Finding a single stock to buy and hold isn't an easy task. The stock needs to cover a wide range of outcomes, and failure isn't an option. While this stock may not provide the highest returns in your portfolio, it is also the most likely to beat the market in a safe manner over a long time frame.

After searching through my portfolio, I've identified a single stock that I would put all of my money into if I were forced to only hold one stock: Taiwan Semiconductor Manufacturing (TSM 0.01%).

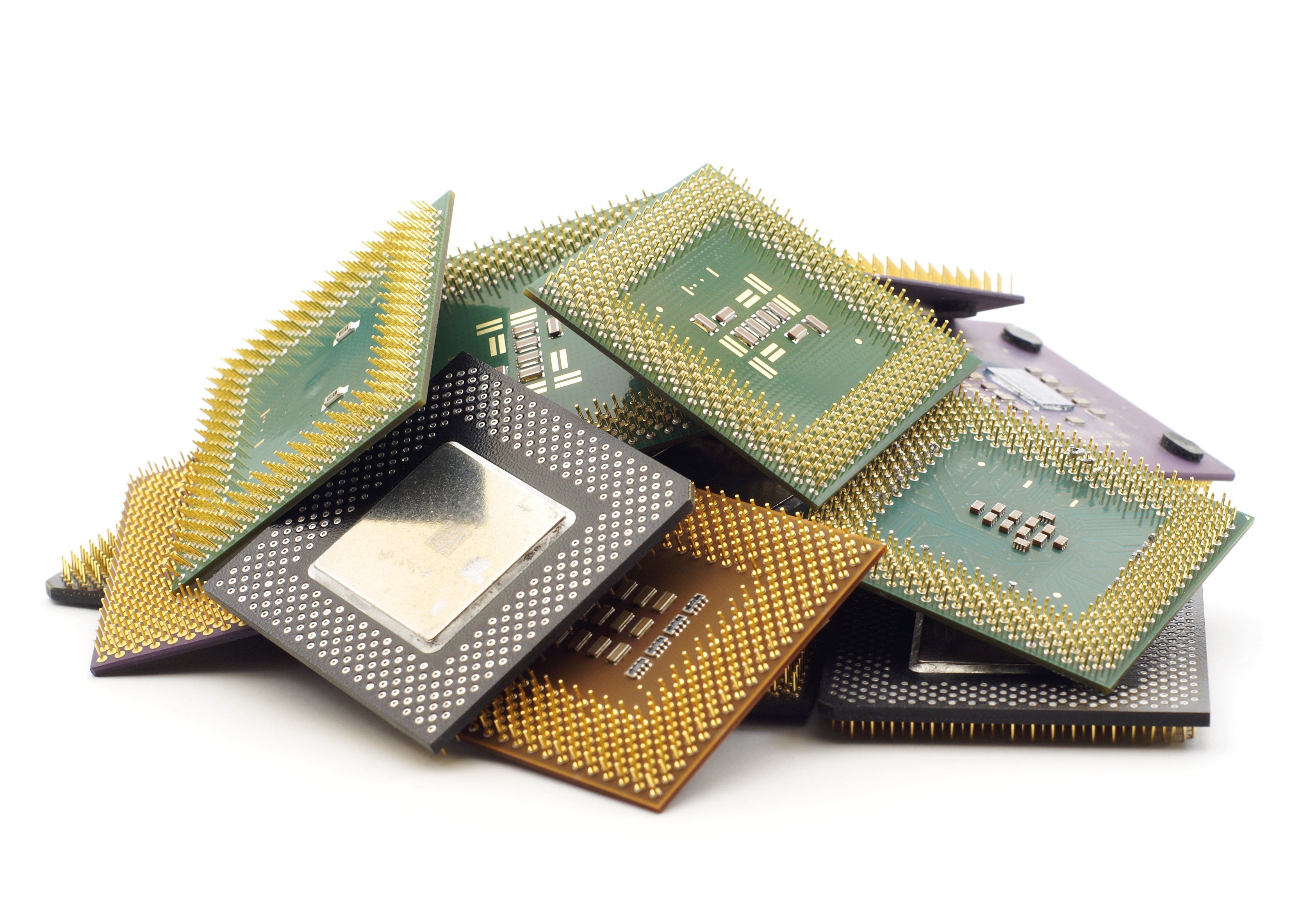

TSMC, as it's also known, is the world's leading contract chip manufacturer, and is at the center of the artificial intelligence (AI) buildout, even though it isn't discussed as much as some of the direct hardware providers. Its importance has led to it becoming the eighth-largest company by market cap.

I believe Taiwan Semiconductor is an incredibly safe stock (outside of two reasons), and it's the stock I'm most comfortable putting all of my investments in if I could only hold a single stock in 2026.

Image source: Getty Images.

Taiwan Semiconductor is a critical company in the AI realm

Companies like Nvidia (NVDA 1.17%) and Advanced Micro Devices (AMD 1.21%) are known as fabless chip companies. They do all of the design work, then outsource the chip manufacturing to a company like Taiwan Semiconductor. There isn't a ton of competition in Taiwan Semiconductor's realm.

The two other major players are Samsung and Intel. While Samsung is a worthy competitor, its foundry division is far smaller than Taiwan Semiconductor's. Intel's foundry business has really fallen off in the past few years, and has few clients left, as most chose to work with Taiwan Semiconductor.

NYSE: TSM

Key Data Points

Even though competition is limited for Taiwan Semiconductor, it's continuously developing new technologies, with its latest 2nm (nanometer) chip node entering production right now.

With Taiwan Semiconductor at the leading technological edge and having the largest foundry capacity, it's no wonder that the stock is one of the most important in the AI boom. Regardless of which company you think will have the best computing hardware in 2026, there's a high chance that Taiwan Semiconductor is supplying the chips. This means it will benefit over the long run as long as AI spending continues, which brings me to my first risk.

If the AI buildout stalls, TSMC is in trouble

Should the AI hyperscalers decide to slow their AI buildout, Taiwan Semiconductor's stock will struggle. However, I don't see any signs of that happening. Nearly every company that's competing in the AI realm has informed investors that 2026 will be another year of record-setting capital expenditures, mainly going toward building data centers.

Furthermore, this trend is expected to continue for the foreseeable future, as companies like Nvidia have projected that global data center capital expenditures will be between $3 trillion and $4 trillion annually, compared to $600 billion in 2025.

That's huge growth and a bold prediction, but it's impossible to know which company will capture it. If Nvidia's projection comes to fruition, Taiwan Semiconductor will be an undeniable winner, as it will be supplying the chips for many of the devices that will go in these data centers.

Another risk for Taiwan Semiconductor is its location. Taiwan and mainland China's relationship is incredibly complicated. China could attempt to take over Taiwan, which would crush the stock and the company. This would result in TSMC's stock crashing, making it prone to a single event risk.

However, if Taiwan is attacked, the rest of the market would likely crater too, because TSMC is so important to the tech supply chain. There's also a chance that an invasion could trigger a widespread war, which really would not be good for the market (or humanity).

As a result, I'm not as worried about this risk because there would be no safe haven (besides gold and defense stocks) if military action occurred.

At its core, Taiwan Semiconductor is a neutral investment in the tech buildout. If we use more advanced chips in greater quantities, TSMC will be a solid investment choice. I think that's about as no-brainer of an option as it gets, making Taiwan Semiconductor my top stock to buy and hold entering 2026.