For the last three years, the stock market's biggest tailwinds have stemmed from virtually anything that touches artificial intelligence (AI). Within the AI landscape, semiconductor giant Nvidia (NVDA 0.27%) has emerged as the most influential business.

While Nvidia's nearly 1,000% stock gains throughout the AI revolution might suggest you've missed the boat, smart investors understand that the chip behemoth's story is really just getting started.

Let's break down what makes Nvidia such a unique opportunity and assess why now is as good a time as ever to scoop up some shares.

Image source: Nvidia.

AI infrastructure isn't going anywhere

The chart below illustrates quarterly trends in capital expenditures (capex) among AI hyperscalers.

AMZN Capital Expenditures (Quarterly) data by YCharts.

Indeed, big tech has spent the last three years procuring as many graphics processing units (GPUs) as possible to outfit next-generation data centers. But the subtle theme from the financial profile above is that this spending activity isn't slowing. In fact, it's accelerating among the major players.

While Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure are designing their own custom hardware, these cloud infrastructure giants still partner heavily with Nvidia.

For example, OpenAI recently signed a $38 billion contract with AWS to rent clusters of Nvidia's GB200 and GB300 GPUs. Per the agreement, OpenAI is targeting all capacity to be deployed "before the end of 2026" with the potential to ramp further.

In a similar fashion, Anthropic agreed to buy $30 billion of compute capacity from Azure in a deal featuring Nvidia's Grace Blackwell and upcoming Vera Rubin chip architecture.

Here's the big picture: Nvidia is becoming a key layer of the overall AI infrastructure foundation. While AWS and Azure may fetch more attention from their respective agreements with OpenAI and Anthropic, Nvidia is really the hidden winner here.

As these build-outs come online throughout 2026 and beyond, Nvidia is well positioned to experience continued, robust revenue and profit acceleration this year and throughout the rest of the decade.

Watch out for new revenue streams

I expect Nvidia's data center segment to continue to be the most meaningful driver of growth this year.

However, smart investors will be listening closely to what CEO Jensen Huang has to say about new revenue streams in 2026 and how these businesses could reshape Nvidia's future roadmap.

Nvidia recently invested $5 billion into Intel as the two semiconductor leaders join forces to design custom central processing units (CPUs) and PC systems. While these new architectures will take time to design and then fully deploy, I expect that 2026 could feature some announcements with original equipment manufacturers (OEM) that plan to integrate Nvidia's new hardware outside of its current AI accelerator lineup.

In addition, Nvidia made a $1 billion strategic investment in telecommunications specialist Nokia in late 2025. Per the press release, AI radio access networks (RAN) is a $200 billion market. Not only does Nvidia have a first-mover advantage in this emerging market, but "trials are expected to begin in 2026" -- signaling Nvidia is diversifying outside of its core competencies and investors could see some nominal revenue mix shift beginning this year.

Lastly, I think a hidden catalyst for this year could be Nvidia's $20 billion licensing deal with Groq. While it's difficult to forecast how much this relationship could move the needle for Nvidia, I think 2026 could be the beginning of a pivotal shift in how Nvidia plans to complement its AI training expertise with deeper inference integrations through some help from Groq.

NASDAQ: NVDA

Key Data Points

Nvidia's valuation is too good to ignore

As of this Jan. 8, Nvidia traded at a forward price-to-earnings (P/E) multiple of 24.7. On the surface, this may look expensive. However, a more thorough look under the hood suggests that Nvidia stock may be dirt cheap.

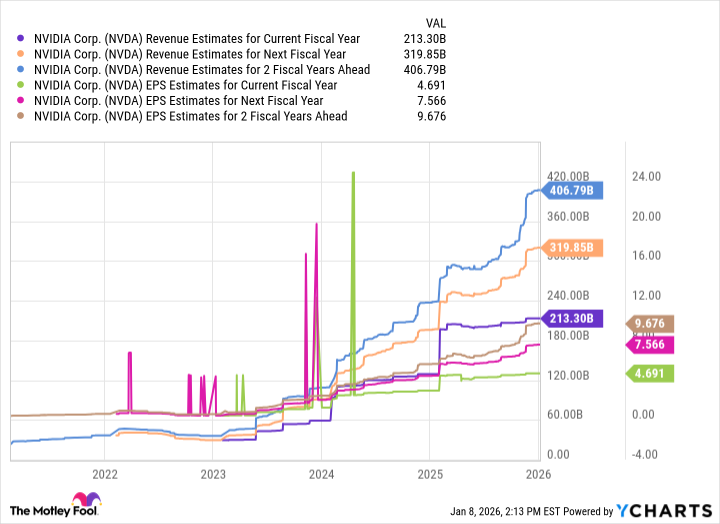

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

According to Wall Street's consensus estimates, Nvidia's revenue and earnings per share (EPS) are expected to double over the next two years. While this is impressive, I think these figures could be understated.

As outlined above, Nvidia has a number of multiyear commitments from the hyperscalers as well as the potential to disrupt several new verticals. The impact of these developments are virtually impossible for sell-side analysts to model in their projections given the uncertainty around timelines and the magnitude of how these applications scale.

Perhaps a more revealing valuation metric for a hypergrowth business like Nvidia is to look at the price/earnings-to-growth ratio (PEG ratio). This ratio is useful because it is forward-looking and accounts for long-term earnings growth potential. In general, a PEG below 1 suggests a company is undervalued. Right now, Nvidia's PEG ratio is a modest 0.72 -- its lowest level in a year.

At the end of the day, Nvidia remains a category-defining company with immense pricing power benefiting from a multiyear structural AI capex cycle that's helping it evolve into more of a diversified platform business.

All told, I think Nvidia is on a path to continue growing throughout the rest of the decade with 2026 being an important time for the company's evolution from chip designer to multifaceted ecosystem scaling from increased investment across both hardware and software.

For these reasons, I see Nvidia as the most compelling buy-and-hold AI stock of the decade and think now is a great opportunity to pounce on its reasonable price point.