Every investor out there loves to claim they've found a hidden gem in the stock market. The automotive sector might be low on the list for most investors searching the market for hidden gems, as it's known for being a capital-intensive, low-margin, and ultra-competitive industry.

That rule of thumb doesn't do Ferrari (RACE +1.05%) justice, though, as the ultra-luxury sportscar maker is a true bright spot in the industry. The company rarely trades at a discounted price-to-earnings ratio, but over the past three months it's shed an unusually large 25% chunk of its valuation. Here's why it's a great opportunity for investors.

Image source: Ferarri.

Why the dip?

Let's start with the most obvious question: "Why did Ferrari's stock take a substantial dip?" It's a fair question, and one that takes a bit of context to answer. Ferrari's stock took a dip after the company announced its announced its 2030 guidance that disappointed analysts looking for more growth. Ferrari's net revenue is expected to reach at least 7.1 billion euros this year, but is only forecast to reach around 9 billion euros in 2030.

NYSE: RACE

Key Data Points

To be fair, it's worth acknowledging that Ferrari management has a bit of a history of low-balling its medium-term guidance. In fact, it's become sort of a trend for Ferrari to low-ball its guidance, sometimes presenting a rare small dip for the stock price, before often easily topping estimates down the road. So far, the trend is holding true as Ferrari's stock had its worst trading day ever after delivering the forecast, and remains lower as of this writing.

Embarrassing the competition

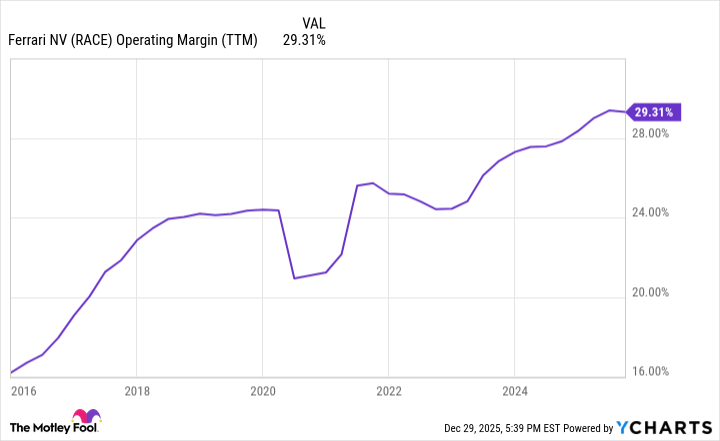

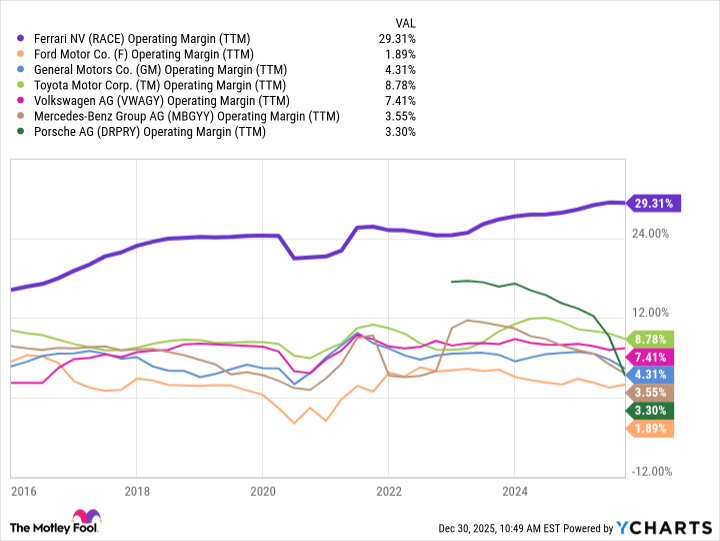

Despite the recent dip in Ferrari stock price, the company is not only dwarfing industry standards with its margins, but those margins continue to expand due to the company's competitive advantages. Let's take a quick look at two graphs: one showing Ferrari's operating margin expansion, and the other comparing margins of other automakers.

RACE Operating Margin (TTM) data by YCharts

Over the past decade, Ferrari's operating margins have consistently risen and have almost doubled. Part of the driving force is the automaker's famous strategy of selling one fewer vehicle than the market demands. It's just a fancy way of saying Ferrari intends to maximize growth for shareholders up to the point of undermining its exclusivity and pricing power.

While Ferrari will likely sell between 15,000 and 17,000 vehicles when 2025's data is all wrapped up, compared to the millions of vehicles mainstream automakers will sell globally, the company supports its top and bottom-line growth with racing technology that filters down into its supercars.

One upcoming example that will be hitting roads soon is Ferrari's F80, which filled its roughly 800-vehicle order book long ago, and will debut with a price tag approaching $4 million. One Wall Street analyst told Barron's the profit margins are likely to be so high that it could account for about 2% of Ferrari's units sold but could generate 20% of the company's profit.

Here's a look at how Ferrari's impressive margins compare to some industry stalwarts.

RACE Operating Margin (TTM) data by YCharts

Buy the dip

Another interesting tidbit about Ferrari that some potential investors may not know is that it has yet to launch its first full-electric vehicle, but generates roughly half of its sales via hybrids. At a time when major automakers are reversing multi-billion dollar decisions to pivot away from full-electric vehicles for now, and lean more on hybrids and extended range vehicles, Ferrari is well-positioned for a smooth transition.

Further, Ferrari has proven it has an excellent go-to-market playbook by incorporating racing technology into its new models and limiting the sales to drive exclusivity. This playbook should continue working and don't be surprised if 2030's estimates end up easily beaten by this hidden-gem luxury stock.