More than 3,500 companies have chosen to go public by listing their shares on the Nasdaq (NDAQ 0.66%) stock exchange. It's typically the destination of choice for early-stage technology companies, because it offers lower fees and fewer barriers compared to alternatives like the New York Stock Exchange.

The Nasdaq-100 is an index featuring 100 of the largest nonfinancial companies listed on the Nasdaq. It's dominated by the technology sector with a weighting of more than 60%, because many of the early-stage companies that listed on the Nasdaq decades ago are now worth trillions of dollars. Nvidia, Apple, and Microsoft are just a few examples.

The Nasdaq-100 is coming off a 20% gain in 2025, and it's currently trading near an all-time high. The Invesco QQQ Trust (QQQ 0.57%) is an exchange-traded fund (ETF) that tracks the performance of the index by holding the same stocks and maintaining similar weightings, so is it a good buy right now? Here's what history says.

Image source: Getty Images.

A high degree of exposure to the fast-moving tech sector

A company's market capitalization (value) determines its weighting in the Nasdaq-100, meaning larger companies have a greater influence over its performance than smaller companies. However, there is a cap to ensure no single company represents more than 24% of the index, because excessive portfolio concentration can lead to volatility.

With that said, the Nasdaq-100 is still very top heavy. The 10 largest positions in the Invesco QQQ ETF have a combined weighting of 51.7%, so they are far more influential than its other bottom 90 holdings.

|

Stock |

Invesco ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

9.04% |

|

2. Apple |

8.01% |

|

3. Microsoft |

7.17% |

|

4. Alphabet |

7.01% |

|

5. Amazon |

4.92% |

|

6. Tesla |

3.97% |

|

7. Meta Platforms |

3.87% |

|

8. Broadcom |

3.26% |

|

9. Palantir Technologies |

2.24% |

|

10. Netflix |

2.19% |

Data source: Invesco. Portfolio weightings are accurate as of Jan. 1, 2026, and are subject to change.

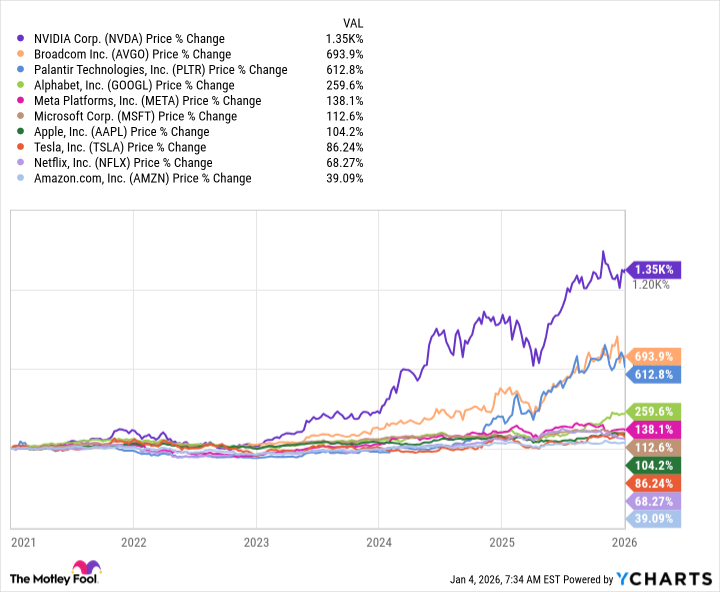

The above companies operate in some of the most exciting and fastest-growing segments of the technology industry, including artificial intelligence (AI), robotics, autonomous vehicles, and even quantum computing. The 10 stocks have delivered an average return of 346% over the last five years, which is a key reason why the Nasdaq-100 has consistently outperformed the more diversified S&P 500 (^GSPC +0.01%).

I also want to make special mention of Advanced Micro Devices and Micron Technology, which sit just outside the Invesco ETF's top 10 holdings. They had a breakout year in 2025, with their shares soaring by 77% and 239%, respectively. They are shaping up to be two of the most important AI semiconductor companies alongside Nvidia and Broadcom.

Although the technology sector is at the heart of the Nasdaq-100, the index does offer a splash of diversification with non-technology holdings like Costco Wholesale, Linde PLC, PepsiCo, and Starbucks. They won't be able to offset a tech-specific market crash on their own, but they can help reduce some of the general volatility in the index.

It's always a good time to invest for the long term

The Invesco QQQ ETF has produced an average annual return of 10.5% since it was established in 1999. But it delivered accelerated annual returns of 19.3% over the last decade specifically, thanks to the widespread adoption of technologies like enterprise software, cloud computing, electric vehicles, and of course, AI.

NASDAQ: QQQ

Key Data Points

Those returns account for every sell-off in the Nasdaq-100 along the way, including five bear markets since 1999 (a peak-to-trough decline of 20% or more), which were triggered by economic shocks like the dot-com crash in 2000, the global financial crisis in 2008, the COVID-19 pandemic in 2020, the inflation surge in 2022, and President Trump's "Liberation Day" tariffs in 2025.

Volatility is a normal part of the investing journey -- it's the price we pay for the opportunity to earn enormous compounding returns over the long term. The secret to success is to stay the course, and to always maintain a long-term investment horizon of five years or more, which will smooth out the market's wild swings.

Therefore, even though the Nasdaq-100 is trading near an all-time high right now, history suggests it might still be a great time to buy the Invesco QQQ ETF for anyone seeking long-term returns.