The Vanguard S&P 500 ETF (VOO 0.08%) is a staple in many investors' portfolios, and for good reason. The S&P 500 Index (^GSPC 0.06%) is a powerhouse wealth generator, earning total returns of nearly 695% over the past 20 years, as of this writing.

But as the index becomes increasingly tech-heavy, some investors may want an alternative that is less weighted toward megacap tech giants while still providing exposure to the S&P 500. In that case, the Invesco Equal Weight S&P 500 ETF (RSP 0.26%) could be a smart choice. Here's how to decide which is the better choice for you.

Image source: Getty Images.

An emerging risk with the S&P 500 ETF

Most S&P 500 ETFs -- including the Vanguard S&P 500 ETF -- are market-cap-weighted, meaning the largest companies make up the largest proportion of the portfolio. With the largest companies in the U.S. now worth trillions of dollars, a small number of stocks influence the entire S&P 500.

Nvidia, Apple, and Microsoft alone have a combined market cap of more than $11 trillion, and together, these three stocks make up over 20% of the Vanguard S&P 500 ETF's portfolio.

That heavy tilt toward tech giants can be both an advantage and a risk. Tech stocks are famously lucrative (Nvidia has surged by nearly 1,000% in the last three years alone), but they can also be notoriously volatile.

Many people invest in S&P 500 ETFs because they want a relatively safe and stable investment. And while it remains a solid long-term choice, this type of investment does have a higher risk of volatility as it leans increasingly toward the tech sector.

A different play on the S&P 500

The Invesco Equal Weight S&P 500 ETF also tracks the S&P 500, but rather than being market-cap-weighted, each stock makes up roughly the same percentage of the portfolio.

This means that each stock makes up a very small fraction of the fund, which can limit risk. When tech behemoths are weighted the same as the more stable, established companies within the S&P 500, no single stock or industry can significantly sway the fund's performance.

Again, this can be a double-edged sword. While this fund's equal-weight nature helps limit risk, it can also limit its earnings. When overperformers are weighted the same as slower-growing companies, the superstar stocks can't lift the ETF's overall earnings like with a market-cap-weighted S&P 500 ETF.

How the two ETFs stack up to each other

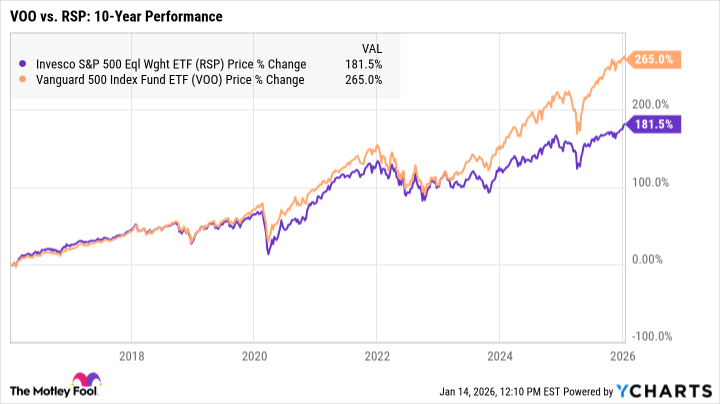

Over the last 10 years, the Vanguard S&P 500 ETF has significantly outperformed the Invesco Equal Weight S&P 500 ETF.

It's worth noting that much of those gains came in the last few years, as tech stocks experienced staggering growth compared to the rest of the market. Prior to 2020, the two funds were relatively aligned in their performance. If tech continues to outperform -- especially with the rise of artificial intelligence (AI) stocks -- we could see an even more significant gap in the funds' total returns.

Notice, too, that throughout the 2022 bear market, the Vanguard fund was hit hard -- with its returns nearly falling below that of the Invesco fund at times. Tech stocks are generally more likely to experience steeper downturns during periods of volatility, and this is more pronounced with a market-cap-weighted fund like the Vanguard S&P 500 ETF.

Where you might choose to invest will depend on your risk tolerance and what you're looking to achieve with an S&P 500 ETF.

If you're seeking tech-heavy growth while still gaining exposure to the entire S&P 500, the Vanguard S&P 500 ETF may be your best choice. But for more risk-averse investors aiming to minimize risk and volatility, the Invesco Equal Weight S&P 500 ETF could be a better option.