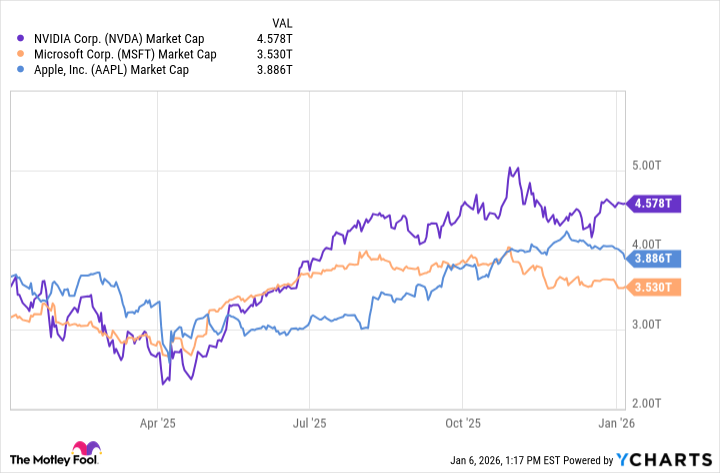

In the history of the stock market, only three companies have achieved a market capitalization of $4 trillion. Nvidia was the first to reach the mark, doing so on July 9, 2025, and then went on to briefly vault over the $5 trillion barrier.

Microsoft briefly touched a $4 trillion valuation in July as well, and then hit the target again on Oct. 28, along with Apple, although both have since retreated to $3.5 trillion and $3.88 trillion, respectively.

Market Cap data by YCharts

The continued run-up in artificial intelligence (AI) is creating a lot of growth among some top companies, and now there's a fourth company that's poised to make the $4 trillion club a foursome this year. It won't take long for Alphabet (GOOG +1.05%) (GOOGL +0.96%) to cross the finish line.

A look at Alphabet stock

The second half of 2025 set Alphabet up to challenge the $4 trillion barrier this year. Alphabet started the year slowly as it faced a series of challenges. First, there was the threat that AI assistants, such as ChatGPT, and social media platforms like Meta Platforms' Instagram and TikTok, would begin to erode Google's substantial market share in internet searches.

And perhaps more serious was a lawsuit from the Department of Justice, which accused Google of an illegal monopoly over digital advertising. The DOJ asked a federal judge to force Google to sell its Chrome and Android products, but the judge declined to impose the penalty.

That led to an enormous run-up for Alphabet. The stock price, which fell nearly 7% in the first six months of 2025, vaulted 78% higher in the second half of the year.

NASDAQ: GOOGL

Key Data Points

And not only did the company avoid a breakup, but it's also been able to maintain its dominant position in internet search. Google actually has a stronger position now -- an estimated 90.83% of internet search volume -- than it did at the beginning of 2025. Alphabet is now using AI in its search engine, incorporating a feature called AI Overviews at the top of search queries. Google AI mode uses the Gemini chatbot to provide conversational answers to prompts.

Alphabet CEO Sundar Pichai said:

AI is driving an expansionary moment for Search. As people learn what they can do with our new AI experiences, they are increasingly coming back to search more. Search and its AI experiences are built to highlight the web, sending billions of clicks to sites every day.

Image source: Getty Images.

What will it take for Alphabet to reach $4 trillion?

The short answer to that question: not much. Alphabet currently has a market cap of $3.77 trillion, so a gain of just 6.1% puts it at $4 trillion. And that seems inevitable, considering Alphabet's impressive financial performance.

In the third quarter, Alphabet reported its first quarter of $100 billion in revenue, a 16% increase from the same period a year ago. Seventy-two percent of Alphabet's revenue comes from its powerful advertising engine, and Google Cloud brought in another $15.15 billion in revenue.

That translates to a massive increase in net income. In the first nine months of 2024, Alphabet reported a net income of $73.58 billion; however, in the first three quarters of 2025, that number increased by 32% to $97.71 billion.

Analysts have a consensus price target on Alphabet stock of $332, or 6% higher than the current stock price as of this writing. So, if it reaches that target, you can start the proverbial $4 trillion market cap party.

When will all this happen? Alphabet will likely report its full-year earnings in early February, and a stock price pop would push Alphabet the magic number.

That's why Alphabet is a strong buy for me right now, and a stock that investors should consider holding for the long term as a cornerstone of their portfolios.