Often, investors only look at total return numbers at the end of a period. That ends up ignoring the performance that occurred between the start and end of the period. That's super important right now as you examine the underperforming consumer staples sector.

Here's why consumer staples stocks like Coca-Cola (KO +1.69%) could be the stocks to buy if you have $1,000 to invest today.

Image source: Getty Images.

The performance ride matters

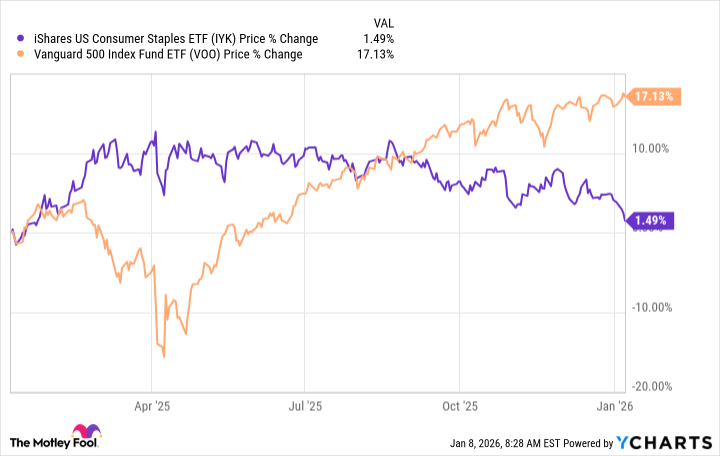

Over the past 12 months, consumer staples stocks have gone virtually nowhere, rising just 1.5% or so. The S&P 500 index (^GSPC +0.65%), on the other hand, has risen a very attractive 17%. However, as the chart below highlights, the performance paths were very different from the start of the period to the end of the period.

In early 2025, consumer staples stocks rallied (the purple line), rising by around 10% before gradually cooling over the remainder of the period. The S&P 500 index, however, began the period with a correction, declining by around 15%. Only after the big drop, while consumer staples stocks were rallying, did it start to rise. The market drop was largely driven by a steep decline in the large technology stocks that have been driving the market higher.

Notably, technology stocks make up nearly 35% of the S&P 500 index's portfolio. Consumer staples stocks only account for around 5% of the index. The disparate performance is important because consumer staples stocks are generally considered safe haven investments.

Going contrarian the "safe" way

Wall Street fluctuates over time, with various sectors taking the lead at different points along the way. With the S&P 500 index being driven higher by a narrow group of high-tech stocks, the dichotomy between tech and consumer staples, roughly a year ago, should serve as both a warning sign and an opportunity. If you think the market is in an artificial intelligence bubble, now could be the right time to focus on the lagging performance of consumer staples stocks.

After all, you aren't going to stop buying food, toilet paper, or toothpaste just because AI stocks are falling sharply. And you have a lot of different options at your disposal, from a strongly performing Coca-Cola to a stalwart performer like Procter & Gamble (PG +0.24%) to an underdog story like Conagra (CAG +2.14%).

Coca-Cola's organic sales rose 6% in the third quarter of 2025, up from 5% in the second quarter. That improvement came despite the headwinds the consumer staples sector is facing from increasingly cost-conscious consumers and the current push for healthier foods coming from the U.S. government.

NYSE: KO

Key Data Points

For conservative investors, Coca-Cola and its 3% yield will be a solid option. Note that it has increased its dividend for over six decades, making it a Dividend King. So it should be particularly attractive to dividend investors. Procter & Gamble is also a Dividend King, with a dividend streak that's six years longer than the one Coca-Cola has built.

NYSE: PG

Key Data Points

Procter & Gamble's yield is also around 3%. Despite operating at the high end of most of the consumer products niches in which it operates, it has seen organic sales hold at around 2% over the past year or so. While that's not as impressive as Coca-Cola's results, it highlights the consistency of Procter & Gamble's business.

The difference is that Procter & Gamble's dividend yield is near its highest levels in five years, while Coca-Cola's yield is about middle of the road over that span. That suggests that value-focused investors might prefer Procter & Gamble.

Conagra and its 8.7% yield is going to be a riskier choice that only more aggressive investors should probably consider. Coca-Cola and Procter & Gamble's brands are industry-leading, while Conagra's are iconic, but by and large, they aren't really industry-leading brands.

For example, you may be familiar with the Slim Jim brand, but it is hardly a leading food brand in the industry.

It shouldn't be surprising that Conagra's organic sales fell 3% in the second quarter of fiscal 2026.

NYSE: CAG

Key Data Points

The dividend has been a trouble spot, too, noting that it was cut during the recession that occurred between 2007 and 2009. Sure, the recession earned the nickname the Great Recession because it was so severe, but Coca-Cola and Procter & Gamble increased their dividends regularly throughout that period.

Basically, Conagra has been playing a game of catch-up for many years as it competes with better-positioned peers. Still, for those with a risk-taking attitude, the business's huge yield and turnaround potential might make it an attractive stock to invest in.

Going against the grain while everyone is focused on tech

It is very difficult to buy stocks that other investors are selling. In fact, right now, it would be much easier to follow the crowd in lemming-like fashion and buy technology stocks.

However, if you can handle being a contrarian investor, you might want to consider buying stocks like Coca-Cola, Procter & Gamble, and, for risk takers, Conagra. A $1,000 investment will let you buy around 14 shares, seven shares, and 61 shares of these consumer staples stocks, respectively. And that will let you get a toehold in an out-of-favor sector that has historically been a safe haven during market downturns.