Most of the time, most investors make a point of keeping their risk in check, even more so than they look for growth. A great deal of potential upside means nothing if you're not actually likely to reap a gain, after all.

Every now and then though, a higher-risk opportunity comes along with a prospective gain to match. Assuming you can afford to risk it, a position of up $50,000 might even be considered a smart bet.

AST SpaceMobile (ASTS +1.94%) may be one such opportunity right now.

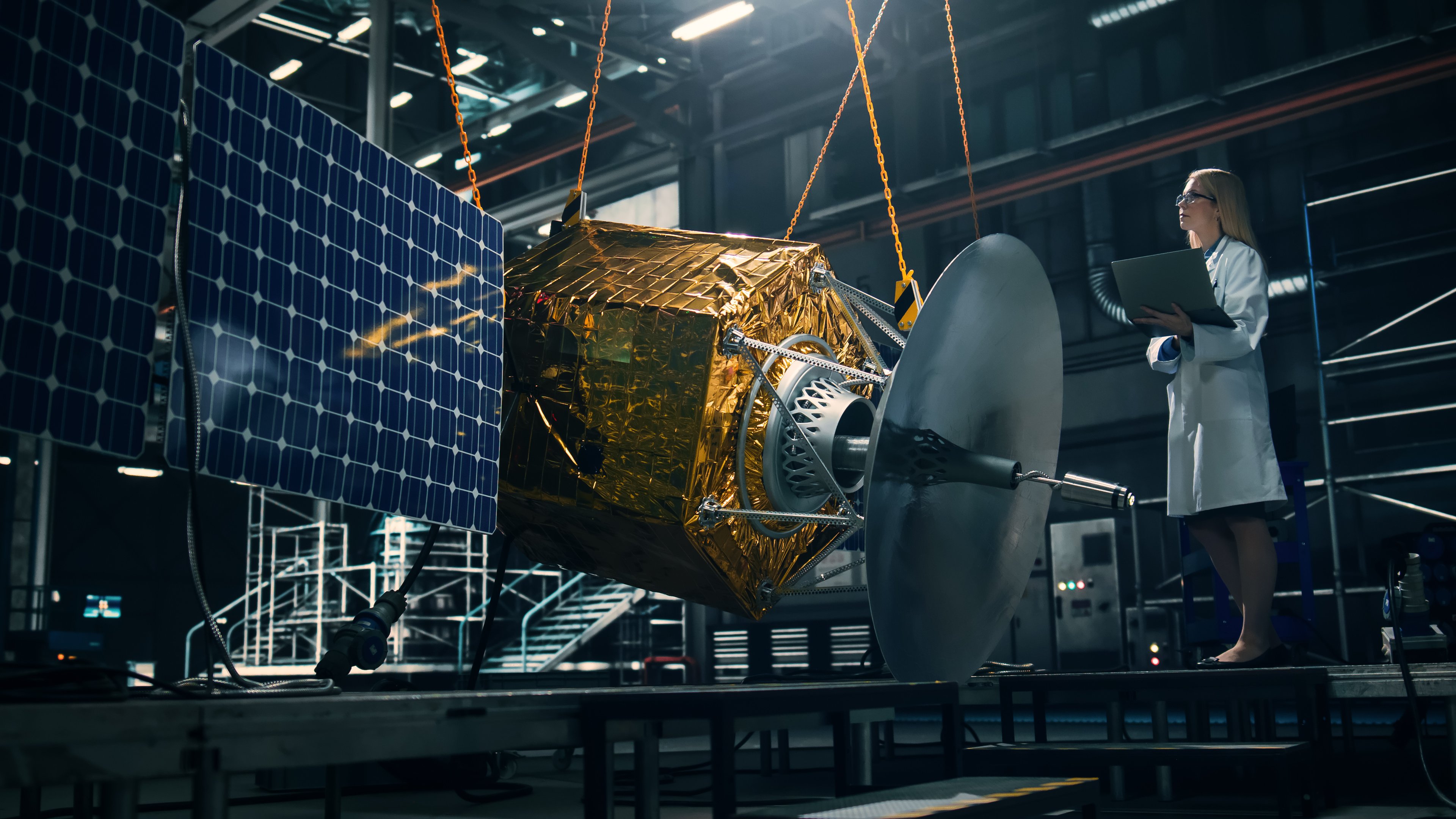

Image source: Getty Images.

What's AST SpaceMobile?

Just as the name suggests, AST SpaceMobile is developing a means of connecting mobile phones to broadband networks using satellites in Earth's orbit. It's not just a mere theory either. It's already got a handful of mostly proof-of-concept satellites already deployed, with plans to launch between 45 and 60 more over the course of 2026. Connecting to this satellite-based network wouldn't require any special device either; an ordinary mobile phone will work.

It's already working with more than 50 mobile service providers and telecom technology companies to help promote the solution, including AT&T, American Tower, and Alphabet, just to name a few. All told, these developmental partners represent on the order of 3 billion potential customers. While individual consumers are clearly prospective users, the biggest beneficiaries of AST's solutions could be emergency responders and defense personnel operating in the 87% of the world that isn't covered by traditional mobile networks.

And the opportunity isn't insignificant. An outlook from Precedence Research suggests the worldwide space-based mobile broadband market is set to grow at an average annualized pace of 22% through 2034, jibing with a prediction from Straits Research. For its part of this growth, analysts expect AST's top line to improve 311% this year -- to $236 million -- en route to more than $800 million next year and in excess of $2.5 billion in 2028.

Just keep it in perspective

As compelling as the bullish argument for owning a stake in AST SpaceMobile may be at this time, it's still not for the faint of heart. While serious revenue may be on the near-term radar, actual profits could take a while to produce; analysts don't expect any until 2028. This makes for extreme volatility in the meantime.

AST shares are also just coming off a record high reached earlier this month, as the stock has gained more than 4,000% since its mid-2024 low. There's no denying there's some pent-up profit-taking potential already built up here, underscored by the consensus price target of $78.89 that's nearly 20% below the stock's present price.

NASDAQ: ASTS

Key Data Points

This company appears to have the right tech along with the right partners in place, though, addressing a clearly unmet need. It wouldn't be wild to take a shot even at this stock's frothy price, while any healthy pullback from here makes this higher-risk trade even more attractive to risk-tolerant investors.

Again, though, just be sure the money behind this trade isn't a major amount of money (for you) that you absolutely need to protect for retirement.