Archer Aviation (ACHR 0.11%) stock lost altitude across 2025's trading despite a bullish backdrop for the broader market. The electric-vertical-take-off-and-landing (eVTOL) company's share price declined 22.9% last year, according to data from S&P Global Market Intelligence. Meanwhile, the S&P 500 rose 16.4%, and the Nasdaq Composite jumped 20.4%.

Archer Aviation's valuation moved lower last year amid continuing losses and an unclear path to certification for its vehicles in key markets. Short reports on the stock and competition from Joby Aviation also factored into the pullback.

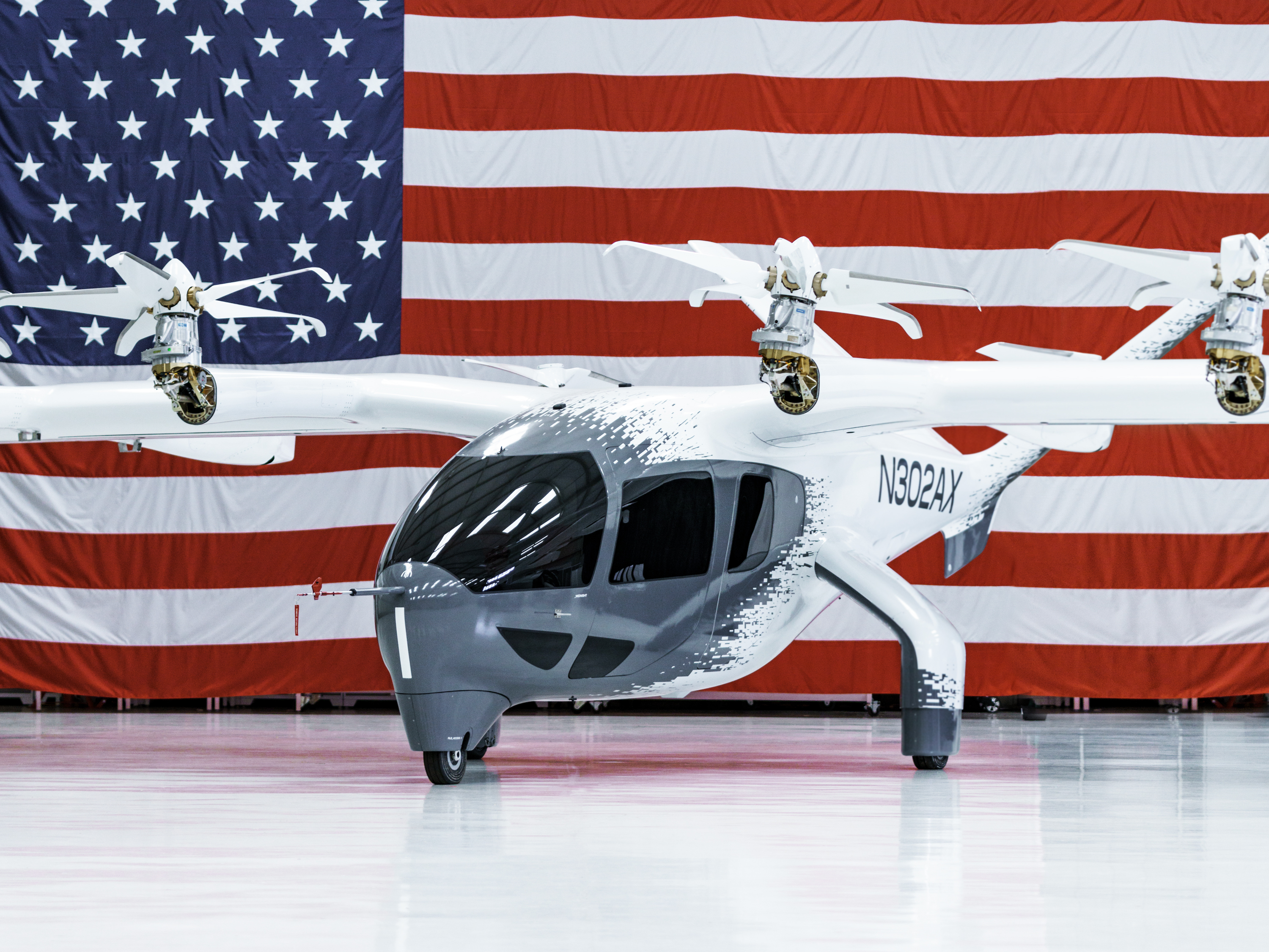

Image source: Getty Images.

Archer Aviation faced bearish pressures last year

Archer Aviation stock saw big swings across 2025's trading. While the company's share price spiked at various points in the year, big gains were typically wiped out by pullbacks shortly after. Joby Aviation's faster commercialization progress put a damper on enthusiasm for Archer stock -- and the dynamic was evident in divergent performances for the stocks. While Archer got hit with a double-digit valuation pullback, Joby Aviation's share price climbed roughly 62% last year.

In May, Culper Research published a short report on Archer Aviation stock and said that the eVTOL specialist had been misleading investors about testing timelines and flight milestones. Grizzly Research also published a short report on Archer later in the year and said that the company's projections had been misleading and that there weren't many signs that manufacturing was ramping up.

NYSE: ACHR

Key Data Points

Archer stock fell in July in response to fears that Stellantis could ease up on its investments in the company. Stellantis's announcement that it was shutting down its hydrogen-fuel-cell development project raised concerns that it could cut back on other growth bets. The next month, Archer published its Q2 results and reported a net loss of $206 million -- up from a loss of $106.9 million in the prior-year quarter.

Archer Aviation stock got hit with another post-earnings pullback in November with the publication of its third-quarter report. The business posted a net loss of $129.9 million in the third quarter -- higher than expected and up from a loss of $115.3 million in the prior-year period. The company paired the Q3 report with news that it had sold $650 million worth of new stock and that it had acquired Hawthorne airport in a $126 million all-cash purchase, which raised additional concerns about share dilution and spending.

Archer Aviation stock has been surging this year

Following last year's sell-off, Archer Aviation stock has been regaining ground in 2026. As of this writing, the company's share price has risen 17.8% in the year's trading.

Defense-tech stocks have been hot this year, and Archer Aviation's share price is benefiting from the trend. Archer has a partnership with Anduril to develop hybrid-propulsion VTOL aircraft for use by the U.S. military. While the pathway to achieving commercial certification from the Federal Aviation Authority (FAA) for its Midnight eVTOLs remains uncertain, interest in potential defense applications for its aircraft tech could help the stock continue to bounce back from last year's sell-offs.