For the last three years, investors have been bombarded by the stock market's newest megatrend: artificial intelligence (AI). Indeed, AI's grip on investor sentiment echoes the euphoria that Wall Street witnessed over a quarter of a century ago, when the internet was the subject of all the buzz.

Within the technology arena, a small set of megacap stocks that have come to be known as the "Magnificent Seven" -- Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla -- have become the ultimate barometers of the AI trade.

However, some smaller companies have proven that they can go toe-to-toe with these behemoths. In particular, data analytics expert Palantir Technologies (PLTR 2.50%) has become one of the most influential players at the intersection of AI, defense and intelligence operations, and enterprise software.

Palantir has experienced a parabolic rise throughout the AI revolution, which has given it an ambitious valuation profile. The question for investors today is whether its ongoing rally is sustainable in the long run.

Image source: Getty Images.

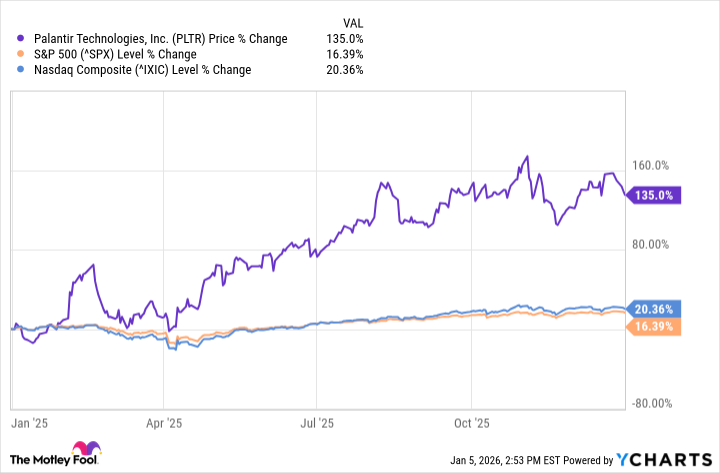

Palantir topped the market for the third year in a row

Last year, shares of Palantir rocketed 135% higher -- handily outpacing both the S&P 500 and Nasdaq Composite. It was the third year in a row that Palantir clocked a triple-digit percentage gain -- making it one of the best-performing stocks on the market.

The catalyst behind Palantir's rise was the strong demand for its Artificial Intelligence Platform (AIP), stitched together by its comprehensive software suites: Foundry, Gotham, and Apollo.

Foundry offers tools for commercial enterprises, helping them drive better decisions from unstructured data hosted across other platforms. Gotham plays a similar role, but is specifically targeted toward defense and intelligence agencies in the public sector. Apollo acts as a security backbone supporting Palantir's AI protocols across both cloud and on-premise environments.

AIP enters the picture with its ability to integrate Foundry and Apollo with existing large language models (LLMs) -- allowing users to run simulations and queries leveraging real-time data.

NASDAQ: PLTR

Key Data Points

In 2025, Palantir won a number of high-profile contracts, among them:

- A U.S. Army enterprise service agreement (ESA) worth up to $10 billion over the course of 10 years.

- A $795 million expansion of its Maven Smart System (MSS) contract with the Department of Defense that brought the total deal value to $1.3 billion.

- A deal with NATO for the use of the MSS platform.

- A collaboration agreement on next-generation aviation systems with Archer Aviation.

- A collaboration deal on telecommunications innovation with Lumen Technologies.

According to global consulting firm Bain & Company, the total addressable market for AI-powered hardware and software is expected to grow at a compound annual rate of up to 55% through 2027 -- culminating in an estimated $990 billion opportunity.

Bain further predicts that LLM-enabled software-as-a-service (SaaS) vendors should continue to experience robust demand for their generative AI services. Against this backdrop, I am confident that Palantir's pipeline will remain in good standing throughout 2026 and beyond.

Is Palantir stock a buy right now?

While Palantir's business performance has been impressive, there is a major disconnect between the company's underlying fundamentals and its valuation.

Over the last 12 months, Palantir has generated $3.9 billion in revenue and $1.1 billion in net income. As of this writing (Jan. 5), Palantir boasts a market capitalization of $417 billion -- giving it a price-to-sales (P/S) ratio of 115.

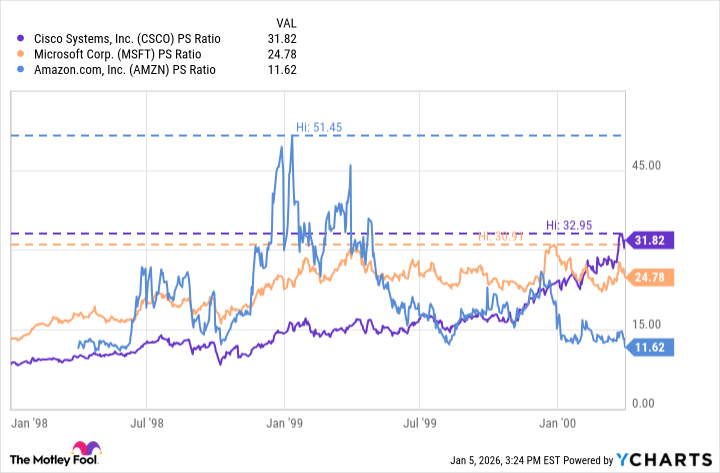

As the chart below illustrates, three of the most iconic pioneers of the internet era -- Cisco Systems, Microsoft, and Amazon -- never came anywhere near that P/S level, even at their dot-com bubble peaks. Moreover, all of them experienced sizable valuation corrections after the dot-com bubble burst in early 2000.

CSCO PS Ratio data by YCharts

The key takeaway from this analysis is that Palantir's business may well continue to hum along so long as AI remains a top priority in companies' tech budgets. Where things get murky is that Palantir's valuation expansion seems unsustainable.

I think it's a real possibility that Palantir could struggle to satisfy investor expectations over the next five years. I suspect it's headed for a valuation de-rating that could take years to overcome.

For this reason, I think Palantir's stock price will be lower in five years compared to where it is today, making it a potentially risky buy.