Investors are always looking for the next big innovation, one that may transform the way the world operates. And that's what's inspired them to buy artificial intelligence (AI) stocks in recent years. AI could revolutionize how businesses operate by streamlining routine tasks and even make it faster and easier to innovate -- we might see the results of this in drug discovery, for example.

The companies developing and selling AI systems, as well as those applying AI to their needs, may score a big win over time -- and investors who get in early on these stocks could generate impressive returns.

Enthusiasm over this potential has driven many AI stocks to double- and triple-digit gains, which is great, but at the same time, it's resulted in a jump in valuations. In fact, AI stocks have climbed so much that a couple of months ago, concern mounted about the possibility of an AI bubble taking shape. Should you worry? This trend among retail investors offers a strikingly clear answer.

Image source: Getty Images.

A look at valuation

So, first, let's consider valuations. A stock such as Palantir Technologies (PLTR 3.52%) offers us a great example. The company has seen tremendous revenue growth thanks to its AI-driven platform that helps customers aggregate and make better use of their data. Investors have flocked to the stock, and it's soared more than 2,600% over three years.

NASDAQ: PLTR

Key Data Points

At the same time, valuation also has roared higher, with the stock trading for more than 170x forward earnings estimates.

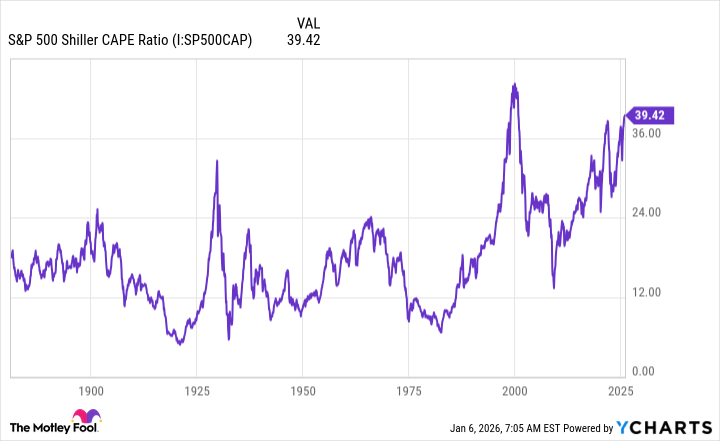

Meanwhile, the market as a whole is looking pricey too, as we can see through the S&P 500 Shiller CAPE ratio, an inflation-adjusted measure of stock price in relation to earnings per share.

S&P 500 Shiller CAPE Ratio data by YCharts

All of this has prompted investors to worry that stock prices are getting ahead of the actual value of many businesses -- and that at some point, these prices will drop. This is the bubble scenario, and concerns about it emerged late last year.

Now, let's consider our question: Should you worry about a possible bubble in the AI market? A look at retail investors' thoughts and moves offers us a clear answer.

A report by The Motley Fool

The Motley Fool's 2026 AI Investor Outlook Report shows that 62% of investors are confident that companies investing in AI will generate significant returns over the long run. And that number rises to 93% for investors who have already invested in AI stocks or AI-related funds. Meanwhile, 9 out of 10 AI investors plan to maintain or add to their holdings. These results come from a Motley Fool survey of 2,600 American adults in early November.

This doesn't mean an AI bubble isn't forming or won't ever form, but it shows us that even if AI stocks experience some turbulence, investors still believe in the long-term potential of these players -- and they intend to keep betting on this growth story.

Elements that don't support a bubble

It's also important to remember that various elements don't support the idea of an AI bubble on the horizon. First, unlike the dot-com boom, this AI boom isn't driven by young start-ups but instead by tech giants that have the resources to keep this growth going -- I'm talking about players like Meta Platforms and Amazon, two companies that have been investing heavily in AI infrastructure.

Second, cloud companies and chip designers have spoken of enormous demand quarter after quarter, and this has resulted in significant revenue growth.

And all of this supports analysts' forecasts of an AI market on track to reach into the trillions of dollars a few years from now.

So, what does this mean for you as an investor? Like the retail investors surveyed by The Motley Fool, focus on the long-term AI story. When considering an AI stock to add to your portfolio, look at its prospects down the road and whether it has the financial resources to achieve its goals. Some stock price turbulence could happen at any point, but if you choose quality players, they may offer you a fantastic AI win over the long haul.