34 years |

|

11.7% (Midpoint) |

28 years |

|

14.2% |

23 years |

Calculations by author.

But for investors who don't want to outlay $50,000 in 2026, here's how long it could take to build a million-dollar fortune by consistently investing just $500 per month in this ETF over the long term:

|

Compound Annual Return |

Time to Reach $1 Million |

Total Deposits |

|---|---|---|

|

9.2% |

31 years |

$186,000 |

|

11.7% (Midpoint) |

26 years |

$156,000 |

|

14.2% |

23 years |

$138,000 |

Calculations by author.

To be clear, it's probably unrealistic to expect the Vanguard ETF to maintain its accelerated annual return of 14.2% forever. But given the momentum in the AI space, above-average returns are certainly possible for the next few years at least, especially if the benefits of this revolution continue trickling down to the smaller end of the stock market.

Nevertheless, this Vanguard ETF could still be a millionaire maker in as little as 31 years, even if it reverts to its long-term average annual return of 9.2%.