If you're a stock market investor, last year was fruitful but also quite bumpy. Corporate earnings were strong, but investors had to navigate a rising inflation rate, a rising unemployment rate, and political uncertainty headlined by President Trump's "Liberation Day" tariffs, which triggered a temporary crash in the S&P 500 (^GSPC +0.01%) stock market index.

On top of that, the U.S. government ran another trillion-dollar budget deficit that sent the national debt soaring to new highs. All of this political and economic uncertainty fueled a 64% surge in the price of gold in 2025, which has been a reliable store of value for thousands of years.

But gold's close sibling silver delivered an even bigger return of 144% last year. It benefited from many of the same tailwinds, but a looming global supply shortage served as rocket fuel for its rally. Could 2026 bring similar returns? Here's what history says.

Image source: Getty Images.

The perfect environment for precious metals

High-quality assets -- whether they be stocks, real estate, or precious metals -- typically appreciate in value over time. Some of them produce internal growth and generate cash flow that increases their intrinsic value, but their perceived worth also increases because fiat currencies like the U.S. dollar tend to depreciate over time.

Gold, for example, doesn't produce any revenue or earnings. In fact, it's practically useless in industrial settings outside of the jewelry industry, yet the price of a single ounce in U.S. dollar terms continues to rise.

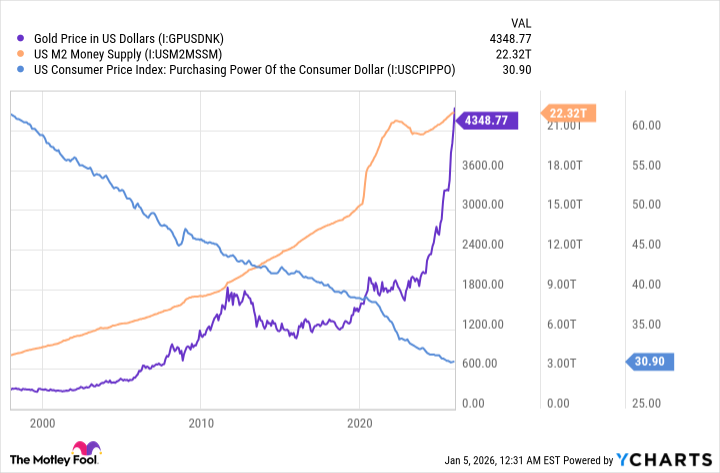

In 1971, the U.S. government abandoned the gold standard, which was a mechanism that limited how much paper money could be printed. The supply of U.S. dollars has exploded since then, driving a 90% collapse in the currency's purchasing power. The below chart shows that the price of an ounce of gold is basically a function of how much new money enters circulation.

Gold Price in US Dollars data by YCharts

Silver benefits from the very same phenomenon, except it's more abundant. Around eight times more of the precious metal pulled out of the ground each year compared to gold, so it isn't quite as valuable. On the flipside, silver is also significantly more useful, with around half of all available supply each year soaked up by electronics manufacturers, so there is constant demand.

China is the world's second largest exporter of silver, and it recently announced a set of restrictions on how much producers are allowed to ship out of the country from Jan. 1, 2026 onward. It's trying to protect its enormous electronics manufacturing industry by securing its supply chains, but the export restrictions also create leverage in trade negotiations with economic rivals like the U.S. and Europe.

In any case, investors fear China's chess move could lead to a global shortage of silver this year, which is why the price per ounce soared to new record highs over the last few months.

History points to modest gains ahead

The U.S. government spent $1.8 trillion more than it took in during fiscal 2025 (ended Sept. 30), and it's on track for another trillion-dollar deficit in fiscal 2026. The national debt is now at a record high of $38.6 trillion, and investors fear the only way the government can resolve this dire fiscal situation is by devaluing the U.S. dollar even further by increasing money supply.

Therefore, the bull case for precious metals certainly remains intact. But silver's situation is more complex due to supply and demand dynamics that can shift at a moment's notice if China decides to reverse its export restrictions.

NYSEMKT: SLV

Key Data Points

As a result, it isn't realistic to expect another triple-digit percentage gain in silver during 2026. It has delivered a compound annual return of just 5.9% over the last 50 years, which is probably what investors should be aiming for. It's also important to keep volatility in mind, because silver has routinely plunged by 70% to 90% after experiencing powerful rallies in the past, which could happen again. Prior to 2025, it actually hadn't set a new record high in 14 years.

That's why investors who want to own silver should maintain a very long time horizon to maximize their chances of earning a positive return. Buying physical metal is the surest way to benefit from any further upside, but buying an exchange-traded fund (ETF) like the iShares Silver Trust (SLV 1.76%) might be an even simpler option.