Bloom Energy (BE +7.42%) is a clean energy company that makes big, box-shaped power generators that convert fuel (like natural gas) into electricity through an electrochemical process without combustion. In a nutshell, this technology (also called solid oxide fuel cells) lets businesses generate their own electricity on-site rather than taking it from the grid.

While Bloom has been designing these box-like energy servers for two decades, only in the last year has the stock grown at breakneck speed. In the last 12 months, the stock is up over 550%, and, as of Jan. 16, it's up about 72% on the year.

When a growth stock explodes by triple digits in a short time, it's wise to pause and ask before starting or adding to a position -- does it still have room to grow?

The bull case starts with the grid

Bloom Energy is selling a product that can solve a real, urgent problem: data center growth. Indeed, massive investment into new data center construction in the U.S., which was over $60 billion in 2025 according to CNBC, will need a concurrent overhaul in the U.S. electric grid, much of which was built 50 to 75 years ago.

That's because data centers gobble up enormous amounts of power, which not only strains traditional grids but also increases electricity costs. Running giant warehouses of modern servers on a power grid that was built in the decades following the second World War is a recipe for a grid outage, and modern energy companies like Bloom are well aware of the need for someone to step in as a stop-gap.

Image source: Bloom Energy.

So, how can Bloom become a data center's trusted sidekick?

Well, for one, its servers generate on-site power. Since this is independent of electric grids, customers don't have to worry about peak prices or grid outages. Second, its technology is modular: Customers can add more servers as their needs grow. Lastly, it's fuel-flexible -- it runs on natural gas but can also run on biogas -- and it's cleaner than conventional fossil fuel generation.

In some ways, Bloom is already a trusted sidekick: Its customer list includes Fortune 100 companies, like Walmart, AT&T, and Verizon. Among that list are players in the data center arena, too, like Equinix and Oracle. It also formed a blockbuster $5 billion strategic partnership with Brookfield (BAM +1.42%) to deploy its fuel cells for the asset manager's "AI factories."

Bloom is growing, but pay attention to its valuation

Given the surge in AI data center growth, Bloom had a few blow-out quarters in 2025. Its third-quarter revenue, for instance, was up over 57.1% from the year before, marking the fourth straight quarter of record revenue. It also reported a gross margin of about 29% and operating income of $7.8 million in Q3.

That's great for the business. But the valuation isn't anything to write home about.

Right now, the company carries a market cap of about $31.5 billion, trading at roughly 153 times forward earnings and 48 times book value. By comparison, the average forward price-to-earnings ratio for the entire energy sector is about 17, while the average price-to-book sits near 2. Investors, then, clearly aren't paying for today's Bloom; they're paying for a Bloom of the future, what it might (hopefully) become.

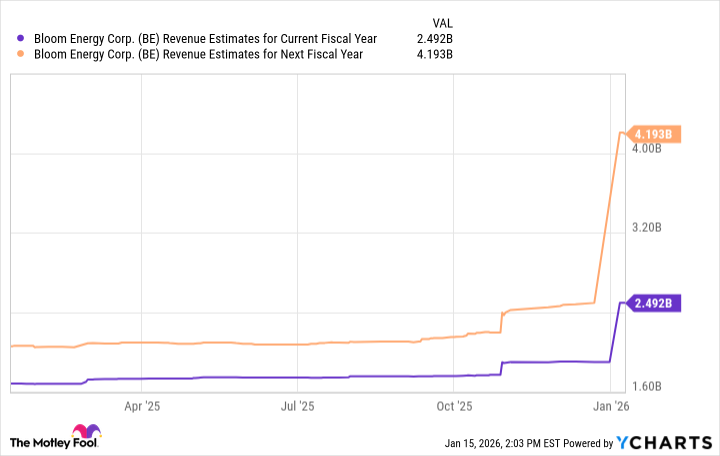

That said, the valuation could justify itself over time if data center construction remains strong and it inks more big deals. Consensus revenue estimates suggest Bloom could nearly double revenue by the next fiscal year, as the chart below indicates.

BE Revenue Estimates for Current Fiscal Year data by YCharts

Does Bloom Energy stock still have room to run?

Bloom is currently trading at all-time highs. And while I think there could be more room to grow long-term, I would expect Bloom to grow more moderately in 2026.

That said, Bloom does have something other novel energy companies lack: a deployable product. Customers can have Bloom's servers installed in under 50 days. That gives it a leg up on other businesses vying for data center clients, like Oklo and Nano Nuclear Energy, which are likely years away from commercialization. Another huge deal for Bloom could see its stock hitting more record highs.

Just keep a long-term perspective. For investors who believe future electricity demand needs a novel solution, a small stake in Bloom could capture some upside over a long period.