If you had made an investment of $1,000 in shares of Nebius Group (NBIS 10.18%) a year ago, that position would now be worth more than $3,200. The stock's stunning surge during this period was the result of terrific growth in its revenue, as well as a fast-improving pipeline that points toward a significant acceleration in growth from here.

The remarkable results that Nebius has been clocking in recent quarters aren't surprising. Nebius is a neocloud provider that offers full-stack artificial intelligence (AI) infrastructure services to customers. Nebius operates dedicated AI data centers equipped with high-end graphics processing units (GPUs) that customers can rent to train and run their AI models. Even better, it offers software services and tools along with computing capacity to enable its clients to develop and deploy AI applications.

This integrated approach of providing an end-to-end hardware and software AI development platform has been a hit with customers. But can Nebius sustain its remarkable growth in the long run and deliver enough gains to turn today's retail investors into millionaires?

Image source: Getty Images.

Nebius Group is scratching the surface of a massive opportunity

Nebius operates in a market where demand is outpacing supply by a wide margin. Consulting firm Deloitte predicts that AI data center power demand in the U.S. alone could grow from an estimated 4 gigawatts (GW) in 2024 to 123 GW in 2035. It is easy to see why that's the case.

NASDAQ: NBIS

Key Data Points

According to PwC, the proliferation of AI could increase global economic output by up to 15 percentage points over the next 10 years. AI adoption won't just enhance productivity and reduce redundancy for consumers and enterprises -- it's also expected to underpin breakthroughs in a host of fields. This explains why the need for AI computing power is set to increase rapidly.

Data centers equipped with the state-of-the-art chip systems necessary to develop and run AI applications are the prerequisites for those hoped-for productivity gains and research breakthroughs. Nebius is providing them.

The company had 220 megawatts (MW) of connected data center power capacity at the end of 2025, up almost tenfold from 2024. Its active data center power, though, was just 100 MW, as the hardware and GPUs needed to make full use of its connected capacity are still in short supply.

This year, Nebius is looking to shore up its connected data center capacity to a range of 800 MW to 1,000 MW (1 GW). The company counts major tech players such as Meta Platforms and Microsoft among its customers, as well as numerous AI start-ups.

Importantly, all the capacity that Nebius is bringing online has been sold out in advance. That's not surprising considering the immense demand for AI computing capacity. According to a forecast from Goldman Sachs, data center demand in the U.S. will exceed supply by an estimated 10 GW in 2028. As a result, hyperscalers and AI companies are contracting for capacity before it's online, giving lucrative long-term contracts to the likes of Nebius.

Microsoft, for example, gave Nebius a deal worth $17.4 billion in September. That contract runs through 2031, and its value could go up to $19.4 billion. Meta Platforms followed in December, inking a five-year deal with the cloud company worth $3 billion.

The size of these deals shows that Nebius is poised to become a much larger company.

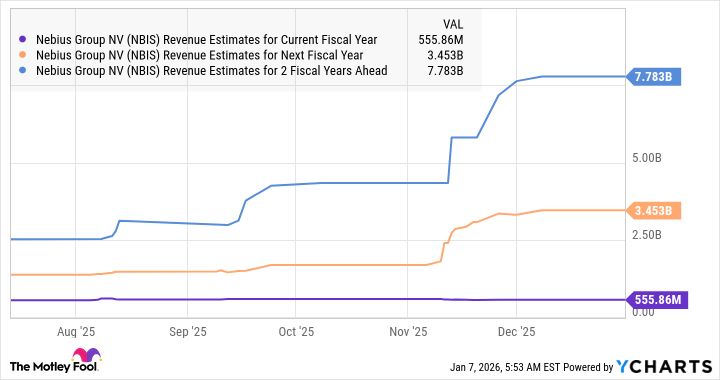

NBIS Revenue Estimates for Current Fiscal Year data by YCharts.

Given that it is sitting on a contractual backlog of more than $20 billion that it needs to fulfill over the next five years, it is easy to see why the analysts' consensus projects a massive increase in its top line -- but can investors count on Nebius to sustain such momentum over the long run?

Can this high-flying AI company help you become a millionaire?

Putting all your money into a single stock in the hope that it will deliver life-changing gains isn't a smart strategy. However, constructing a diversified portfolio can indeed help you build your wealth and may even help you become a millionaire over the long term. Nebius appears to be a good option to add to a growth-focused portfolio, given its significant upside potential.

The company's growth is set to soar in the next couple of years, and it is capable of sustaining impressive momentum over the next decade as well, given the booming demand for AI data center capacity. It is worth noting that Nebius is taking consistent steps to help fill the supply gap in its market, having increased its target for contracted power capacity for 2026 to 2.5 GW from an earlier target of 1 GW.

Contracted capacity refers to the committed supply of electricity Nebius has secured from energy companies or utilities -- power that it can use to bring servers and data centers online once it has the hardware in place. Since there is considerably more demand for AI cloud servers than there is capacity available on the market, it could easily sell out whatever additional capacity it brings online. Also, the acceleration in its revenue growth, as well as lucrative customer contracts that are being used to finance the construction of data centers, should help it keep tapping into the long-term opportunities in the AI data center space.

All this makes Nebius an ideal investment for anyone looking to build a million-dollar portfolio in the long run. This AI stock seems primed for healthy long-term gains thanks to its accelerating growth and immense potential.