Turnaround attempts are challenging in the best of times. Amid economic uncertainty, they can be much more daunting.

That's the situation Nike (NKE +2.56%) finds itself in today. New CEO Elliott Hill is working on improving relationships with key partners and reenergizing the brand, and it comes at a time when consumers are struggling with rising costs and where high-priced apparel may not be a top priority.

One executive who is a believer in the company's turnaround efforts, however, is Apple CEO Tim Cook. Cook recently boosted his position in Nike by purchasing $3 million in additional shares, nearly doubling his stake in the business.

Is this a positive sign for the stock, and should you also consider buying shares of Nike today?

Image source: Getty Images.

Nike's business is still struggling

Hill took over as Nike's CEO in October 2024. It's been over a year since then, and there unfortunately hasn't been significant progress for investors to point to as proof that the business is going in the right direction. Turnarounds can take considerable time, especially when there are significant factors to consider, such as economic ones like tariffs, that are out of the company's control.

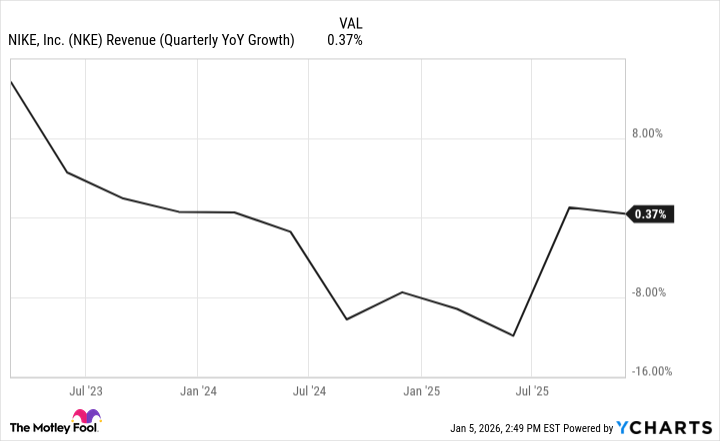

NKE Revenue (Quarterly YoY Growth) data by YCharts

Nike's revenue has been fairly stagnant, with the only positive being that the top line didn't go on a big decline in the most recent quarter. But earnings plummeted by 32% in the period ended Nov. 30, 2025, from $1.2 billion a year ago to $792 million. A big part of the reason is that the company's gross margin has been declining as tariffs weigh on Nike's costs.

Why Cook's purchase of Nike stock shouldn't impact your decision

Cook has a net worth of $2.6 billion and is the CEO of one of the most valuable companies in the world. For Cook, investing an additional $3 million in Nike's stock may be a worthwhile risk to take on, given his financial position. Every investor has their own goals and financial situation to consider. This is why following the moves of billionaires, whether it's Tim Cook or Warren Buffett, may not be practical, as they can afford to take risks that an average investor can't.

At the end of the day, Cook has access to the same information that anyone else does about Nike's business. And if you're feeling as bullish on Nike's prospects as Cook is and are willing to take on the risk, then perhaps it may be a good move to consider following suit and investing in the business. But another CEO investing in a company is by no means a sign that the stock is a good or safe buy.

NYSE: NKE

Key Data Points

Why I'd avoid Nike's stock for now

If it were as simple as fixing relationships with vendors and coming up with new styles, I could see Nike being a good stock to invest in, given its popular brand. But I believe its issues go far deeper. There are a growing number of cheap options in apparel these days, and consumers may not see the value in paying more for Nike's brand anymore. While there may be loyalists who are willing to pay more, that is not likely to be the case for the average consumer who may be looking at more cost-effective options.

Nike needs to prove to investors that it's still a growth business, because right now, it isn't. The apparel stock has lost more than half of its value in the past five years, and with profits continuing to plunge, the stock still looks expensive at 38 times its trailing earnings.

Things could get much worse for Nike before they get better, assuming they improve at all. That's why taking a wait-and-see approach may be the safest option with the stock.